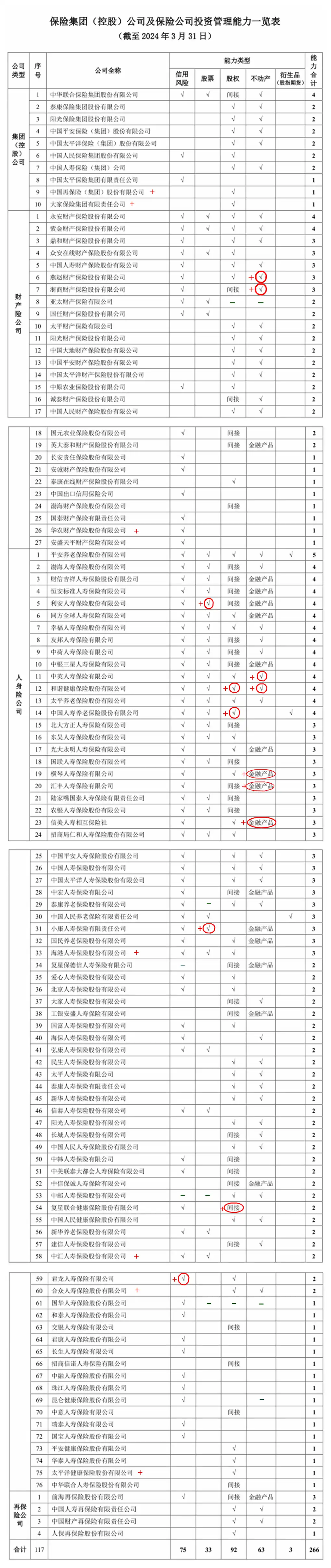

Insurance companies 'investment management capabilities reappear:7 companies add new real estate management capabilities

Recently, the Insurance Industry Association of China issued the "Notice on Building Investment Management Capabilities of Insurance Group (Holding) Companies and Insurance Companies", presenting the investment management capabilities of 117 insurance companies to the public.

Asset Insights talks about this.

————

Pre-decentralization assessment + post-event strict supervision

Insurance companies announced their investment management capabilities, which began on September 3, 2020.

At that time, the China Banking and Insurance Regulatory Commission issued a "No. 45 Document"-"Notice of the China Banking and Insurance Regulatory Commission on Matters Related to Optimizing the Supervision of Investment Management Capabilities of Insurance Institutions."

"Document No. 45" requires insurance companies to disclose their investment management capabilities to the public through self-assessment and accept relevant supervision.

The reason is simple:You can make what investment you have only if you have investment management capabilities; if you don't have relevant investment management capabilities, you can't make relevant investments.

So how to determine that an insurance company has certain investment management capabilities?

The China Banking and Insurance Regulatory Commission provides relevant standards, and insurance companies establish an evaluation and related work system, compare self-evaluation, and publish it to the public on a dynamic cycle (half a year or one year), and require the public to know it. Since it is announced, it must be responsible for being honest and trustworthy. Accept real-time supervision, and accept punishment if there is any falsehoods.

Ex-ante decentralization evaluation + strict supervision after the event-Through the "No. 45 Document", the China Banking and Insurance Regulatory Commission established a market-oriented management method for insurance companies 'investment management capabilities. The public can also learn about the relevant situation of insurance companies through this window.

According to "Document No. 45", the investment management capabilities of insurance institutions are divided into seven categories, and insurance institutions are divided into two categories. Two different types of insurance institutions correspond to five types of investment management capabilities respectively.

Corresponding investment management capabilities of insurance group (holding) companies and insurance companies: Credit risk management capabilities; stock investment management capabilities; equity investment management capabilities; real estate investment management capabilities; derivatives utilization management capabilities.

Corresponding investment management capabilities of insurance asset management institutions: Credit risk management capabilities; stock investment management capabilities; derivatives application management capabilities; debt investment plan product management capabilities; equity investment plan product management capabilities.

After the release of "No. 45 Document", on June 8, 2022, the Insurance Industry Association of China issued the "Self-discipline Management Guidelines for Information Disclosure of Investment Management Capabilities of Insurance Companies (Trial)"-after the China Banking and Insurance Regulatory Commission determined the management measures, China Insurance Industry Association coordinates and solves details such as specific implementation and how to disclose investment management capabilities.

On March 31, 2023, that is, a year ago, the Insurance Association of China organized and issued the "Notice on the Building of Investment Management Capabilities of Insurance Companies" in accordance with the above requirements. The investment management capabilities of 119 insurance companies were intensively demonstrated to the public.

So far,"No. 45 Document" has been implemented into specific management results.

