Geophysical factors have become the main driving force for the upward trend of oil prices, and the subsequent trend is highly uncertain

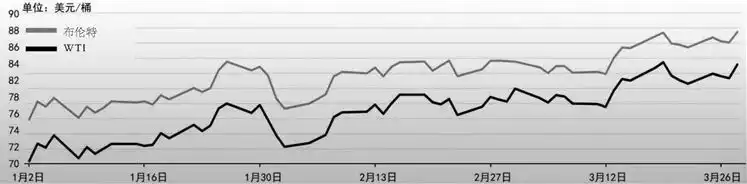

今年年初以来,The unstable geopolitical situation in the Middle East has given support to oil prices, and international oil prices have generally fluctuated and strengthened. 。尤其是进入3月,欧佩克+延长自愿额外减产、乌克兰频繁袭击俄罗斯炼厂、国际能源署(IEA)等三大机构上调全球石油需求增长预期等,这些因素给油价带来进一步提振,国际油价显著冲高。

总体来看,地缘政治因素是一季度国际油价震荡冲高的主要动力。展望后市, Factors such as OPEC + production policy, the Federal Reserve's monetary policy, the situation in Russia, Ukraine and the Middle East, and the U.S. election may all have important uncertain effects on the trend of oil prices.

Experts of this issue

Huo Lijun

Petroleum Market Research Institute, China National Petroleum Corporation Economic and Technological Research Institute

Insufficient momentum for oil demand growth

The fundamentals of the oil market remained tight balance in the first half of the year

From the perspective of demand, global oil demand growth momentum is insufficient, but demand growth in the first quarter of this year exceeded expectations, and demand in the peak season in the third quarter needs to be verified.

The global economic outlook has improved, but growth momentum is still insufficient. This year, global inflation has steadily declined, major central banks 'monetary policies are about to turn, and the world economic growth prospects tend to improve. However, under the influence of factors such as insufficient demand, sluggish trade, and continued geopolitical tensions, economic growth momentum is still insufficient. Since the beginning of this year, the United Nations and the World Bank have lowered their forecasts for global economic growth this year, while the International Monetary Fund (IMF) and the Organization for Economic Co-operation and Development (OECD) have raised them. However, overall, most institutions still believe that global GDP growth this year will be lower than in 2023.

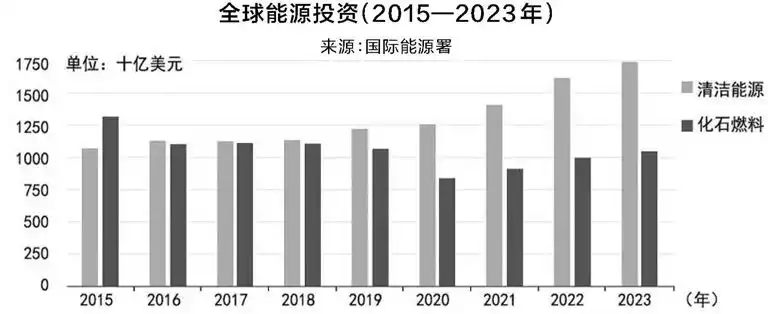

The growth rate of world oil demand slowed down, and demand growth exceeded expectations in the first quarter. Global oil demand has basically completed post-epidemic recovery and will return to its previous trend growth this year. Under the influence of factors such as slowing economic growth, improving energy efficiency and accelerating replacement of new energy vehicles, global oil demand growth will slow down, and is expected to increase by 1.3 million barrels per day year-on-year this year. Due to the improved economic prospects of the United States, the growth in demand for chemical oils, and the increase in demand for shipping fuel due to a large number of oil tankers circling the Cape of Good Hope, global oil demand growth was better than expected in the first quarter of this year (the off-season season for seasonal demand), with an estimated year-on-year increase of approximately 1.7 million barrels per day. Global oil demand is expected to gradually rise in the second quarter, but before the arrival of the third quarter (peak oil demand season), it is difficult for the demand side to effectively pull oil prices, and the demand performance in summer (peak demand season) also needs to be verified.

From a supply perspective, OPEC + production cuts have limited the growth of oil supply, and increased production by non-OPEC + oil-producing countries will still drive world oil supply to maintain growth.

