Feed demand affects the trend of corn prices:The impact of import substitution deepens, and the market may return to a low-inventory model

Since September last year, corn market prices have been sluggish, with a cumulative drop of 532 yuan/ton, a drop of 18.1%. At the end of January this year and during the Spring Festival, corn prices bottomed out and rebounded, but the recovery was limited. Entering March, corn prices were relatively stable. What are the reasons for the continued decline in corn prices? What is the impact of corn imports on the domestic market? What will be the future trend of corn prices?

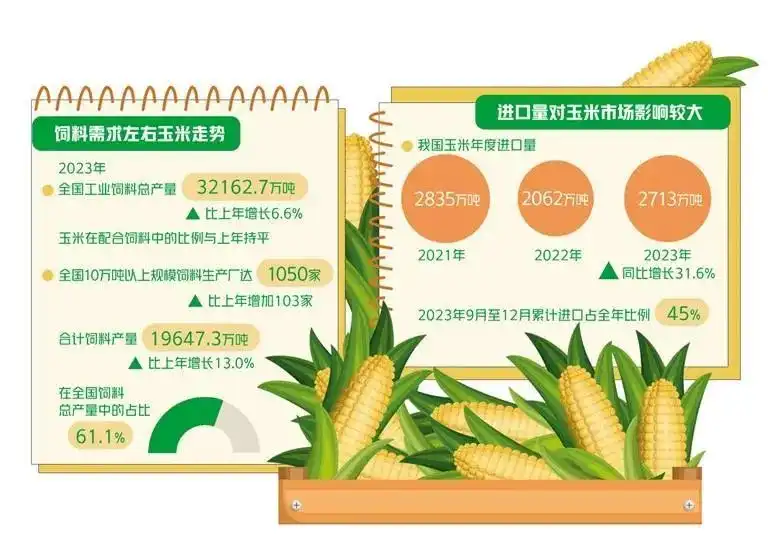

Feed demand affects price trends

造成此前玉米价格下跌的主要原因,是春节前猪肉价格不及预期,拖累了玉米饲料需求。加上小麦价格快速下跌,市场看空氛围浓厚,多数企业提前停机回家过年,开机率同比下降,玉米价格走低。 1月底和春节期间,玉米价格反弹,主要由于猪价回升,加工企业为春节备货,带动部分需求增加。同时,雨雪天气使得流通粮源偏紧,价格上涨,企业开始积极入市收粮,市场价格逐渐企稳。 以此来看,上半年生猪行业去化程度以及下半年回升速度,决定了饲料需求情况,进而左右着玉米价格走势。 去年,全国饲料产量再创新高。据中国饲料工业协会发布的数据,2023年全国工业饲料总产量达32162.7万吨,比上年增长6.6%。玉米在配合饲料中的比例与上年持平,因此去年全年玉米饲料消费量同比有所增加。  玉米地。王建威摄(新华社)

玉米地。王建威摄(新华社)

Last year, the output of most varieties of feed increased year-on-year, while pig feed is still the main force in terms of absolute volume and growth rate. The main reason is that the pig industry still maintains high production capacity despite widespread losses. In recent years, the concentration of the pig industry has increased significantly, and the trend of retail investors 'withdrawal has continued. Large-scale breeding entities have a large investment in fixed assets. During the downward cycle of pig prices, their ability and willingness to compress production capacity are weaker than that of small farmers, and the speed of de-production capacity will be slower. In addition, large pig companies have stronger financing capabilities, but their asset-liability ratios have also reached relatively high levels. This feature also leads to fewer changes in production capacity during the pig cycle. As a result, pig production capacity remains at a high level, and feed production has also reached a new high.

At the same time, the concentration of the feed industry is also increasing. According to data from the China Feed Industry Association, in 2023, there will be 1050 feed production plants with a scale of more than 100,000 tons across the country, an increase of 103 over the previous year; the total feed output will be 196.473 million tons, an increase of 13.0% over the previous year, accounting for the country's total feed output. The proportion is 61.1%, an increase of 3.5 percentage points over the previous year. This has also led to stronger feed yields.

Whether there is support for feed consumption this year depends on the degree of de-production capacity in the pig industry. It is necessary to focus on variables such as sow stocks, number of piglets born, frozen products and secondary fattening admission. It is expected that the reduction of pig production capacity will continue to advance in the first half of this year.

Data from the Ministry of Agriculture and Rural Affairs show that the number of Nengfengxing sows in January this year was 40.67 million, a month-on-month decline for four consecutive months and a year-on-year decrease of 6.9%, the lowest value in the past three years, but it is still 1.1 million higher than the normal number. The fundamentals of pig supply have not changed fundamentally. As production capacity is digested in the second half of the year, pig prices are expected to rebound, stimulating secondary fattening and a new round of production capacity construction, and increasing feed consumption.

