Enhance the inherent stability of the capital market and protect high-quality economic development

As a hub that affects the whole body, the capital market connects thousands of businesses and thousands of households. Having a tough and stable capital market is the key to stabilizing expectations and confidence, and it is also what all parties hope for. This year's "Government Work Report" emphasizes "enhancing the inherent stability of the capital market", which not only responds to the concerns of all parties in the market, but also points out the direction for the reform and development of the capital market. It will help boost investor confidence, promote the smooth and healthy operation of the capital market, and better play The function of market resource allocation is of great significance.

improving the quality of listed companies

What kind of market is an inherently stable capital market?

在粤开证券首席经济学家、研究院院长罗志恒看来,“增强资本市场内在稳定性”意味着It is necessary to ensure the stability of the system and also take into account the stability of prices. 以资本市场为代表的直接融资体系本身与新兴产业的发展更契合,要保证融资渠道畅通,形成贷款的良性替代,匹配产业发展要求。同时,资本市场是形成预期、交易预期的“场所”,资产价格尤其是股票价格是反映预期最直观的载体。急涨、急跌都是资本市场制度不健全、主体不成熟的表现,要通过制度的完善、优化,保持价格的相对平稳。

“稳定是市场成熟和健康发展的重要标志,对促进长期投资和经济发展至关重要。”招商基金研究部首席经济学家李湛表示,On the one hand, capital markets should have endogenous robustness ,包括市场价格的稳定和市场结构、市场机制与市场参与者行为的稳定,不依赖外部干预或短期政策措施即能维持平稳运行。On the other hand, capital markets should have the ability to resist risks ,在经济波动或政策调整时依然能发挥其基本功能,不会出现极端波动或系统性风险。

"The" Government Work Report "proposes to enhance the inherent stability of the capital market, reflects the importance attached to the healthy development of the capital market, and reveals the main tone of China's capital market reform and development in the future." Zhu Keli, executive director of the China Information Association and founding director of the National Research Institute of New Economics, said that the stability of the capital market stems from its complete basic system, effective regulatory mechanism and dynamic risk control capabilities. When market participants behave in a standardized manner, information disclosure is transparent, transactions are fair and orderly, and risks are preventable and controllable, the capital market can truly serve the real economy and optimize resource allocation.

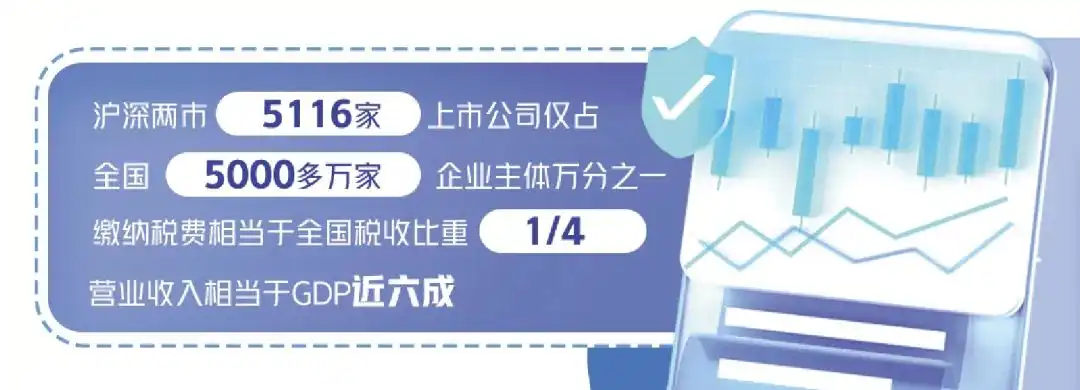

The "barometer" function of the capital market is mainly reflected by listed companies. Improving and strengthening listed companies and improving the overall investment value is a key measure to optimize the capital market ecology and stabilize the core of the capital market.

“上市公司是资本市场的主体,其质量的高低直接影响着市场信心。”李湛建议从三方面提升上市公司质量:The first is to strengthen corporate governance ,提高上市公司信息披露标准,确保投资者能够获得准确、全面的信息,从而作出投资决策。The second is strict supervision ,制定和完善相关法律法规,对市场操纵、内幕交易等违法行为进行严厉打击,维护市场公平。The third is to encourage long-term investment ,引导投资者关注公司的长期价值而非短期利润,通过激励机制支持长期投资,为上市公司提供更加长久稳定的源头活水。

Recently, the China Securities Regulatory Commission issued the "Opinions on Strictly Controlling the Access to Issuance and Listing to Improve the Quality of Listed Companies from the Source (Trial)", and stated that in the future, it will establish a modern enterprise system before listing, study and improve the listing indicators of some sectors, and strictly control the access to issuance and listing in aspects such as strictly supervising the listing of unprofitable enterprises.

