Shopping mall "rage" strong people are always strong

Today, starting from China Resources--

On March 26, 2024, China Resources Vientiane Life released its 2023 financial report. The 22.9% revenue growth and the 31.2% profit growth seem to confirm the legend that shopping centers are currently "raging".

At a time when Ali is adjusting "new retail", Vanke is responding to the debt crisis, and Wanda is mired in the capital whirlpool, China Resources's window data is "as expensive as gold."

————

Shopping center "rage"

I have often heard that the fate of fate turns.

When the shadow of the epidemic gradually dissipated in 2023, people found that many things had changed.

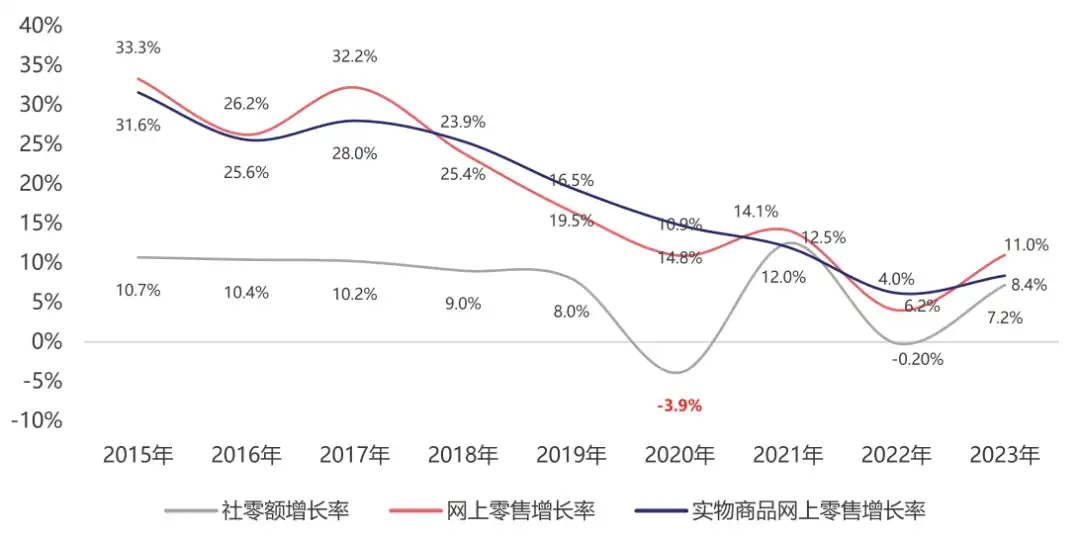

In March 2024, the China Department Store Commerce Association released the "China Department Store Retail Industry Development Report from 2023 to 2024." Among them, there is an analysis chart--

社会消费品零售总额增长率、网上零售额增长率及实物商品网上零售额增长率比较(中国百货商业协会)

社会消费品零售总额增长率、网上零售额增长率及实物商品网上零售额增长率比较(中国百货商业协会)

As you can see from the above analysis chart--

Before 2017, online retail maintained high growth, far exceeding the growth rate of social retail sales, indicating that residents 'shopping habits have shifted from physical to online. In 2015, the growth rate of online retail sales reached 33.3%. However, after 2017, the growth rate of online retail sales has dropped year after year, emerging from a clear downward trend. After the fluctuations of the epidemic, by 2023, the trends and growth rates of online retail (up 11%) and social retail (up 7.2%) are relatively close.

While the growth of online retail has slowed down and stabilized, in recent years, offline entities have also used digital means to expand their living space, strengthen the connection between entities and the network, and enhance the appeal of offline entities. Offline survival mode has been turned on.

Shopping centers stand out in this change.