————

7 companies increase their real estate investment management capabilities

Today, one year later, in accordance with dynamic cyclical requirements, the Insurance Industry Association of China once again released a "list" of insurance companies 'investment management capabilities. This is the investment management capabilities of 117 insurance companies that we saw in 2024.

So, what can you see in the 2024 "list" of investment management capabilities of 117 insurance companies?

It should be said that compared with 2023, the two "lists" have basically changed little in one year. Most insurance companies have maintained the investment management capabilities of one year ago, but individual companies have also made major adjustments.

What the two lists have in common:

1. There are few all-around insurance companies.

In the past two years, Ping An Pension is the only one with five investment management capabilities. There will be 17 insurance companies with 4 investment management capabilities in 2023 and 16 in 2024, a decrease of 1.

** 16 insurance companies with 4 investment management capabilities in 2024--** China United Insurance Group Co., Ltd.; Yong 'an Property Insurance Co., Ltd.; Zijin Property Insurance Co., Ltd.; Bohai Life Insurance Co., Ltd.; Caixin Jixiang Life Insurance Co., Ltd.; Heng' an Standard Life Insurance Co., Ltd.; Lian Life Insurance Co., Ltd.; Tongfang Global Life Insurance Co., Ltd.; Happiness Life Insurance Co., Ltd.; AIA Life Insurance Co., Ltd.; Sino-Dutch Life Insurance Co., Ltd.; BOC Samsung Life Insurance Co., Ltd.; Sino-British Life Insurance Co., Ltd.; Harmony Health Insurance Co., Ltd.; Taiping Pension Insurance Co., Ltd.; China Life Pension Insurance Co., Ltd.

2. Among the five investment management capabilities, insurance companies play the most "equity" and play the most "derivatives".

Number of insurance companies ranked in two-year investment management capabilities:"Equity" comes first (92 of the 117 insurance companies in the 2024 "List" have this ability),"credit risk" comes second,"real estate" comes third,"stocks" come fourth, and "derivatives" come fifth. Among them, there will be 4 insurance companies that have the ability to make "derivatives" in 2023, which will be reduced to 3 in 2024.

Changes in the two "lists":

1. There have been changes in the insurance companies on the "list".

There were 7 new companies, 9 fewer companies, and the total number of companies on the "list" decreased by 2.

Among the group's holding companies, 2 new companies are:China Reinsurance (Group) Co., Ltd. and Dajia Insurance Group Co., Ltd.

In terms of property insurance companies, Huanong property insurance was added, but Huatai property insurance did not appear.

There are major changes in life insurance companies-4 new companies:Harbor Life Insurance, Zhonghui Life Insurance, Hezhong Life Insurance, Pacific Health Insurance;8 companies on the 2023 "List" did not appear:Qianhai Life Insurance, Yingda Taihe Life Insurance, Huagui Life Insurance, Dingcheng Life Insurance, Tianan Life Insurance, Shanghai Life Insurance, Evergrande Life Insurance, Changjiang Pension Insurance.

2. The investment management capabilities of insurance companies have been adjusted.

When the total number of companies is reduced by 2, the total capability items of the "list" are reduced by 3 items. However, specifically, each company has its own contraction and expansion points according to different circumstances.

In Asia Pacific Property Insurance, investment management capabilities have been reduced from 4 to 2, and "equity" and "real estate" have been reduced. Taikang Pension Insurance has reduced its investment management capabilities from 4 to 3, and its "stocks" have been reduced. Fosun Prudential Life's investment management capabilities have been reduced from 3 to 2, and its "credit risk" has been reduced. China Post Life Insurance has reduced its investment management capabilities from 4 to 2, and its "credit risk" and "stock" have been reduced. Guohua Life Insurance has reduced its investment management capabilities from 4 to 1, leaving only "credit risk". Kunlun Health Insurance's investment management capabilities have been reduced from 2 to 1, leaving only "credit risk".

In contrast to the reduction, in 2024, a total of 7 insurance companies (Yanzhao Property Insurance, Zheshang Property Insurance, Sino-British Life Insurance, Harmony Health Insurance, Hengqin Life Insurance, HSBC Life Insurance, and Sinmei Life Insurance) will increase their "real estate" investment management capabilities, which is almost the most eye-catching change compared to the two-year "list".

In addition, Lian Life Insurance, China Life Insurance, Xiaokang Life Insurance, and Junlong Life Insurance also have investment management capabilities.

2024年《保险集团(控股)公司及保险公司投资管理能力建设情况通报》一览表

2024年《保险集团(控股)公司及保险公司投资管理能力建设情况通报》一览表

Editorial board on duty:Li Hongmei

edit:Han Jianming

studying the:Dai Shichao