Sichuan Road accepts the offer of Sichuan Trust:Central enterprises withdraw and local governments take over

Recently, Sichuan Trust's bankruptcy and reorganization was heard-Shudao Group (controlled by the State-owned Assets Supervision and Administration Commission of Sichuan Province) and Chengdu Xingshuqing Enterprise Management Co., Ltd.(controlled by the State-owned Assets Supervision and Administration Commission of Qingyang District of Chengdu City) entered the market to take over the offer.

The background is a bit grand, so "Asset Insights" will sort out here.

————

Why "Shu Road"

First of all, the two major state-owned companies take over Sichuan Trust at a high price.

In June 2020, the Sichuan Trust Crisis broke out due to default on payment of multiple products. It is said that the product scale involved is as high as 25 billion yuan.

On December 19, 2023, Sichuan Tianfu Chunxiao Enterprise Management Co., Ltd., which is 50% owned by Shudao Group and Chengdu Xingshuqing, was established and accepted the qualified trust beneficiary rights held by Sichuan Trust natural person investors.

On December 25, 2023, Sichuan Trust's transfer plan was announced, signing contracts with natural person investors for payment at rates ranging from 40% to 80%(biased towards small and medium investors). By 24:00 on March 5, 2024, the signing window will officially close, and the overall signing rate will be 95.02%.

The signing was smooth--

On April 1, 2024, the Sichuan Supervision Bureau of the State Financial Supervision and Administration issued an announcement approving the bankruptcy reorganization of Sichuan Trust. After nearly four years of entanglement, Sichuan letter has finally embarked on the track of reorganization.

"This plan has exhausted all chemical insurance resources that can be mobilized. Provincial and municipal governments and state-owned enterprises have made great contributions and provided a large amount of real money." From the official account, you can also understand what efforts Sichuan has made to successfully complete this reorganization.

Sichuan Trust previously controlled Liu Canglong, who was in charge of the "Hongda Family"(Sichuan Hongda two companies controlled 54.2% of Sichuan Trust).

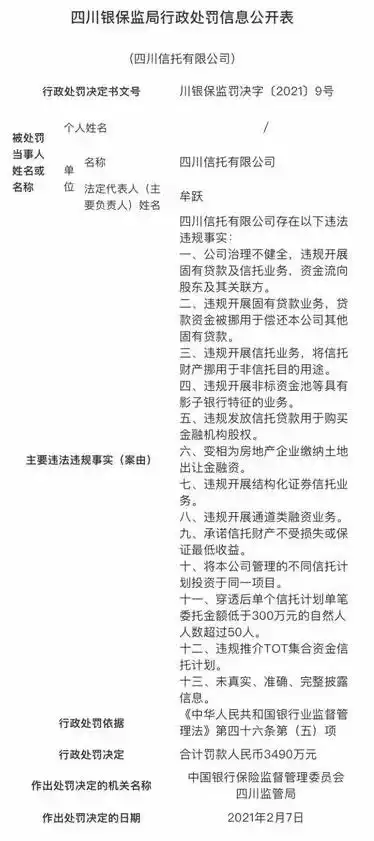

In February 2021, the former Sichuan Banking and Insurance Regulatory Bureau issued a major administrative penalty decision on Sichuan Trust with a fine of 34.9 million yuan, ruling on 13 violations and violations. In June 2021, Liu Canglong, the company's actual controller, was detained by the Chengdu City Public Security Bureau on suspicion of breach of trust and use of entrusted property.

**万得数据显示,四川信托持股情况为:**四川宏达(集团)有限公司32.04%; 中海信托股份有限公司30.25%; 四川宏达股份有限公司22.16%; 四川濠吉食品集团有限公司5.04%; 汇源集团有限公司3.84%; 中国铁路成都局集团有限公司3.57%; 四川省投资集团有限责任公司1.39%; 四川成渝高速公路股份有限公司1.17%; 中铁八局集团有限公司0.42%; 中国烟草总公司四川省公司0.11%。

原四川银保监局行政处罚信息公开表

The trust industry is undergoing overall adjustments in recent years. Strengthening supervision, rectifying various violations, and allowing the trust industry to "return to its roots" are the main tone of the industry.

Due to the strong policy background, it is more reasonable to reorganize trust companies that have problems and replace them with state-owned assets. Maintaining the legitimate rights and interests of investors and stabilizing the overall situation is also the basic background for the two major state-owned companies to take over Sichuan Trust.

But at the same time, it should also be noted that restructuring and taking over the offer, rather than letting Sichuan Trust go into bankruptcy and liquidation, also reflects Sichuan's proactive and enterprising side.

Although the cost is high, restructuring Sichuan Trust is still meaningful from an operational perspective.

As we all know, trust licenses have a certain scarcity. There are 68 trust companies across the country (among which Xinhua Trust has been bankrupt and liquidated), except for 11 in Beijing, 7 in Shanghai, 5 in Guangdong, 5 in Zhejiang, 4 in Jiangsu, and 3 in Shaanxi, there are only one or two registered places in other provinces. There are two trust companies in Sichuan, one is Sichuan Trust and the other is China Railway Trust.

