Lithium price rebound vane:Huge short bets under threat

据Mining.com网站援引彭博通讯社报道,由于供应过剩显示出缓解迹象,Billions of dollars in short bets against the world's largest lithium producer are under threat.

UBS and Goldman Sachs lowered their 2024 supply forecasts by 33% and 26% respectively, while Morgan Stanley warned of risks to falling inventories in China. Prior to this revision, international lithium prices plummeted last year as supply grew faster than demand, and some producers cut production.

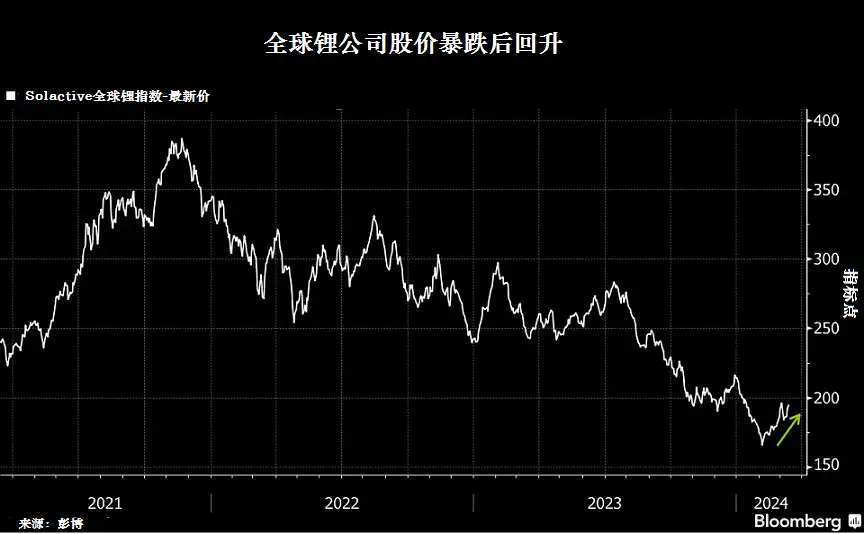

Last year, lithium prices plummeted, lithium mining companies 'stocks were shorted, and stock prices fluctuated. Now, the price of lithium, a key material used in power batteries, is showing signs of stabilizing. 彭博通讯社汇总的数据显示,全球主要产锂商美国雅宝公司(Albemarle Corp.)和澳大利亚矿企皮尔巴拉矿产公司(Pilbara Minerals Ltd.)1/5的股票,即相当于50亿美元遭空头押注。

"The lithium market has lost double-digit production capacity, which is usually a signal that commodity prices bottom out.",悉尼翠贝卡投资伙伴公司(Tribeca Investment Partners)对冲基金经理刘军贝(Jun Bei Liu,音译)表示,他持有皮尔巴拉矿产公司的多头头寸。由于锂价显示出企稳信号,做空该公司“非常危险”。

After the shares of two lithium producers climbed 20% in February, some short sellers have been trapped. After a 20% decline in January, the Solactive Global Lithium Index, which tracks the performance of the world's 40 largest and most liquid lithium mining companies, rose 10% in February.

Investors 'short bets on Pilbara Minerals accounted for 22 per cent of its total outstanding shares, or US$1.8 billion, making it the most short-sold company in Australia's benchmark securities index, according to S&P Global. Short bets on Arpell accounted for the same proportion, with a market value of approximately US$3.2 billion.

Australia mining company Global Lithium Resources Ltd. Manager Ron Mitchell said,"Market confidence has returned, so a lot of short positions need to be covered."

然而,并不是所有人都相信锂市反弹。Goldman Sachs said in a report that the surge in lithium contracts "does not mean the bear market is over." Goldman Sachs warned that the lithium surplus remains large.

Still, other analysts expect Chinese lithium carbonate prices to stabilize after falling 80% from their all-time high in 2022. Capital market company Canaccord Authenticity Group Inc. In an investment alert earlier this month, it said "sustainable" prices would return, while UBS suspected further declines could be found.

The broker also said the market was rebalancing after some miners cut production. In January, Core Lithium Ltd. Suspension of lithium ore production and switch to uranium, whose prices are soaring. At the same time, Arcadium Lithium said it would reduce the production of spodumene for lithium extraction.

"I think lithium prices have bottomed out," says Maple-Brown Abbott Ltd. said fund manager Matt Griffin. "The signs of a bull market we are looking for are demand growth-either through unexpected increases in demand for electric vehicles, or the battery supply chain is once again entering the inventory cycle."

_