Jingdong competes with BYD in the decisive battle against zero kilometers of new energy vehicles

One is the first brother of a Chinese private enterprise in active service, and the other is the world's top seller of electric vehicles. On March 16, 2024, Jingdong Group signed a strategic cooperation agreement with BYD. How will this affect our lives and economic ecology? "Asset Insights" is here to discuss with you.

————

BYD speeds up and the market opens the book

In 2023, BYD will become the global new energy vehicle sales champion with annual car sales of 3.02 million vehicles. For every five new energy vehicles sold in the world, there is one BYD.

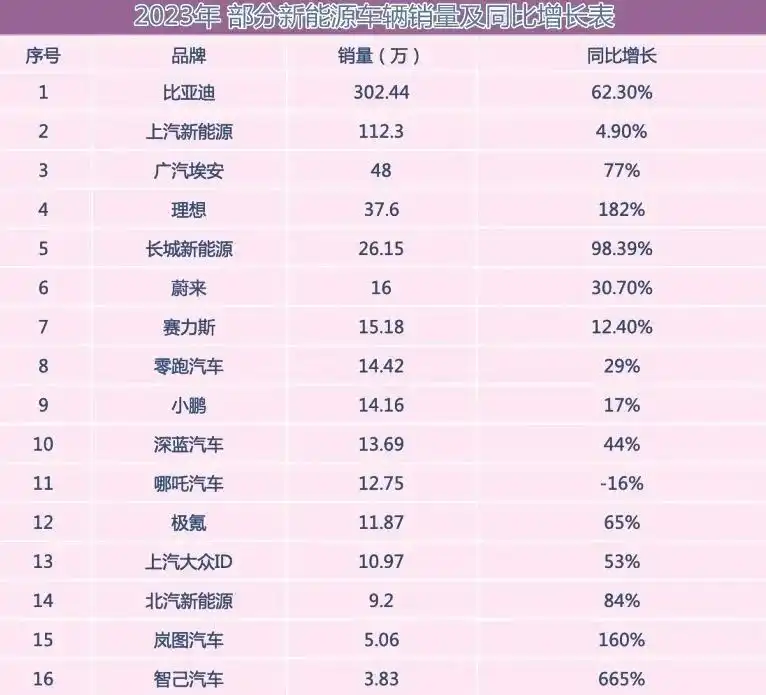

Wind data shows that in the field of new energy vehicles, BYD's sales are far ahead, about three times that of SAIC Motor Group, which ranks second (nearly 2 million more vehicles). Compared with Tesla, it also has three times advantage.

At the same time as sales volume, we can refer to BYD's profitability.

BYD's total revenue will be 424 billion yuan in 2022, 647 billion yuan in 2023, and is expected to reach 834.6 billion yuan in 2024; total profit will also increase from 21 billion yuan in 2022 to 51.9 billion yuan in 2024.

比亚迪与其他新能源上市车企销量比较(万得数据)

比亚迪与其他新能源上市车企销量比较(万得数据)  比亚迪2022~2024年部分财务摘要,单位:万元(万得数据)

比亚迪2022~2024年部分财务摘要,单位:万元(万得数据)

The rise of BYD is part of the overall rise of China's new energy vehicles.

Data shows that in 2023, China's new energy vehicle market share will reach 31.6%, with annual production of 9.587 million units, an increase of 35.8%; sales of 9.495 million units, an increase of 37.9%.

BYD achieved a high growth rate of 62.30% year-on-year.

In the same period, new energy vehicles such as GAC Ai 'an, Ideal, NIO, and Jikrypton also experienced considerable growth.

Analysts believe that as the new energy vehicle market accelerates, the stronger, the market head and the Matthew effect are beginning to appear-new energy vehicle companies that do not have the ability to follow will soon fall behind. At the same time, market profits were further thinned in the high-speed rush. It will be more difficult for new energy vehicles to make profits in the future. The industry is no longer the most "volume", only more "volume".

2023年部分新能源车辆销量及同比增长表

2023年部分新能源车辆销量及同比增长表

Some people say that Xiaomi, the "king of scrolls", came to build cars and joined the battle group, which is one of the symbols of the new energy vehicle market-market manufacturing is close to maturity, and it can "open books" to make money.

The new news in 2024 is that European and American car companies such as Apple, BMW, and Mercedes-Benz have announced that they will abandon their electric vehicle plans. Some voices in the investment community believe that the electric vehicle field has changed too much, the risks are unpredictable, and it is a bottomless hole for spending money.

New energy vehicles, an industry where dangers and opportunities coexist.

Data from the China Association of Automobile Manufacturers shows that in recent years, the profit margin of the automobile industry has declined year by year-from 2015 to 2023, the profit margins of the automobile industry were 8.7%, 8.3%, 7.8%, 7.3%, 6.3%, 6.2%, 6.1%, 5.7% and 5%, respectively.

