AI Pharmaceutical:Looking for dawn in the cold winter, the popularity of giants and the dilemma of enterprises

The following article comes from Health News Consulting, the author of Health News Consulting

Health News Consulting.

Health News Consulting.

Cross-border insights into the medical industry

2024.0411

Number of words in this article:3447, reading time is about 6 minutes

introduction:英伟达掀起的热潮并不能惠及所有的AI药企,大部分公司仍旧身处寒冬之中。

** Author| ** First Financial Health Advisory

The A I pharmaceutical industry seems to be experiencing a "double day of ice and fire".

On the one hand,"AI enthusiasts" like Nvidia are making great progress in the primary market and making in-depth arrangements. In 2023 alone, Nvidia has invested in more than 10 AI pharmaceutical companies.

Entering 2024, Nvidia's tilt in AI pharmaceuticals will become more obvious:At the 42nd JPMorgan Healthcare Annual Conference in early January, Nvidia announced that it would cooperate with Amgen to establish an AI model platform called Freyja to accelerate and shorten the drug development cycle; at the Nvidia GPU Technology Conference that ended in March, there were more than 90 meetings related to life sciences/healthcare, surpassing hardware, semiconductors, automobiles and other technology fields for the first time, ranking first in the industry.

Huang Renxun, the head of Nvidia, lamented that "AI+ Medicine" will become the next "golden track".

On the other hand, AI pharmaceutical companies that have already entered the market are struggling under heavy pressure:The first batch of AI-designed drugs suffered a major defeat after entering the clinical market. So far, no drug has been successfully marketed. AI technology has fallen to the altar, gradually distancing former fans; the stock prices of leading companies that have already been listed have plunged. As the cold wave spreads, the primary market has also shrunk rapidly. Investors have become more cautious in their actions, and AI pharmaceutical companies that have lost their blood supply are on the verge of collapse.

At the end of March, shortly after the Nvidia GPU Technology Conference ended, Insilicon Intelligence, which went to Hong Kong to apply for an IPO, updated its prospectus that had expired for three months, once again bringing the only two AI pharmaceutical companies in the process of listing in China. In everyone's eyes, Jingtai Technology's prospectus will soon expire in May. What will the fate of the domestic AI pharmaceutical track go?

2 struggling star companies

** **

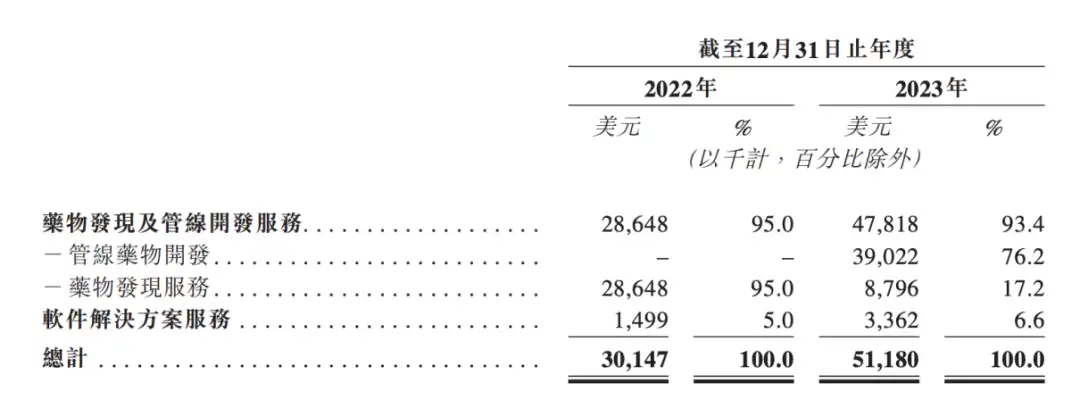

In the latest prospectus of InSilicon Intelligence, there is one piece of data worth noting:Revenue in 2023 was US$51.18 million, a year-on-year increase of 70%. Among them, US$39 million came from external authorization of drug development projects, which was the main source of revenue.

This is due to Insilicon's first AI drug external licensing project reached in September 2023. Insilicon granted Exelixis an exclusive global license to develop and commercialize ISM3091 and other targeted USP1 compounds, with a down payment of US$80 million.

Soon after, in January 2024, Insilicon Intelligence once again reached a licensing agreement with Menarini Group ("Menarini") and its wholly-owned subsidiary Stemline Therapeutics. Menarini will receive the global exclusive development and commercialization rights of ISM5043, with a total project cooperation of US$500 million, including a down payment of US$12 million, as well as subsequent development, regulatory and commercial milestones.

As one of the earliest AI pharmaceutical companies in China, InSilicon Intelligence has layout in three business models: AI-biotech, AI-CRO and AI-SaaS. With AI-biotech as its core, it is a representative company in this direction.

Before reaching the first AI drug external authorization project, InSilicon Intelligence's revenue consisted of two parts: AI-CRO and AI-SaaS. In terms of revenue in 2022, software solution services only account for 5%, while drug discovery services account for 95%. In 2022, the cooperation reached with Fosun and Sanofi has contributed the vast majority of AI-CRO's revenue to InSilicon Intelligence.

