2024 Q1:Gold and copper companies are dazzling, and Chinese companies perform well

_

_

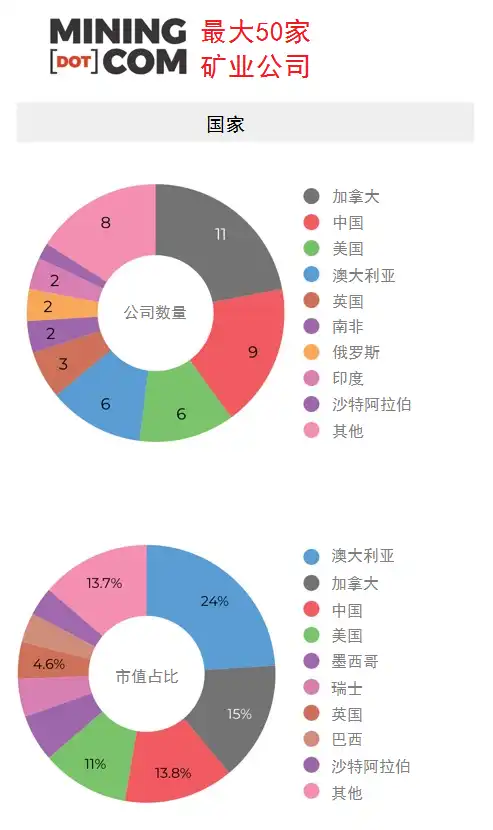

According to the Mining.com website, at the end of the first quarter of 2024, the total market value of the 50 largest mining companies listed by the ** Mining.com website was less than US$1.4 trillion, a decrease of US$13 billion from the beginning of the year. **

Since the beginning of the year, gold prices have hit new highs, and copper prices have also moved strongly. As of the end of March, gold and copper prices have risen by 14% and 12% respectively, and stocks of related companies have also been among the top gainers.

Despite the recovery of major metals, corporate market performance has been flat, and the overall market in 2024 is mixed.

Aluminum prices are close to 52-week highs, but zinc prices are difficult to break through US$3000/ton in a short period of time, and cobalt prices fluctuate at historical lows of US$30000/ton.

Nickel prices have rebounded after hitting a mid-term low of US$15000/ton last year, but are still in a bear market, and lithium's good fortune in 2024 seems to have ended.

Confidence in the platinum group metals market has hardly improved, with both platinum and palladium prices falling in 2024. Even if iron ore prices, which are crucial to the vitality of international mining giants, return above US$100 per ton, it will not be enough to get investors back into the industry.

Copper and gold mining companies perform well

After falling out of the top 50 at the end of last year due to the closure of Panama's copper mines, First Quantum Minerals 'market value has risen 58% in dollar terms to return to 44th place.

Indonesian copper-gold mining company Amman Mineral has grown 380% since its listing in July last year and may soon enter the top 10.

Lundin Mining entered the top 50 industries for the first time, rising 5 places to 48, also because copper prices hit a 14-month high. After Pilbara Minerals withdrew from the top 50 mining companies this quarter, Lundin Mining's market value rose by 25% in 2024, making Vancouver once again the city with the most headquarters of the top 50 mining companies.