China Railway and Sichuan Road, which participated in this reorganization of Sichuan Telecom Corporation, are in the same industry. However, China Railway is a state-owned enterprise, and Shu Road is a local state-owned enterprise.

After taking Sichuan letter, the two families have similar patterns:China Railway is owned by China Railway Trust, and Sichuan Trust is owned by Shudao.

Chengdu Xingshuqing, one of the two state-owned enterprises that took over Sichuan Trust this time, has little information, while Shudao Group is an extraordinary existence in Sichuan.

蜀道集团宣传片截图

蜀道集团宣传片截图

In September 2020, SASAC began to deploy the "Three-Year Action Plan for State-owned Enterprise Reform (2020 - 2022)". The State-owned Assets Supervision and Administration Commission of Sichuan Province then deployed a local three-year operation, the core of which is called:"1+6" major special reform.

"1" means the integration and formation of Shudao Group. In November 2020, the former Sichuan Communications Investment Group and Sichuan Railway Investment Group launched restructuring and integration. On May 26, 2021, the newly established Shudao Investment Group Co., Ltd. was unveiled in Chengdu. ("6", for the reorganization of the "aircraft carrier fleet" of six provincial enterprises, including Sichuan Province Ecological and Environmental Protection Industry Group, Sichuan Province Tourism Investment Group, Sichuan Province Coal Industry Group, Sichuan Aviation Group, Sichuan Province Airport Group, and Sichuan Development (Holding).)

Shudao Group can be called the "leader" of Sichuan's local state-owned enterprise reform, and its establishment is also known as the "first battle" of Sichuan's three-year state-owned enterprise reform.

After the reorganization, Shudao's total assets account for "half of the enterprises affiliated to Sichuan Province, ranking among the world's top 500 companies. Its business development is divided into four core business segments: "Road and Railway Investment, Construction and Operation","Related Diversified Industries","Smart Transportation" and "Integration of Industry and Finance".

Among the four major sectors, the first three are related to their own industry or industry, that is, their own strengths, while the integration of industry and finance, that is, the part that uses financial power to serve entities, needs to be strengthened. In addition, the trust industry has a high degree of compatibility with infrastructure. Therefore, there should be practical strategic considerations for Shu Road to enter Sichuan and Sichuan.

It is worth noting that in January 2024, Shudao also won another financial company:UNITA Insurance.

————

Central enterprises withdraw and local governments take over

Shudao Group was very proactive in taking over UNITA Insurance.

UNITA Insurance, the original full name of "AVIC UNITA Property Insurance Co., Ltd.", was jointly initiated and established by AVIC Group and UNITA Group of France, with each party holding 50%.

In June 2021, AVIC Group agreed to transfer its 50% stake in AVIC UNITA Property Insurance to its subsidiary AVIC Investment at a price of approximately 703 million yuan. Just two years later, in September 2023, AVIC Investment listed and transferred the 50% equity on the Beijing Equity Exchange, with a reserve price of 885 million yuan.

The analysis believes that AVIC's investment in the transfer of UNITA's equity is related to the overall background of the reform of central enterprises. At present, central enterprises are demanding to return to their own businesses, and many central enterprises are also making major moves to divest some financial companies that have financial investment. The integration of industry and finance not only requires central enterprises to leverage financial resources, but also requires finance to have a close relationship with their main business support and serve the main business.

AVIC has invested in existing financial sectors, including finance, leasing, trust, securities, futures, funds, etc., and its insurance brokerage business has also been operating for many years. UNITA Insurance has a short investment period from the group to AVIC, has low compatibility and low profit contribution. UNITA is the only joint venture insurance company in China that operates policy-based agricultural insurance business. Agricultural insurance belongs to a large-scale, long-term stable category with low profit margins.

In November 2023, Shudao obtained a 50% stake in UNITA from AVIC Investment through bidding, and officially unveiled it on January 30, 2024, changing its name to:UNITA Property Insurance Co., Ltd.(the word "AVIC" is removed).

The same point as Sichuan Credit is that UNITA Insurance is also a financial company registered in Sichuan.

For AVIC Investment, which has a lot of financial content, UNITA Insurance is nothing, but for Shudao, it has a completely different meaning.

First of all, UNITA itself is a Sino-French insurance company and has unique advantages in further development.

Secondly, Sichuan itself is one of the top agricultural provinces in the country. Strengthening and expanding local agricultural insurance companies is a very important bonus for both insurance companies and Sichuan Road, a local state-owned enterprise.

Moreover, through years of development, UNITA has spread a certain scale across the country and laid the foundation.

What's more, UNITA Insurance still has many other business categories to be developed. Combined with the relevant advantages of Shudao Group, there is huge room for expansion.

Therefore, the acquisition of UNITA was a favorable opportunity for Shu Dao to take advantage of the withdrawal of central enterprises to take advantage of the situation, lay out control, and pick up the "treasure" as soon as it needed it most.