In 2023, Insilicon Intelligence's AI-biotech business will finally begin to take shape. The external licensing of pipelines will bring US$39 million in revenue to Insilicon Intelligence, accounting for 76.2% of the total revenue for the year.

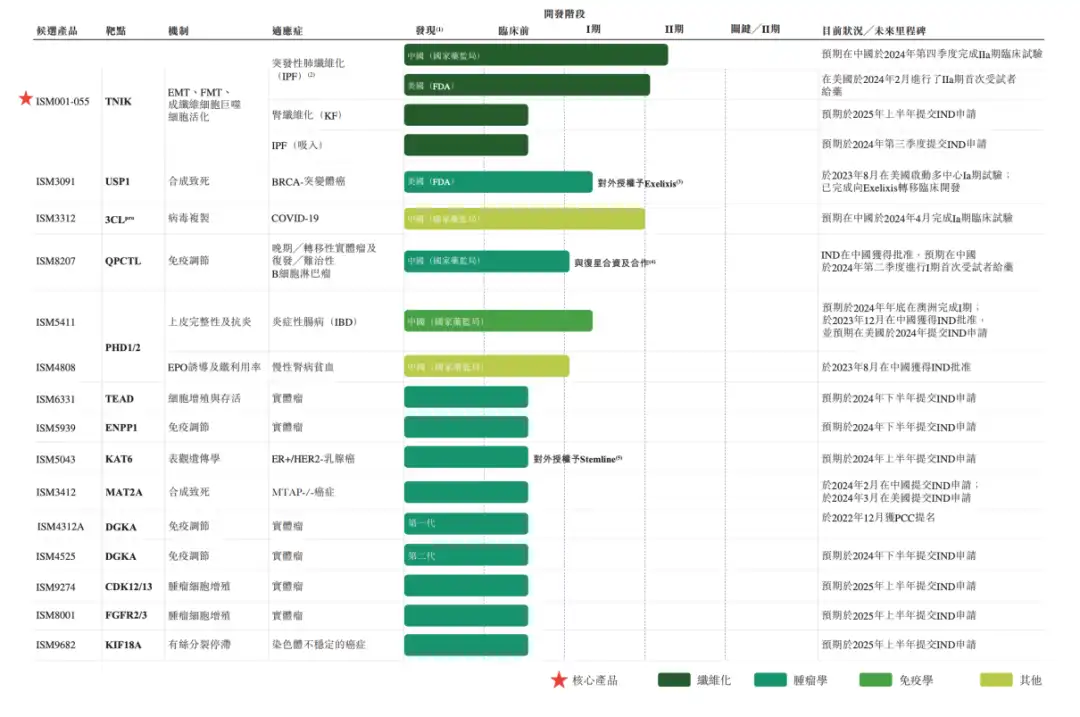

The prospectus also updates the current pipeline progress of InSilicon Intelligence, the fastest one has been advanced to clinical phase II.

The US Phase IIa clinical trial of the core product ISM018_055 has completed the first subject administration in February 2024; the Chinese Phase IIa clinical trial is expected to be completed in the fourth quarter of 2024. In addition, drugs developed by many companies such as USP1 inhibitors (licensed to Exelixis), QPCTL small molecule inhibitors (in cooperation with Fosun Pharma), and oral PHD inhibitors have also entered the clinical stage.

▲ 资料来 自英矽智能 招股 书

▲ 资料来 自英矽智能 招股 书

So, will the two newly reached external licensing cooperation and the slightly improved financial data in 2023 add fuel to the IPO process of InSilicon?

In terms of time, Insi Intelligent reached cooperation with its two partners Exelixis and Menarini in September 2023 and January 2024 respectively much earlier than the date of the prospectus update. If these two external licensing cooperation can become a bargaining chip for InSilicon to impress capital and complete fundraising, they should have responded as early as last year, rather than allowing the prospectus to expire.

After InSilicon completed its Series D financing in 2022, its valuation will reach US$895 million.

As the market goes down, capital is becoming increasingly sensitive to high valuations, and it is difficult for companies to find investors willing to take over."The company's own valuation is already very high. If we continue to invest money at this time, once the stock price falls after listing, it will be stable. Loss of money."

Chen Ming (pseudonym), a senior investor in the medical field, admitted that there is a high probability that companies that are not going to go public will not be able to find investors.

In-silicon intelligence is not the only one. Jingtai Technology, another AI pharmaceutical company in the process of IPO, is also facing a very serious situation.

Around 2021, when the primary market is most prosperous, Jingtai Technology is a more sought after star project than InSi Intelligence. In 2021 alone, it received US$400 million in financing. After Series D financing, the valuation of US$1.968 billion is more than twice that of InSi Intelligence. Jingtai Technology also carries higher expectations of investors.

However, at the threshold of listing, high valuations have become an insurmountable threshold, making investors discouraged.

Pipeline progress determines the fate of the company

** **

In July 2022, InSilicon completed its last round of financing before applying for an IPO. This was the last boom in the primary AI pharmaceutical market. Since the second half of 2022, the capital carnival that has lasted for more than two years has come to an end.

