In March, CPI rebounded slightly, core CPI maintained a moderate rise, and PPI decline widened slightly

2024.0411

Number of words in this article:1190, reading time is about 2 minutes

introduction:扣除食品和能源价格的核心CPI同比上涨0.6%,保持温和上涨。

** Author| ** First Finance Zhu Yanran

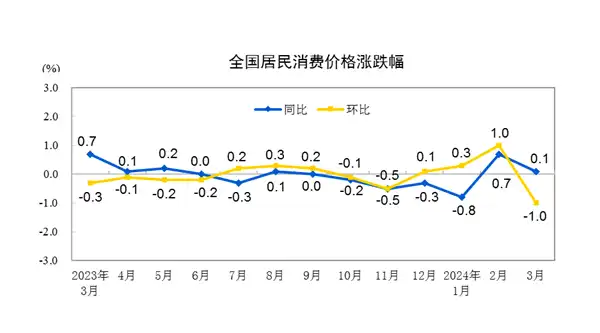

Affected by factors such as the seasonal decline in consumer demand after the holiday and the overall adequacy of market supply, the year-on-year increase in CPI fell back in March. However, due to the decline in the prices of domestically priced commodities such as coal and steel, the year-on-year decline in PPI expanded slightly. Data released by the National Bureau of Statistics on April 11 showed that CPI rose by 0.1% year-on-year in March, down 0.6 percentage points from the previous month and 1.0% month-on-month. The core CPI excluding food and energy prices rose 0.6% year-on-year, maintaining a moderate increase.

Dong Lijuan, chief statistician of the City Department of the National Bureau of Statistics, said that the year-on-year decline in CPI growth was mainly affected by lower prices for food and travel services. Among them, food prices fell 2.7% from the same period last year, an increase of 1.8 percentage points over the previous month. The prices of fresh vegetables and pork fell 1.3% and 2.4% respectively from 2.9% and 0.2% last month. Non-food prices rose 0.7% in March from a year earlier, down 0.4 percentage points from the previous month. Among non-food, service prices rose 0.8%, down 1.1 percentage points, mainly because the prices of travel services fell more, of which the increase in tourism prices fell to 6.0% from 23.1% last month, and air ticket prices fell by 14.7% from 20.8% last month. Pang Ming, Chief Economist for Greater China of Jones Lang LaSalle, said that the price of food, tobacco and alcohol, which is most sensitive to the decline in demand after the holiday, is the main drag on CPI. In the short term, CPI may still fluctuate at a low level, but throughout the year, under the background of improving the quality, expansion, efficiency and coordination of macro policies, and under the condition of continuous recovery and improvement of economic momentum and the endogenous driving force of the main body of the market, the inflation center will gradually repair in the fluctuation and return to the normal level. The probability of gradual and moderate recovery of CPI in stability is further improved.

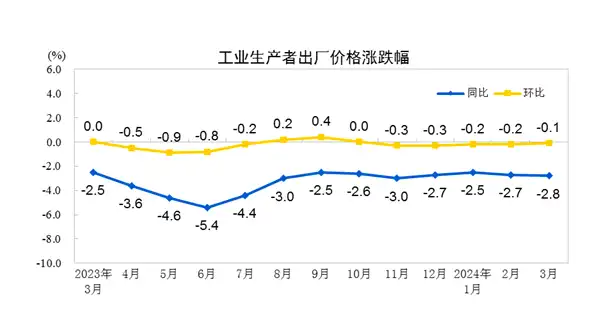

As for PPI, with the resumption of post-holiday industrial production in March, the supply of industrial products was relatively adequate. The national PPI fell 0.1% month-on-month, narrowing the decline compared with the previous month, and 2.8% from the same period last year, slightly expanding the decline. Of the-2.8 per cent year-on-year changes in PPI in March, the tail-warping impact was about-2.3 percentage points, and the new impact of price changes this year was about-0.5 percentage points. Among the major industries, the prices of coal mining and washing industry fell 15.0% compared with the same period last year, the prices of non-metallic mineral products industry fell 8.1%, and the prices of ferrous metal smelting and Calendering processing industries fell 7.2%. The declines in the above three industries were all larger than last month. The prices of chemical raw materials and chemical products fell 6.3 per cent, electrical machinery and equipment fell 4.3 per cent, and oil, coal and other fuel processing industries fell 4.2 per cent, all of which were narrower than last month. The price of the non-ferrous metal smelting and Calendering industry increased by 0.6% from 0.2% last month. CICC Macro Research said that the rise and fall of black and non-ferrous metals, building materials and oil prices in March highlighted the recovery differentiation between internal and external demand, the old economy and the new economy. Specifically, black prices generally fell, blast furnace start-up after the festival, hot metal output is still falling, steel prices are lower, coking coal production restrictions have not changed the price fatigue, building materials prices continue to fall. While the Federal Reserve is expected to cut interest rates, the global manufacturing sector rebounds to boost exports, domestic demand for new energy remains strong, non-ferrous prices rise, while OPEC+ extends additional production cuts, domestic copper smelters jointly cut production, and supply adjustment is expected to rise. With regard to the next PPI trend, Wu Chaoming, deputy director of the Caixin Research Institute, analyzed that it is expected that with the rebound in demand and the gradual decline in the base last year, the decline in PPI this year is expected to narrow, but due to the mild impact of the pick-up in demand, the probability of negative growth for the whole year is on the high side. **