Inflation rebounds, Federal Reserve's expectation of interest rate cuts weakens

2024.0409

Number of words in this article:1489, the reading time is about 2 minutes

introduction:美国汽车协会表示,上月全美汽油价格上涨超7%。

** Author| ** First Finance Fan Zhijing

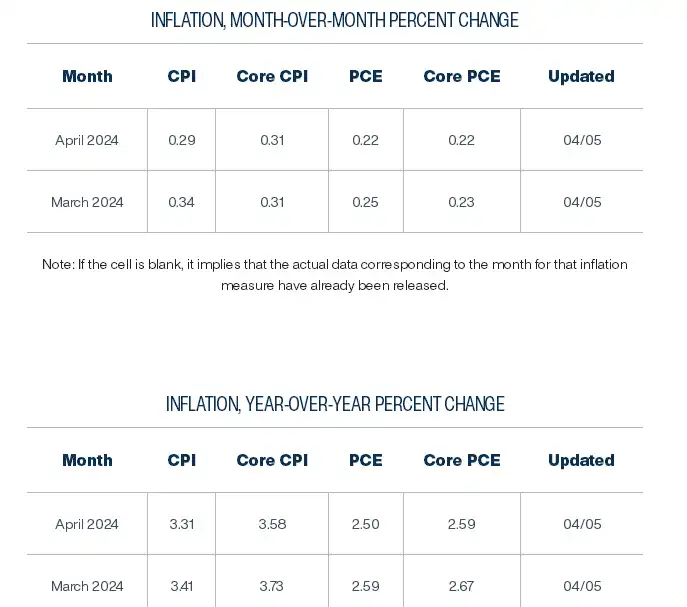

On the 10th local time, the United States will release March consumer price index (CPI) data. Although the Federal Reserve's interest-rate meeting last month maintained its expectation of cutting interest rates three times during the year, economic resilience, price pressures and the statements of Federal Reserve officials have made the prospects for easing no longer clear. Therefore, the latest inflation report may become an important reference for whether the Fed can usher in a policy turning point in the first half of the year.

Short-term inflation rebounds or ends

** **

今年以来,美国CPI开始缓慢回升。 根据机构的最新预测,3月通胀数据很可能继续加速,CPI同比上升3.5%,环比上升0.3%。燃料价格将继续成为重要推手,受到俄乌冲突、OPEC+减产及经济复苏前景等因素推动,一季度国际油价累计上涨近20%,美国汽车协会(AAA)数据显示,3月末全美平均汽油价格已经升至3.50美元/加仑,较月初上涨超7%。值得注意的是,随着消费热潮来临和炼厂产能受限,今夏油价有望升至4美元以上。 与此同时,围绕住房租金组成部分的不确定性仍将继续。今年1月,美国国土管理局调整了加权指数,独栋房屋现在更为重要,而此类住宅的租金上涨比公寓快。荷兰国际集团(ING)预计,由于该指数计算方式的调整,可能还需要几个月的时间才能看到影响缓解。 不考虑能源和食品,预计核心CPI增速将降至3.7%,环比回落0.1个百分点。不过,保险成本和医疗价格等因素的上涨趋势将继续造成超级核心通胀(剔除住房外核心服务)的压力。 对美联储而言,超级核心通胀的走势将成为未来政策转向的关键。尽管今年以来消费者支出有所放缓,但家庭消费仍然受到紧张的劳动力市场的支持,从最新非农、初请失业金和JOLTS职位空缺等指标看,企业用工需求依然强劲,从而支持了员工薪资健康增长。  值得注意的是,克利夫兰联储通胀模型显示,本轮美国整体物价的反弹有望在3月结束,而核心通胀距离2%的中期目标依然有不小的距离,且回落速度相对有限,这可能给未来政策转向带来一定阻力。

值得注意的是,克利夫兰联储通胀模型显示,本轮美国整体物价的反弹有望在3月结束,而核心通胀距离2%的中期目标依然有不小的距离,且回落速度相对有限,这可能给未来政策转向带来一定阻力。

The Fed's stance becomes cautious

** **

Since early April, combined with the resilience of the U.S. economy and inflationary pressures, federal funds rate futures have significantly tightened their pricing of easing this year. The First Financial Reporter summarized and found that there was no progress within the Federal Reserve on discussing the timing of interest rate cuts. Federal Reserve Chairman Powell's stance is relatively moderate. He has repeatedly stated that recent data on employment growth and inflation have not materially changed the overall situation:With steady economic growth and a strong but rebalancing labour market, prices have fallen to 2 per cent on sometimes bumpy roads. However, Powell reiterated that policy interest rates will not be reduced until there is increased confidence that inflation will continue to fall to 2%. His views were also shared by many committee members, such as Philadelphia Fed Chairman Huck and Richmond Fed Chairman Barkin. 'Services prices are still high, while commodity deflation is turning, and the Fed really needs to re-examine potential changes in the future inflation path, 'Craig Erlam, a senior market analyst at Oanda, said in an interview with China Business News. By contrast, the hawkish statements of some Fed officials have attracted widespread attention. Minneapolis Fed Chairman Kashkari warned last week that the Federal Open Market Committee (FOMC) may not be able to cut interest rates at all this year if inflation stagnates. It is worth mentioning that Federal Reserve Governor Bowman even sent a signal that he would not rule out raising interest rates. Bob Schwartz, a senior economist at the Oxford Institute for Economic Research, told China Business that economic resilience gave the Fed reason to wait longer before cutting interest rates. He believes that the Fed is still inclined to cut interest rates this year, but the rebound in the labor market and prices has become resistance. "cutting interest rates does not necessarily require obvious problems in the labor market, because it may mean economic risks." what the Fed needs to confirm is that prices are back under control. " Erram believes it is still possible for the Fed to cut interest rates in the first half of the year, provided that data over the next two months return to a "soft landing model" in which the economy cools moderately and the labour market tends to balance. Although the risk of a premature policy shift has been frequently mentioned recently, the lag of the impact of interest rates on the economy, which has been restricted for a long time, can not be ignored. **