As the stock price of AI Pharmaceutical, which was previously listed in the U.S. stocks, continued to fall, the decline of the secondary market has greatly affected investors 'confidence in the primary market. The funds that once poured in crazily quickly left the market, leaving only technology and Internet giants such as Nvidia, Google Cloud, and Amazon Cloud, as well as investment institutions specifically tailored for AI, are still looking for new targets.

An investor who has long been concerned about the AI+ medical market said that no matter how cold the AI pharmaceutical market is, there will still be sporadic investors. However, the investment logic is different from the past. For example, early projects are favored to avoid the risk of loss.

"No matter any industry, new results will be born after entering a trough, and investors with a keen sense of smell will always find these new highlights." This investor believes that in the current market environment, it is more sensible for investors to choose more distinctive early projects to invest and withdraw in Series C and D stages, which can at least save costs.

According to incomplete statistics, among the 31 AI pharmaceutical companies that received financing in China in 2023, most are in the Angel Round A+ stage. Only 1 company received Series B+ financing and 2 companies received Series C financing. Among them, the highest financing amount for the whole year was RMB 700 million from Shenshi Technology's Series C financing.

What is special about Shenshi Technology, which can still stand out in the cold winter of the industry, which has won large Series C financing?

An investor who has been exposed to Shenshi Technology said that the uniqueness of Shenshi Technology lies in its long-term research in the field of AI for Science, which has enabled the company to establish a more recognized accumulation of underlying technologies.

In this investor's view, investment institutions follow different logic in evaluating early projects and later projects. For early-stage companies, investors pay more attention to the implementation and reliability of the company's key technologies and which field problems can be solved; for late-stage companies, they pay more attention to product effects and specific data,"relying on investors can no longer get paid for telling stories."

In the pharmaceutical field, pipeline progress and commercial milestones are the best achievements.

Jingtai Technology, which has AI+CRO as its core business, has not announced any news that drugs developed by these customers using the company's technology have entered clinical trials since it reached an AI new drug research and development cooperation relationship with major customers such as Pfizer in 2017. Therefore, the company's AI The technical value of new drug research and development has been questioned by the outside world, and the road to listing is not optimistic.

The biggest question people have about AI pharmaceuticals comes from the fact that this technology has not yet developed a truly marketed drug, and the value of this path has yet to be explored. AI pharmaceutical companies may have to spend a long winter before there are real pioneers to pick the fruits.

Hibernation AI Pharmaceutical Track

** **

The craze set off by Nvidia does not benefit all AI pharmaceutical companies, and most companies are still in the cold winter.

A founder of an AI pharmaceutical company that has completed Series A financing told "Health News Consulting" that recent communication with investment institutions has not been smooth. Most investors said that if they encountered their projects two years ago, they would definitely invest, but Now under the pressure of return on investment, it is difficult to move without hesitation like before.

It is unknown whether InSilicon Intelligence and Jingtai Technology, the top echelon in China, will be able to overcome the difficulties of listing.

Companies such as InSilicon Intelligence and Jingtai Technology that have already completed Series D financing have chosen to apply for IPOs, both to raise funds and to cope with investor pressure. Even though he knew that there was little hope of successfully listing the funds raised during this period, he had to try his best."Even if it didn't pass in the end, it would be an explanation to investors after two years of hanging up on the Hong Kong Stock Exchange." One investor analyzed this.

These companies that received overvalued valuations during the boom period of the industry have difficulty finding opportunities to implement:If it is listed at the original valuation, it is almost impossible to raise funds, and no one will bet on a bet that knows that it will lose money; if you actively cut the valuation, you will inevitably violate the interests of investors in the later stage. Faced with strong investment institutions, it is difficult for the company's founders to win in the game, and in the end, you can only bear the deficit, so it is almost impossible to achieve it.

For most companies, the best choice at the moment is to lay off employees, suspend pipeline research and development, actively enter a hibernation period, and wait for the industry to recover.

Since 2022, foreign AI pharmaceutical companies have heard news of layoffs. On August 9, 2022, Absci laid off 50 people; in May 2023, BenevolentAI announced that it would lay off 180 people due to the failure of clinical trials of its core pipeline BEN-2293, close to 50% of the total number; In August 2023, BioXcel Therapeutics laid off 110 people, accounting for 60% of the total number; In January 2024, Canadian AI pharmaceutical company BenchSci announced that it would lay off 70 people due to plans to change its development focus, accounting for 17% of the total number.

Once cash flow support is insufficient, even listed companies such as Absci and BioXcel Therapeutics will not escape the fate of shrinking even if they have entered the secondary market.

Among domestic companies, according to former employees of Jingtai Technology, the company has also laid off employees many times in 2023, abolishing a total of hundreds of people, and abolishing some business lines and departments as a whole.

"For companies, without capital input, controlling costs by layoffs and suspending pipelines can minimize the operating pressure of the company and preserve the company's assets. When the environment improves in a few years, we will make a comeback." Chen Ming believes that this is also a solution acceptable to both companies and investment institutions.

Only surviving companies have hope to cross the industry cycle, and the best choice now is to ensure that they remain at the table.

**