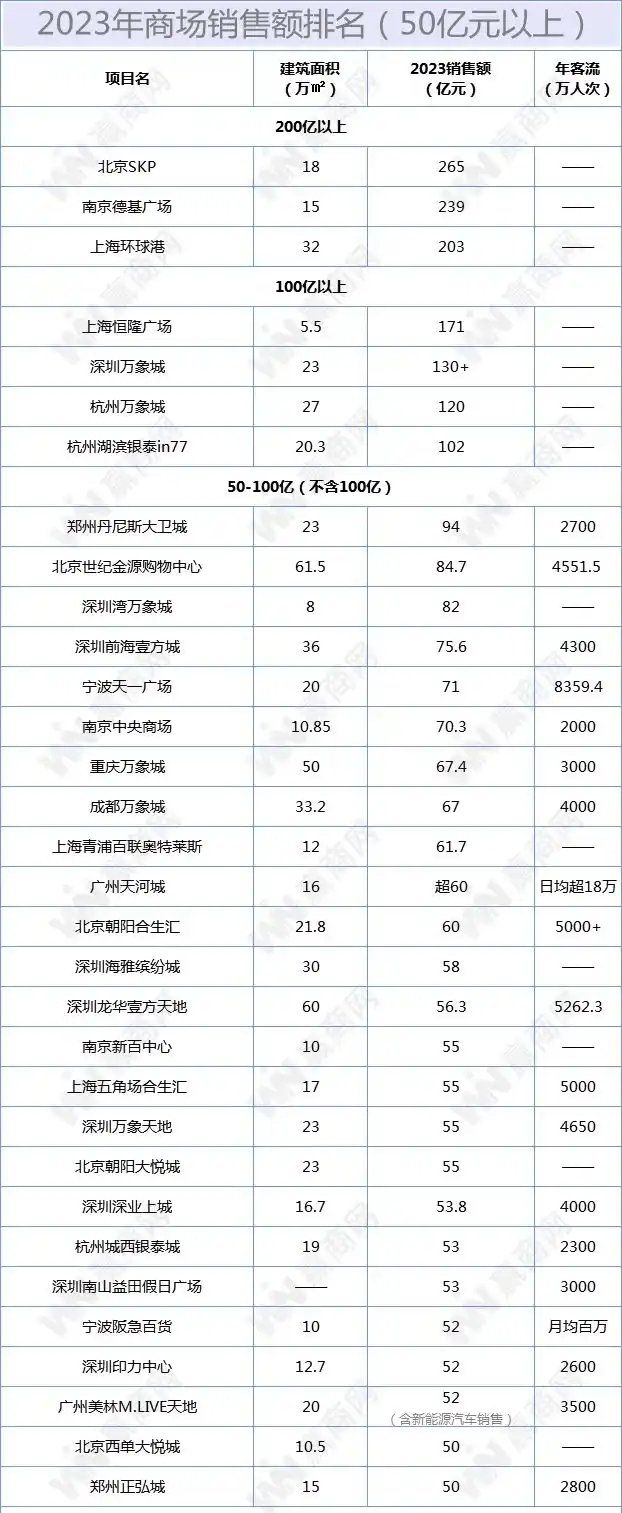

According to statistics from big winners--

In 2023, passenger flow will resume positive growth for the first time since the epidemic, and it is also the best year in the past five years. In 2023, the average daily passenger flow of shopping malls across the country will be 20,000, a significant increase of 35% year-on-year and exceeding the pre-epidemic level, an increase of 10% year-on-year in 2019.

全国部分商场2023年销售额(赢商网)

全国部分商场2023年销售额(赢商网)

In March 2024, Yingshang.com collected business data such as sales and passenger flow of 309 shopping malls across the country in 2023. After comparison, it was found that among the 113 comparable samples of 309 shopping malls, the sales of 105 shopping malls increased year-on-year; the annual sales of 7 shopping malls exceeded 10 billion, of which Beijing SKP, Nanjing Deji Plaza, and Shanghai Global Port were "20 billion yuan" echelon; more than 70% of shopping malls had annual passenger flow exceeding 10 million, with the highest annual customer flow exceeding 83 million + passengers...

In this "madness", China Resources Vientiane Life has industry-representative banner significance.

————

strong and strong

According to data from the National Bureau of Statistics, the total retail sales of consumer goods nationwide in 2023 will be approximately 47 trillion yuan, a year-on-year increase of 7.2%. Among them, retail sales of goods increased by 5.8%, and catering revenue increased by 20.4%.

Corresponding to China Resources Vientiane Life's release of 2023 financial report--

China Resources Vientiane Life achieved comprehensive income of RMB 14.767 billion for the whole year, a year-on-year increase of 22.9%; core net profit of RMB 2.920 billion, a year-on-year increase of 31.2%.