OPEC + will extend its voluntary production cuts until the end of the second quarter of this year, and its policies in the later period are still uncertain. In February, the total crude oil output of OPEC +18 oil-producing countries subject to quotas was still 420,000 barrels per day higher than the quota. This was mainly because the United Arab Emirates, Iraq and Kazakhstan had not fulfilled their commitment to reduce production. These three countries overproduced 310,000 barrels per day, 250,000 barrels per day, and 120,000 barrels per day respectively. At a meeting in early March, OPEC + announced that it would extend the current voluntary production cuts until the end of the second quarter. Under the long-term strategy of reducing production and safeguarding prices, OPEC + market share has been continuously eroded by non-OPEC + oil-producing countries. The implementation effect of various countries 'production cuts has been greatly reduced, and their willingness to increase production has also been continuously enhanced, thus greatly increasing the uncertainty of OPEC + follow-up production policies.

Russia's oil output is generally stable, and the increase in U.S. sanctions against Russia has increased uncertainty about Russia's oil exports. In February, Russia's crude oil output increased slightly by 20,000 barrels per day month-on-month to 9.42 million barrels per day. Since the second half of last year, Russia's crude oil output has generally remained at a level of 9.4 million to 9.5 million barrels per day. In March, Ukraine frequently launched attacks on Russian refineries, which significantly affected the production of Russian refineries. The Russian Ministry of Energy said that from March 14 to 20, Russian refinery output fell by more than 400,000 barrels per day. As its domestic refining volume declines, Russia may later fulfill its commitment to reduce crude oil production and increase crude oil exports while reducing oil exports. However, the United States has previously increased sanctions against Russia and "blackened" Russia's large state-owned shipping company Sovcomflot and its 14 crude oil tankers, which may have a certain negative impact on Russian crude oil exports.

U.S. crude oil production growth has slowed down, but it remains the most important source of growth on the supply side. Since October last year, the number of oil rigs in use in the United States has remained at a low level of around 500, and crude oil producers obviously lack the motivation to increase production. U.S. crude oil production reached a weekly peak of 13.3 million barrels per day at the end of last year, and has not exceeded this level since then, falling back to 13.1 million barrels per day in recent weeks. Despite the slowdown in production growth, U.S. crude oil has eased pressure on the supply side to some extent and will remain the most important source of world oil supply growth this year. The U.S. Energy Information Administration (EIA) predicts that U.S. crude oil and condensate production this year will increase by 260,000 barrels per day and 130,000 barrels per day respectively year-on-year.

From the perspective of supply and demand balance, the fundamentals of the world oil market remained tightly balanced in the first half of this year, and the outlook of the OPEC + production policy determines the fundamental outlook for the second half of the year.

OPEC +'s voluntary additional production cuts have effectively limited supply growth, and it is estimated that the fundamentals of the world oil market will remain tightly balanced in the first and second quarters of this year. At the same time, global oil inventories are still at low levels in recent years, and there is basically overall support for oil prices. In the second half of the year, the outlook for the OPEC + output policy is the key to affecting the fundamental situation. If OPEC + increases production slightly in the second half of the year, it is expected that there will be no significant pressure on fundamentals in the third quarter (peak demand season), but the pressure of oversupply in the market will increase significantly in the fourth quarter. If OPEC + extends the current production cuts until the end of the year, the world oil market will continue to be less than demand in the second half of the year, especially in the third quarter, the market will face a significant supply shortage.

Geophysical factors have become the main driving force for oil price upward

The subsequent trend is highly uncertain

On the financial front, the Federal Reserve's interest rate hike cycle has ended, and the high probability of interest rate cuts will begin in the second half of the year. 在3月的货币政策会议上,美联储将联邦基金利率目标区间维持在5.25%—5.5%不变,依然保持在22年来最高。当前,多数市场人士预计,美联储降息窗口将在下半年才能打开,利率在一段时间内仍将保持高位。同时值得注意的是,3月21日,瑞士央行宣布降息25个基点。市场人士预计,后续欧洲央行可能先于美联储降息,从而导致美元被动走强,这在一定程度上利空油价。预计随着下半年美联储降息成为现实,流动性宽松及美元走弱预期才将给油价带来提振。