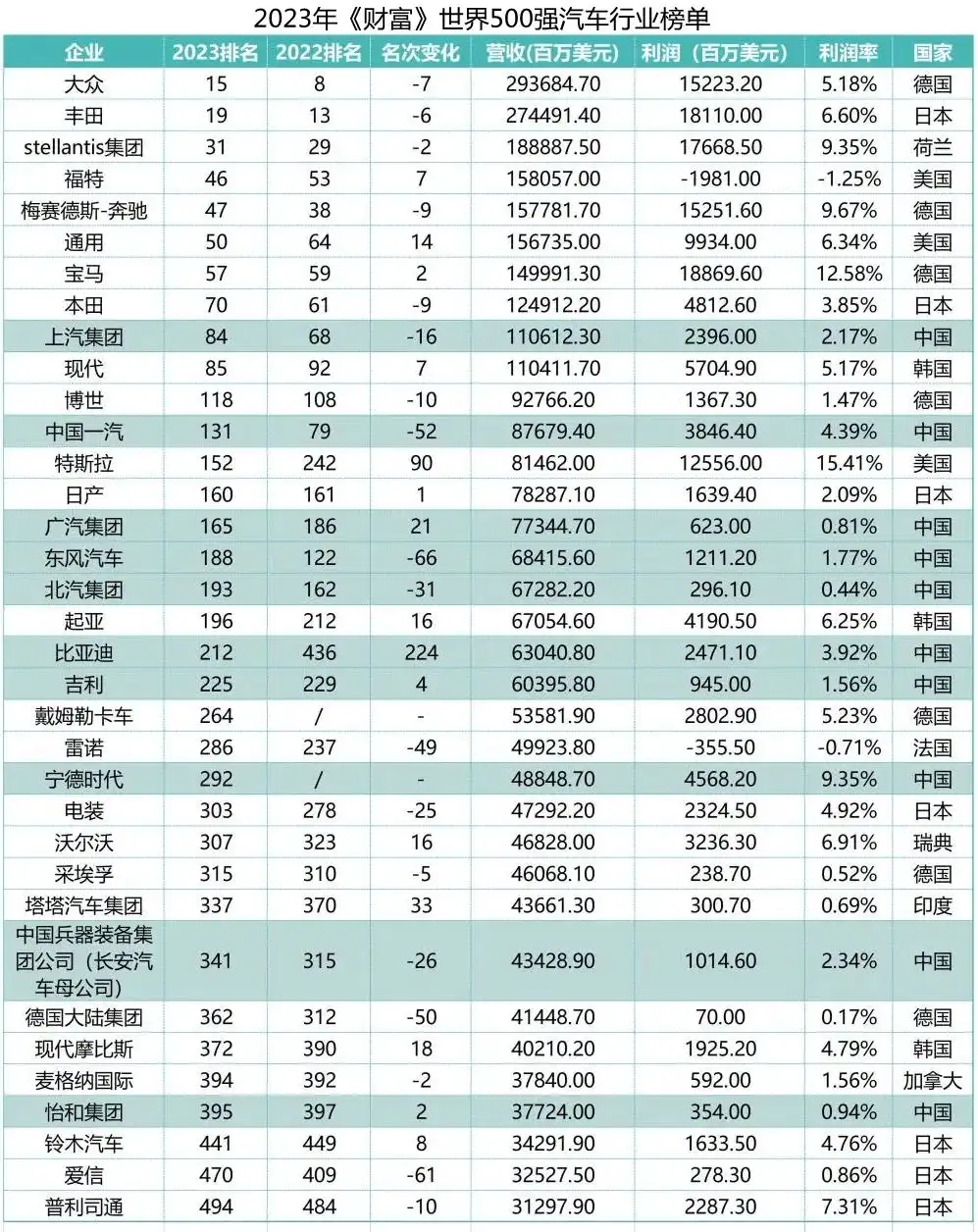

At the same time, through the 2023 Fortune Global 500 auto industry list, it can also be seen that the profit margins of Chinese auto companies are generally relatively low. BYD is still a relatively profitable company, with a profit margin of less than 4%. In comparison, Tesla's profit margin is as high as 15%.

2023年《财富》世界500强汽车行业榜单,可见中国车企利润率较低

2023年《财富》世界500强汽车行业榜单,可见中国车企利润率较低

In such a fierce competition, Chinese new energy vehicle companies are also quite willing to seek breakthroughs.

The choice of breakthrough points includes both technological competition and market development.

At this moment, BYD chose Jingdong.

————

Decisive battle zero kilometers

If BYD is in the limelight, Jingdong is even better than it.

In the 2023 Fortune Global 500 release list, Jingdong Group ranks 52nd, ranking first in the domestic industry for eight consecutive years.

In the "2023 China's Top 500 Private Enterprises" list released by the All-China Federation of Industry and Commerce, Jingdong Group ranks first among the top 500 private enterprises for the second consecutive year, and ranks first among the top 100 private enterprises in the service industry for three consecutive years.

In response to the list, Jingdong's efforts in the market in the past two years are obvious to all.

For example, they entered the sinking market in a high-profile manner and fought against each other; attacked Li Jiaqi hard and launched a live broadcast to bring goods for Douyin; launched the "Last Three Miles" instant retail to challenge Meituan, etc.