Compare past performance--

In 2021, China Resources Vientiane's living operating income will be RMB 8.875 billion, a year-on-year increase of 30.9%; its core net profit will be RMB 1.702 billion, a significant year-on-year increase of 108.5%.

In 2022, China Resources Vientiane's living operating income will be 12.016 billion yuan, a year-on-year increase of 35.4%; its core net profit will be 2.225 billion yuan, a year-on-year increase of 30.7%.

……

The high growth of life in China Resources Vientiane is clear at a glance.

In 2023, China Resources Vientiane Life will open 13 new shopping centers, surpassing the "100 Mall" milestone. At the end of the year, the number of shopping centers in management reached 101, of which the number of luxury shopping centers increased to 13, ranking first in the industry.

It is worth noting that, in parallel with the increase in performance, China Resources is promoting asset-light expansion. In 2023, China Resources Vientiane Life signed 14 asset-light expansion projects, all of which are large-scale TOD (public transport-oriented) in first-tier and second-tier cities. China Resources has achieved a multi-product line layout in 18 cities, of which Shenzhen, Shanghai, Wuhan and Chengdu account for more than 50% of its external expansion projects. Its external expansion projects accounted for 26% of revenue and 17.5% of pre-tax profit.

From Wanda to asset-light, a question has been constantly mentioned, and answers are always being sought:How the real estate industry can obtain high returns from asset-light operations.

In today's market environment, the value of outreach is self-evident.

In 2023, China Resources Vientiane Life achieved the opening of Lanzhou Vientiane City, its first external luxury project. There is a new case of asset-light management in the field of luxury shopping centers. Another important expansion project is Nanchang Honggutan Vientiane Tiandi. The opening of this project means that Vientiane's commercial light asset expansion has achieved comprehensive coverage of the three core product lines "Vientiane City","Vientiane Hui" and "Vientiane Tiandi".

华润万象生活13座重奢购物中心(华润官网)

华润万象生活13座重奢购物中心(华润官网)

If online shopping is solving the problem of saving money, shopping centers with landmark concepts are solving the problem of spending money.

By leading consumption, shopping centers are forming a convergence effect where the strong remain strong.

Looking at the latest shopping center sales list, you can roughly imagine the interests of today's urban people.