In terms of geopolitics, the geopolitical situation is complex and changeable, which may still have a more than expected impact on oil prices. 。今年以来,巴以冲突及红海局势持续给油价带来支撑。3月25日,联合国安理会表决通过一份要求立即在巴勒斯坦加沙地带实现停火的决议草案。但随后,在卡塔尔首都多哈参加加沙地带停火协议谈判的以色列代表团被政府召回,以色列认为此轮停火协议谈判已陷入“死胡同”。这表明,巴以冲突仍未得到有效解决,后期仍有再度升级的可能。俄乌方面,俄罗斯3月大选之际,乌克兰加大对俄能源设施袭击的力度。同时,莫斯科音乐厅遭遇恐怖袭击,使得市场对俄乌局势升级的担忧加重,后续俄乌局势演进亦有较大不确定性,从而可能再度给市场带来重大干扰。此外,今年是美国大选年,临近年底的大选结果也可能成为油市的重要影响因素。美国民主党与共和党在能源、金融、贸易、军事上的政策取向均有较大差异,尤其是如果特朗普当选,可能给全球经济带来更加不利影响。

Looking to the future outlook, oil demand growth is not strong, and supply is still supported by production cuts. Geophysical factors will be the main driving force for the strengthening of oil prices, and the trend of oil prices is unstable and uncertain. 。全球经济增长动能不足,石油需求增速放缓,需求端对油价并无强提振,但欧佩克+自愿额外减产给油价带来重要的基本面托底,巴以、红海、俄乌等地缘局势加剧对市场供应的担忧,继续给油价带来重要的支撑,这也是推动今年以来国际油价大幅上涨的首要原因。短期来看,地缘局势仍是影响油价的重要不确定因素,同时近期市场看涨预期普遍增强,在当前基本面偏紧的状态下仍可能推动国际油价再创新高。

In the third quarter, it is expected that factors such as the Federal Reserve's high probability of opening interest rates and the arrival of the peak demand season will continue to benefit oil prices. However, the OPEC + follow-up production policy will determine whether fundamentals and financial factors can jointly drive oil prices. In the fourth quarter, the U.S. election and OPEC + production policy will become important factors determining the trend of oil prices. The market still needs to be vigilant about the difficulty of sustaining OPEC + high production cuts in the long term after the peak demand season, and the risk of correction brought to oil prices by the uncertainty of global political and economic prospects.

extended reading

All parties look at oil prices

Oil Price Network Michael Cohen:

With the increasingly bullish oil market, Brent crude oil futures prices are indeed likely to rise to US$90/barrel. Although uncertainty about oil demand remains, geopolitical risks, a weak dollar and OPEC + production cuts have pushed oil prices higher.

Bloomberg:

When OPEC + ministers are about to assess global oil markets, they will see a lot of evidence that production cuts are working. After a downturn at the beginning of the year, crude oil prices are showing increasing signs of recovery as oil supplies from Saudi Arabia and its allies decline and demand becomes elastic.

Brent crude oil futures prices have risen about 11% so far this year and have recently stabilized above US$85/barrel. While this could undermine recent efforts to cut inflation and hit central banks and consumers, the rally supports important revenue for Saudi Arabia and its partners.

Standard Chartered Bank:

Global oil demand is expected to hit a record high of 103.01 million barrels per day in May this year, a new record of 103.62 million barrels per day in June, and a higher demand in August, reaching 104.31 million barrels per day. The tightening of the oil market will continue to push oil prices up. The average price of Brent crude oil futures in the second quarter of this year is expected to be US$94/barrel.

Supply growth may remain limited, and U.S. crude oil production is not expected to grow significantly above the historical peak of 13.319 million barrels per day in November 2023.

Forex information website FXEmpire

Market analyst Vladimir Zernov:

As traders focus on the recent improvement in the oil supply and demand situation, international oil prices have gained upward momentum. OPEC + is still maintaining production cuts, while oil demand from China and the United States is expected to grow.

Price Futures Group

Senior Market Analyst Phil Flynn:

Claims about economic recession and OPEC's inability to implement production cuts proved wrong. The market's pessimism about oil prices at the beginning of the year seemed to be dissipating as the actual performance of supply and demand was inconsistent with the pessimistic tone. Although geopolitical factors have not yet caused major oil supply interruptions, they have undoubtedly increased transportation costs and procurement difficulties.

This article was originally published on page 7 of China Petroleum News on April 2, 2024. The original title was "International Oil Price Shock and Higher, and the Subsequent Uncertainty is Greater"

planning:Li Xiaosong Wei Xiaoxi

author:Huo Lijun and Li Xiaosong

edit:Yang Ziyi

editor:he Li

audit:Li Xiangyang

past review

· [Night reading| Missing goes with the wind and rain and brings clarity to this side]( · [Focus! The ordinary power that shines in Tianshan Mountain! ](

· [Qingming special edition of "The Stars of That Year", sung to you who miss you! ](