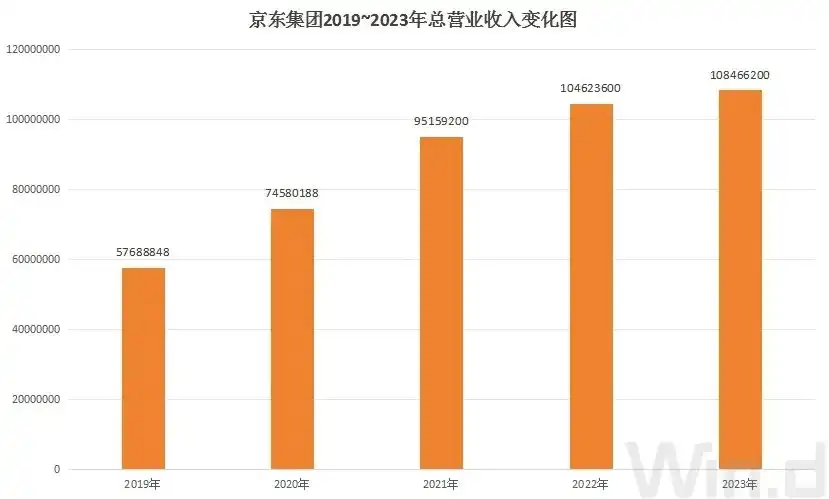

万得数据显示,京东集团20192023年总营收变化,2021年接近万亿元,而20222023年均在万亿元以上  2024年中国民企百强(前30位)、任泽平团队综合2022年各方相关数据排列

2024年中国民企百强(前30位)、任泽平团队综合2022年各方相关数据排列

Jingdong's domineering attitude is endogenous.

For example, in June 2023, Jingdong proposed the "35711" dream for the next 20 years--

There can be 3 companies with revenue exceeding RMB 1 trillion and net profit exceeding RMB 70 billion; 5 companies that have entered the world's top 500 companies; 7 companies that have started from scratch and have a market value of no less than RMB 100 billion; can pay RMB 100 billion in taxes for the country; and provide more than 1 million jobs.

In this process, Jingdong will invest a total of more than 3 trillion yuan in the salary and benefits of front-line employees; increase the income of more than 100 million farmers through the rural revitalization "Benfu Plan"; and work together with 60 million small, medium and micro enterprises to digitally upgrade...

Jingdong's confidence in planning this comes from its core competitiveness-supply chain services.

In recent years, JD. com has promoted the development of digital and intelligent supply chains. It plans that in the next 20 years,"JD. com's supply chain services will basically cover the world and establish supply chain infrastructure in an economy accounting for 80% of the world's size."

Taking advantage of its supply chain advantages, JD has the ability to extend its tentacles to various industries that it is optimistic about, and automobiles are one of them.

Industry analysts believe that the maintenance of new energy vehicles is different from traditional vehicles and is a new track to be opened up. When the influence and saturation of new energy vehicles reach a certain level, automobile online sales may become a new cake.

As JD said, the automobile market is ushering in a new "critical point." JD wants to sell cars like home appliances-what home appliances are sold online now will be sold in the future.

In order to support this concept, Jingdong Automobile has opened six new energy experience centers across the country to complete the combination of online transactions and offline experience.

京东新能源体验店设计图

京东新能源体验店设计图

Although BYD has its own "Haiyang Network" and "Dynasty Network" in terms of automobile online sales, JD has a one-stop solution of "buy-match-maintenance-use-exchange", and JD's supply chain can be integrated with BYD's entire production and marketing links to reduce automobile production and supply costs-while JD cuts a piece of cake, BYD's market competitiveness will also be strengthened. Compared with online sales, BYD should pay more attention to this layout.

When analyzing the development of new energy vehicles, some analyses have proposed 10 constraints:

1. Purchase cost (price); 2. Range anxiety; 3. Limited options (model richness does not match demand); 4. Lack of relevant technicians; 5. Charging infrastructure; 6. Charging speed; 7. Charger compatibility; 8. Grid capacity; 9. Charging station financing and ownership; 10. Charging costs.

The analysis believes that in addition to roads, parking lots, etc., the vast majority of charging in the charging infrastructure takes place in the "home", that is, the living community. This is a real challenge to the popularization of electric vehicles.

From this perspective, BYD and JD may join forces to further shorten the distance between electric vehicles and the community-after breaking through the "instant retail" of the last three kilometers of the community, JD will develop closer to the community. BYD has the opportunity to use Jingdong Network to provide a series of services from pre-sales to after-sales to enter the zero-kilometer community.

In an article on this public account,"Asset Insights" just discussed how Vanke can break through. Today, the Ministry of Housing and Urban-Rural Development is also making every effort to promote the renovation of old cities and urban renewal based on the living needs of new cities... If we put the development prospects of Jingdong's full chain and electric vehicles together with the improvement of living conditions in China, its synchronization is clear. visible. New interest connections will occur in the community economy (real estate development, property management, etc.), Jingdong's entire chain, and BYD Automobile. In other words, when the first brother of private enterprises and the world's largest auto sales leader meet, there is probably one Vanke away in front of them.

Editorial board on duty:su Zhiyong

edit:Han Jianming

studying the:Dai Shichao