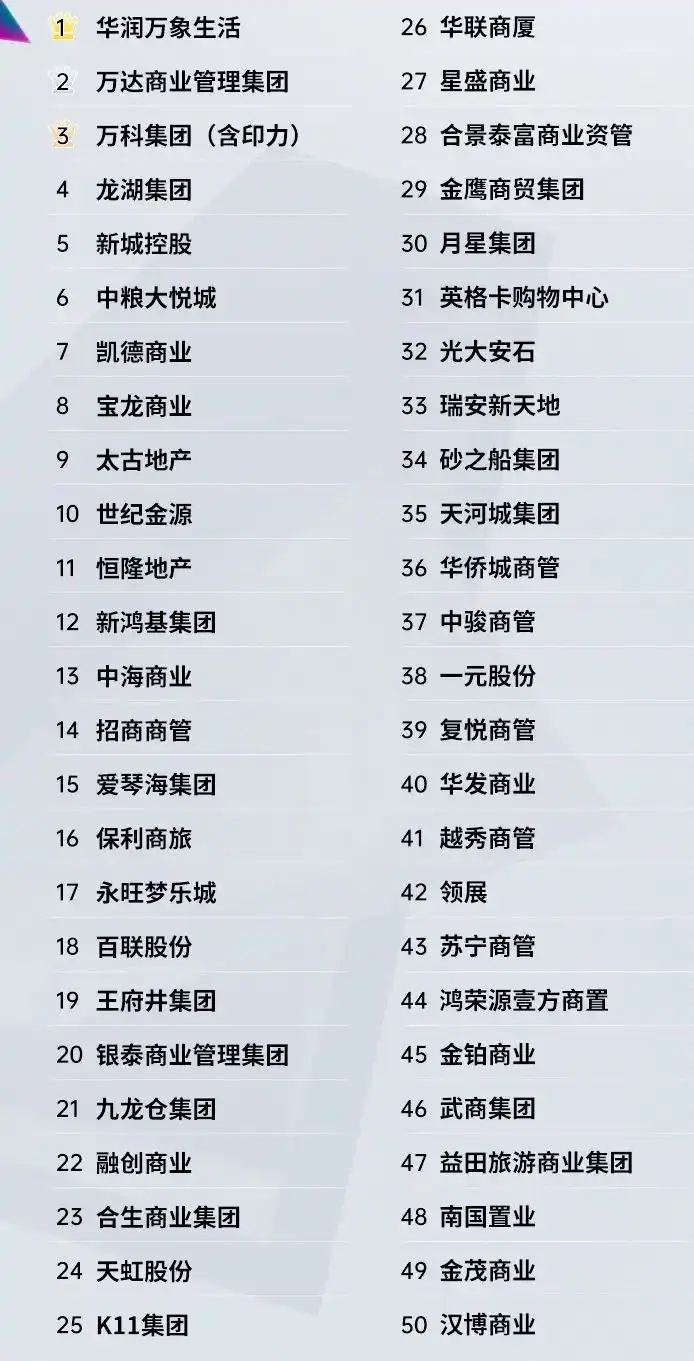

CNPP品牌榜中榜:2024年购物中心十大品牌

CNPP品牌榜中榜:2024年购物中心十大品牌  赢商网联合中城研究院共同发布《2023年度零售商业地产企业综合实力TOP100》榜单(前50)

赢商网联合中城研究院共同发布《2023年度零售商业地产企业综合实力TOP100》榜单(前50)

**————

**

What are consumer REITs

What's even more interesting is that just as the shopping mall was on its way, consumer REITs also arrived.

On March 24, 2023, the China Securities Regulatory Commission issued the "Notice on Further Promoting the Regular Issuance of Real Estate Investment Trusts (REITs) in the Infrastructure Sector."

The "Notice" clearly states that priority should be given to supporting urban and rural commercial outlet projects such as department stores, shopping centers, and farmers 'markets, and the issuance of infrastructure REITs for community commercial projects that ensure basic people's livelihood.

From the perspective of the general environment, the Ministry of Commerce has designated 2024 as the "Year of Consumption Promotion." The issuance of consumer infrastructure REITs not only expands effective investment and promotes consumption, but also serves as a means to support the real estate industry in exploring new models.

Whether it is the real estate market or shopping mall, facing the development of existing markets, there are clear scenarios for the use of funds. First-line shopping centers like China Resources Vientiane Life occupy the best resources (assets) in the existing market. Not only that, commercial formats such as shopping centers are characterized by sustainability and accumulation, and are an industry that continues to enhance profitability in the future.

All kinds of fit make shopping centers and REITs seem like a natural couple.

From March 12 to 14, 2024, the first batch of consumer publicly offered REITs-Huaxia Jinmao Commercial REIT, Jiashi Wumart Consumer REIT, will be listed on the Shanghai Stock Exchange, and Huaxia China Resources Commercial REIT will be listed on the Shenzhen Stock Exchange (another approved Vanke Zhongjin Yinli Consumer REIT is in preparation).

The consumption REIT scale of Jiashi Wumart is 1.068 billion yuan and 953 million yuan respectively.

Huaxia China Resources Commercial has the largest REIT issuance scale, reaching 6.902 billion yuan.

2024 will become the first year of consumer REITs.

The initial underlying asset of China Resources Commercial REIT listed this time is Qingdao Vientiane City. The shopping center is one of the shopping centers with the largest construction area and the largest number of brands in Qingdao City. It is also a benchmark commercial project in the core location of China Resources Land. It has nearly 300,000 square meters of high-quality commercial space and maintains an occupancy rate of over 98%.

With the help of REITs, shopping centers are boiling oil. In turn, the upgrade profits of shopping centers will also give REITs better investment space in the future.

However, some industry experts have warned that relevant issuing companies also need to remain rational in their understanding of consumer REITs.

REITs certainly bring a way to capital turnover, but they do not provide shopping centers with high-turnover weapons similar to the real estate boom that occurred in those years. Instead, they use REITs as a means to support companies to carry out more detailed management and quality improvement to achieve higher profitability. In this way, a virtuous cycle between enterprises and REITs is achieved.

REITs are more like a test. Making good use of REITs will be the next competition for shopping centers.

Editorial board on duty:Li Hongmei

edit:Han Jianming

studying the:Dai Shichao