If we consider the impact of increased concentration of feed companies, large companies tend to build more production capacity to expand market share, and feed production is likely to continue to set records, which will further boost corn consumption.

In addition to feed consumption, deep processing consumption has increased steadily this year, but the overall scale has not changed much. In 2023, the spurt of resumption of catering consumption will promote the consumption of corn processing industry products, especially corn starch. According to agency estimates, as of the end of December last year, the corn starch operating rate rose to around 71%, about 15 percentage points higher than the same period last year. The supply and demand report released by the Expert Early Warning Committee of the Ministry of Agriculture and Rural Affairs predicts that the estimated consumption of China's corn deep processing in 2022/23 will be 81 million tons, a year-on-year increase of 1 million tons. The forecast value for 2023/24 will be 82.38 million tons, continuing to maintain a small growth.

The impact of import substitution continues to deepen

In addition to consumption factors, the increase in import volume also has a greater impact on the corn market.

Data shows that China's corn imports have exceeded 20 million tons for three consecutive years, playing an important role in ensuring domestic supply. In 2023, China imported 27.13 million tons of corn, a year-on-year increase of 31.6%. Since September 2023, corn imports have rebounded significantly year-on-year. In October, the increase exceeded 200%, in November exceeded 380%, and in December exceeded 470%. From September to December, the cumulative import volume reached 12.21 million tons, accounting for the whole year. 45%, showing a trend of low before and high after. The price trend is just the opposite. Starting from August, corn prices have fallen year-on-year in a single month.

农民在 晾晒 玉米。谢剑飞摄(新华社)

农民在 晾晒 玉米。谢剑飞摄(新华社)

The impact of import substitution on the domestic corn market continues to deepen, and its scale and adjustment flexibility are increasing day by day. First, the proportion of corn and coarse grain imports has increased significantly in recent years. Since 2020, China's corn imports have increased significantly as a proportion of total grain imports, with an average increase of more than 15% in the past three years. From 2021 to 2023, China's annual corn imports are 28.35 million tons, 20.62 million tons and 27.13 million tons respectively, with an average annual import volume of approximately 25.37 million tons. In 2023, a total of 43.66 million tons of crude grains (corn, barley and sorghum) were imported, accounting for 27% of the total grain imports for the year.

Second, import sources have been diversified and adjustment flexibility has been improved. For many years, the United States and Ukraine have been the main channels for China's corn imports, accounting for more than 90%. From January to August 2023, the United States and Ukraine are still China's main sources of imports, but the large arrival of Brazilian corn in Hong Kong from September to December changed this pattern. In 2023, China will import a total of 12.806 million tons of corn from Brazil, far exceeding the forecast of 5 million tons at the beginning of the year, accounting for 47.2% of China's total corn imports. Among them, the cumulative import from September to December was 10.28 million tons, accounting for the whole year. 80.3% of the import volume. Brazil overtook the United States as China's largest corn supplier in 2023. It is noteworthy that in 2023, China's total imports of corn from Bulgaria, Russia, Myanmar, and South Africa will be 1.581 million tons, a year-on-year increase of 263%, accounting for 5.8% of China's total corn imports. Import sources tend to diversify.

In 2024, the global supply of corn will be sufficient. The duty-paid prices of corn imports from the United States, Brazil and other countries to Hong Kong will be lower than 2000 yuan/ton, giving an obvious price advantage. Although the import volume of crude grains decreased month-on-month in the first quarter of this year, the scale of low-cost grain sources that can be supplied is large. For the whole year, crude grain imports are expected to remain above 40 million tons, and low import prices will inhibit the domestic corn market.

still many uncertain factors

In recent years, extreme weather has occurred frequently. Although the current El Niño phenomenon is gradually weakening, it will continue to affect the global climate in the coming months. The entire industry chain channels, from seeds to production, storage and transportation, must be adjusted accordingly according to weather changes to ensure food security. In addition, geopolitical conflicts and other issues are inevitable. Factors such as the Red Sea crisis may lead to a rebound in international food prices and a reduction in trade volume.

According to the Food and Agriculture Organization of the United Nations forecast for global grain trade in 2023/24, it was revised down to 468.4 million tons in March, which is expected to be 1.8% lower than the 2022/23 level. Issues such as whether the global economy is performing better than expected and when the Federal Reserve will cut interest rates will also significantly affect commodity prices.

In 2024, the corn market may return to low inventory mode, making it difficult to return to the rapidly rising bull market from 2020 to 2022. However, the bottom has also appeared. In the short term, prices tend to fluctuate within a narrow range under the long-short game. In March, the corn market will still be in a state of oversupply. However, as the pressure on grain sales is concentrated and released in advance, upstream supply will decrease. Supported by factors such as tight channel inventories and warming demand, the supply and demand pattern may reverse. There is room for corn prices to strengthen at this stage. Feed consumption, alternative grain sources at home and abroad, and market sentiment all determine the size of the increase.