With the implementation of various measures to focus on the "entrance gate", the market ecology is expected to be further optimized. “提高上市公司质量,在严把入口的同时还应加大退市力度,尤其要加强对主动退市的引导,通过优胜劣汰的市场机制,出清已丧失持续经营能力的空壳公司、绩差公司,保证存量上市公司质量逐步提高。”罗志恒表示,应强化分红导向,进一步鼓励上市公司及时通过应用市场化增持、回购等手段传递信心、稳定预期,加大现金分红力度,更好地回报投资者。

Focus on dynamic balance of investment and financing

Investment and financing are the basic functions of the capital market. The two are integrated and complement each other. Promoting the dynamic and balanced development of investment and financing is regarded as an important part of enhancing the inherent stability of the market.

从融资端来看,In February last year, the comprehensive registration system was officially implemented, the inclusiveness of the capital market was significantly improved, and more high-quality companies were able to go public to "quench their thirst". “进一步优化融资端结构是当前所需。”朱克力认为,可通过发展债券市场、股权市场等多元化融资渠道,满足不同类型企业的融资需求,从而降低市场对单一融资渠道的过度依赖。

From the investment perspective, medium-and long-term funds bring long-term stable sources of funds to the capital market, can promote the formation of value investment concepts, and can play a role in stabilizing confidence when the market fluctuates. 促进投融资动态平衡,离不开中长期资金的“压舱石”作用。

Data shows that as of the end of 2023, the total market value of A shares held by various professional institutional investors such as social security funds, public funds, insurance funds, and annuity funds was 15.9 trillion yuan, an increase of more than double that at the beginning of 2019, and the proportion of shares increased from 17% to 23%. However, compared with mature overseas markets, there is still much room for improvement.

How to attract more medium-and long-term funds to enter the market? Luo Zhiheng believes that it is necessary to open up the "blocking point" for long-term funds to enter the market, further support social security, annuities, etc. to expand the scope of investment, include index funds and other equity products into the scope of investment options, allow long-term funds to participate in non-public offerings in the market, etc., and gradually increase the allocation proportion of long-term funds equity assets. At the same time, we will speed up the establishment of a long-term assessment mechanism for long-term funds for more than three years, optimize supporting systems such as taxation and accounting, and improve the stability of long-term capital investment behavior. In addition, we can further increase diversified risk management tools, relax restrictions on the use of derivatives by institutional investors, and allow more domestic and foreign investment institutions to use derivatives to manage risks under the premise of prudence.

Good signals to guide medium-and long-term funds into the market are being intensively released. 证监会目前正在研究制定资本市场投资端改革行动方案,作为未来一段时期统筹解决资本市场中长期资金供给不足等问题的行动纲要。《政府工作报告》也明确提出“在全国实施个人养老金制度,积极发展第三支柱养老保险”。养老金和年金等的健康发展和资产配置多元化,将推动更多中长期资金进场。

业内人士认为,Creating a more open, transparent and virtuous market ecosystem and giving investors a real sense of gain is the fundamental reason for attracting long-term funds to be willing to come and retain. “在促进投融资动态平衡发展的过程中,应注重市场机制的完善和市场环境的优化。”朱克力表示,例如,可进一步完善新股发行、交易、信息披露等市场机制,提高市场透明度和公平性,从而更好保护投资者合法权益,让投资者敢投、会投、长投。

"Long teeth and thorns" strong supervision

Recently, regulatory authorities have stepped up efforts to crack down on counterfeiting in the capital market and used heavy efforts to purify the market ecology. On February 22 alone, the China Securities Regulatory Commission posted six administrative penalties at one time, involving illegal activities such as insider trading and market manipulation, conveying the strength and determination to strengthen supervision to ensure the stable operation of the capital market.

At present, the market is generally concerned about the supervision and practice quality of sponsor institutions, and expects to urge intermediaries to return to their duties, truly play their role as "gatekeepers", improve the quality of listed companies from the source, and promote high-quality market development.

** **

**