安盟财产保险有限公司经营区域覆盖四川、吉林、陕西、辽宁、黑龙江、内蒙古、北京、河北、山东、天津、海南、江西等省市自治区

安盟财产保险有限公司经营区域覆盖四川、吉林、陕西、辽宁、黑龙江、内蒙古、北京、河北、山东、天津、海南、江西等省市自治区

————

Sichuan Xiongqi

In fact, Shudao is just a representative enterprise that has taken off Sichuan's economy. In 2023, Sichuan Province ranks first in the country in annual investment in railway and highway construction. Is it just because of Sichuan Road?

Behind the Sichuan Road, the rise of Sichuan is the fundamental reason why Sichuan Road is strong and Sichuan letter is so taken over.

One of the biggest news stories about China's economic opening year in 2024 is that the GDP of Sichuan Province has hit the top five in the country--

2023年,四川GDP总量为60132.9亿元,同比增长6%,为四川经济总量首次突破6万亿元大关。四川经济总量超越河南,跃居中国经济第五大省,跻身中西部经济第一大省,改变了20年未曾变化的中国GDP前五省份排名。 九绵高速,连接九寨沟县、平武县、北川县、江油市、游仙区,四川省唯一一条全国绿色公路建设典型示范工程,坚持“最大程度保护、最小程度破坏、最大限度修复理念”,将高速公路轻轻地放入大自然

九绵高速,连接九寨沟县、平武县、北川县、江油市、游仙区,四川省唯一一条全国绿色公路建设典型示范工程,坚持“最大程度保护、最小程度破坏、最大限度修复理念”,将高速公路轻轻地放入大自然

Sichuan Province integrates various national-level strategies such as the Western Development, the Belt and Road Initiative, the Yangtze River Economic Belt, the Chengdu-Chongqing Twin Cities Economic Circle, the New Western Land-Sea Corridor, the domestic circulation, and the national comprehensive three-dimensional transportation system. Chengdu-Chongqing region is also considered to be the "fourth pole" of China's economy after Guangdong, Hong Kong and Macao, Yangtze River Delta, and Beijing-Tianjin-Hebei.

Some analysts compared the economic growth rates of Sichuan Province and Guangdong Province since the Western Development and found that Sichuan Province was higher than that of Guangdong Province in most years.

This is what the article "Situation of Sichuan Province" in April 2019,"Although the gap exists, the future is promising-Two Dimensions and 16 Groups of Data Perspective the Economy of Sichuan and Guangdong" said-

"Before 2008, Guangdong's GDP growth rate was generally higher than Sichuan in other years except for 1978 and 1983. In the 1990s, with the help of reform and opening up, the economic growth rate even reached more than 20%. After 2008, the situation reversed. Except for 2015, when Sichuan's GDP growth rate was 0.1 percentage points lower than that of Guangdong, other years were generally higher than that of Guangdong. Especially during the three-year post-Wenchuan earthquake recovery and reconstruction period (2009 - 2011), Sichuan's GDP growth rate reached a maximum of 15.1%. Since the economy entered a new normal, the growth rate of the two places has slowed down significantly, but the average growth rate in Sichuan is higher than that in Guangdong. Since the 18th National Congress of the Communist Party of China, Sichuan's GDP growth rate has grown at an average annual rate of 8.4%, 0.7 percentage points higher than Guangdong (7.7%)."

the article concludes that:"Today in Guangdong is Sichuan's tomorrow."

In the past two years, the traditional manufacturing industry in Sichuan Province has been rapidly upgraded, and the layout of emerging industries and high-tech R & D results have attracted attention. In the field of new energy, Sichuan Province is even more motivated.

According to the "2024 Work Report of the People's Government of Sichuan Province"--

The installed capacity of clean energy in Sichuan Province reached 110 million kilowatts, accounting for 86.7%, of which the installed capacity of hydropower was 97.59 million kilowatts, ranking first in the country. The output of natural gas (shale gas) is 55.2 billion cubic meters, ranking first in the country. In a new round of strategic operations for prospecting breakthroughs, Sichuan Province has discovered Asia's largest hard rock-type single lithium deposit in Ganzi. At present, Sichuan has 13 hydropower stations, 21 photovoltaic projects, and 18 wind power projects under accelerated construction. The Kora Photovoltaic Power Station, the world's largest water and light complementary project, has been connected to the grid for power generation. 35 power grid projects to meet peak peaks in summer and winter have been completed and put into operation. The annual new power grid power supply capacity of Sichuan Province exceeds 10 million kilowatts.

Sichuan Province is demonstrating its advantages. Sichuan's population advantages, geographical advantages and traditional cultural advantages have profound potential, which makes Sichuan's economy full of stamina. For investment,"stamina" means being able to see the future.

Looking back, the development of Sichuan gave birth to Sichuan Road; the development of Sichuan Road helped Sichuan Road promote Sichuan Road... The reverse logic is that all efforts are valuable-Sichuan Road hopes Sichuan Road will be strong, and Sichuan hopes Sichuan Road will be strong. Investors hope to see that the distortions and irregularities exposed in the downward trend of the market can be sorted out with the opportunity of restructuring and upward-no matter what, Sichuan needs a healthy Sichuan Trust.

Sichuan Trust stands at the node of the times.

Editorial board on duty:Li Hongmei

edit:Han Jianming

studying the:Dai Shichao