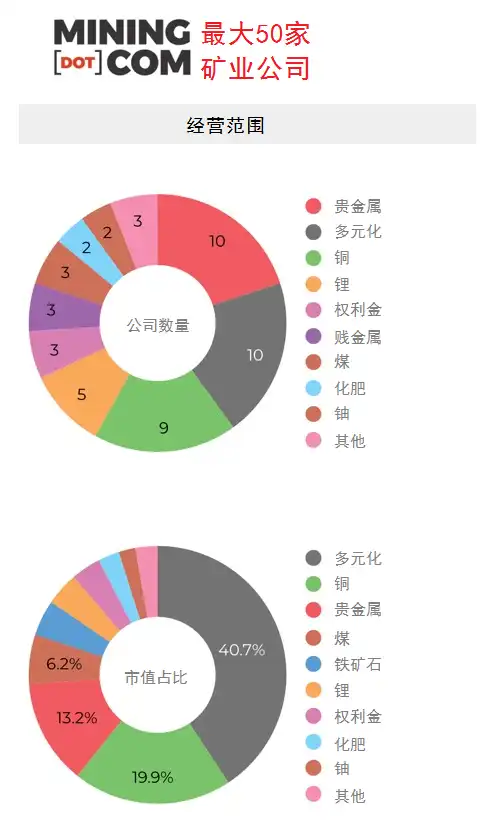

AngloGold Ashanti has returned to the top 50 mining companies, bringing the total number of gold companies to 10, with a total market value of US$183 billion.

Yantai Gold, which acquired Canadian mining company Osino Resources in February, is currently ranked 54th and will continue to rise. Although the market value of Polish Copper Company (KGHM) has increased by 15% so far this year, it is difficult to return to the 50th rank.

Like its main minerals, Pan American Silver may become the only silver company to enter the top 50 after Fresnillo withdrew a year ago. Silver prices have risen by 18% so far this year, making it the best performing metal.

Mining giants are under great pressure

The top 50 mining companies performed poorly overall this quarter. The difficulties faced by the largest diversified companies will remain the same in 2024, and some mining giants have unexpectedly appeared among the worst performing companies.

BHP Billiton and Rio Tinto, which have market capitalizations of 100 billion yuan, had double-digit declines by the end of the first quarter. Glencore's re-rating in the past few years has reversed, and its share price has fallen by 9% in 2024.

Since the end of 2023, Vale's market value in dollar terms has fallen by 24%, and it has been in a bear market. The Brazilian giant sold 13% of its base metals business to a Saudi sovereign wealth fund for $3.4 billion, but it appears that it cannot be listed separately given nickel's performance.

Although its Woodsmith fertilizer project in the UK has struggled, Anglo American shares performed steadily in 2024 after a sell-off in the second half of 2023 due to copper production expectations, platinum group metals and concerns about the South African power crisis.

Still, the company's market value fell below $30 billion for the first time since the epidemic, shrinking by more than 30% in the past 12 months.

Rumors that Swiss giant Glencore might be interested have subsided after its failed bid for Teck Resources, possibly due to ownership issues.

Although the ranking is still top-heavy, the proportion of mining giants in the total market value of the top 50 mining companies in Mining.com has dropped from 36% at the end of 2022 to the current 29%, a record low.

Chinese companies perform well

公平地说,The top five mining giants in history should expand to seven, including Ma 'aden and Zijin Mining, which has increased by more than 30% this year and seems to have firmly ranked in the top 10.

At the end of the first quarter, Zijin Mining's market value was close to US$60 billion (in fact, the rise in gold and copper in the first week of the second quarter has caused the company's market value to exceed this figure).

In the list of the best performing stocks in the first quarter, Zijin Mining was second only to China Molybdenum, followed by Jiangxi Copper, which jumped 9 places to 41st in the first quarter.

The total market value of the top 10 Chinese mining companies is US$192 billion, accounting for 14% of the total market value. Three years ago, the total market value of nine Chinese mining companies was US$115 billion, accounting for 9%.

Lithium companies perform poorly

Three mining companies fell out of the ranks of the 50 largest mining companies, including CSN Mineração, Huayou Cobalt and Australia lithium company Pilbara Minerals.

At the end of March, the market value of Pilbara Minerals was only lower than that of Kinross Gold, which ranked 50th. Although lithium prices have rebounded this year, they are not enough to surpass gold stocks in the second quarter.

The merger of Livent and Allkem to form Arcadium Lithium did not improve the ranking of lithium companies. This year, the market value of Akadem Lithium has dropped below US$5 billion.

At present, the total market value of lithium companies among the top 50 mining companies has dropped from US$119 billion in the second quarter of 2022 to US$59 billion.

_