Strong performance by major global oil companies:Reshaping oil and gas and reducing carbon simultaneously

On March 10, Saudi Aramco announced its 2023 results, with profits reaching US$121.3 billion, the second highest in history; total dividend payments reaching US$97.8 billion, a year-on-year increase of 30%. In 2023, the world's economic growth momentum will be insufficient, and international oil prices will fall. However, major international oil companies will appropriately adjust the pace of energy transformation, strengthen upstream oil and gas, pay equal attention to carbon reduction and profitability, and coordinate the development of traditional oil and gas businesses and new energy businesses, and still achieve strong results. At the same time, we will continue to increase shareholder returns.

Strong performance, focused and stable operations

Last year, the world economy moved forward in turmoil, with Brent crude oil futures prices falling by 18%, and the price difference between diesel and oil (cracking price difference) falling by 23%. Faced with such challenges, major oil companies have generally achieved strong operating results.

In the United States, ExxonMobil will have profits of $36 billion in 2023 and a return on used capital (a measure of the efficiency of capital investments) is 15%. This reflects ExxonMobil's progress to enhance its portfolio by investing in advantageous projects and selling inefficient assets, while promoting efficiency and efficiency improvements across its business. Chevron's full-year profit was $21.4 billion, the second-highest annual profit since 2013. This is due to the company's significant increase in oil and gas production through measures such as acquiring oil and gas assets.

In Europe, in an uncertain environment, Total Energy achieved a profit of US$21.4 billion in 2023, a year-on-year increase of 4% by implementing a balanced transformation strategy that also focuses on the growth of its oil and gas business (especially LNG) and its integrated power business; at the same time, it achieved a return on equity of up to 20% and an average return on capital of up to 19%. Shell's 2023 profit will be US$28.25 billion and operating cash flow will be US$54.2 billion. BP's full-year basic replacement cost profit was US$13.8 billion, operating cash flow was US$32 billion, and net debt was reduced to US$20.9 billion.

Large national oil companies have also achieved outstanding results. Saudi Aramco's net profit in 2023 reached US$121.3 billion, the second highest net profit in history; operating cash flow was US$143.4 billion. Saudi Aramco said the strong results were based on the company's unique operational flexibility, reliability and low-cost production base. Petrobras 'net profit in 2023 was 124.6 billion reais, the second highest net profit in the company's history, while achieving the second highest operating cash flow in history (215.7 billion reais). These results are supported by the diesel and gasoline business strategies.

Steadily increase spending to improve shareholder returns

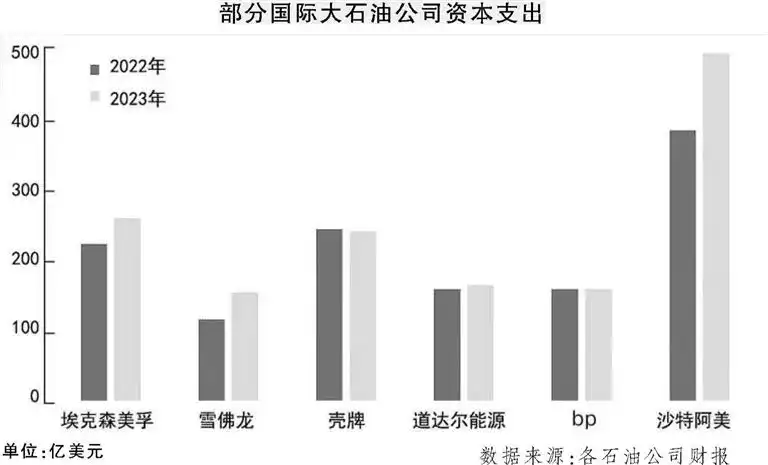

Against the backdrop of ongoing geopolitical conflicts, countries still regard energy security as a core issue, and relatively high oil and gas prices, most large oil companies, especially national oil companies, have steadily increased capital expenditures to increase energy supply and increase revenue.

Some national oil companies have significantly increased investment. Saudi Aramco's capital investment in 2023 will reach US$49.7 billion, a year-on-year increase of 28%. The company is investing in international LNG for the first time while continuing to expand downstream. Petrobras 'capital investment in 2023 will reach US$12.7 billion, an increase of 29% over the previous year. The situation is similar for large international oil companies in the United States. ExxonMobil's capital investment in 2023 reached US$26.3 billion, a year-on-year increase of 16%, mainly due to the company's accelerated activities in the Permian Basin and Guyana. Chevron's capital investment in 2023 will reach US$15.8 billion, a significant increase of 32% year-on-year; the company is improving its product portfolio by acquiring traditional energy and new energy assets.

Large European international oil companies continue to adhere to capital discipline, and some of them even reduce their capital investment. Total Energy's capital investment in 2023 will increase slightly by 3% year-on-year to US$16.8 billion; capital expenditure in 2024 will range from US$17 billion to US$18 billion. Shell's capital investment in 2023 will decrease by nearly 2% year-on-year to US$24.4 billion; it plans to invest US$22 billion to US$25 billion in 2024 and remains cautious. In 2023, bp's capital investment will decrease slightly by 0.5% year-on-year to US$16.253 billion; in 2024 and 2025, annual capital expenditures are expected to be approximately US$16 billion.

Big oil companies vary widely in investment but are consistent in increasing shareholder returns. They continue to increase dividends and share buybacks to continue to gain shareholder support as the energy transition accelerates and the outlook for fossil fuels is uncertain. ExxonMobil will return $32.4 billion to shareholders in 2023 through dividends and share buybacks. The company has increased its annual dividend for 41 consecutive years. Chevron will return US$26.3 billion to shareholders in 2023, a record high, by paying dividends and buying back shares. Shell will return US$23 billion to shareholders in 2023, increasing its dividend for the fourth quarter of 2023 by 4%. Total Energy's 2023 ordinary dividend will increase by 7.1%, and it will complete a $9 billion share repurchase. BP's ordinary dividend for the fourth quarter of 2023 was 7.27 cents per share, a year-on-year increase of 10%; it plans to repurchase US$3.5 billion in shares in the first half of 2024. The total dividends paid by Saudi Aramco in 2023 will be US$97.8 billion, a year-on-year increase of 30%.

Re-strengthen "oil and gas" and strive to reduce emissions

After experiencing an extremely fragile year in 2022, when energy security is extremely fragile, international oil companies will gradually return to rationality in 2023, adjust strategic goals and development paths, pay equal attention to carbon reduction and profitability, and re-strengthen Upstream business, with the goal of establishing a safe, clean and affordable global energy system, and develop traditional oil and gas businesses and new energy businesses in an orderly manner.

Shell and bp, which have always been aggressive in transformation, have adjusted their oil and gas production targets. Shell decided last year to abandon its plan to reduce oil production by 1% to 2% per year. Shell CEO Weiswang said in January 2023 that Shell would adjust its strategy to focus on projects with higher profit margins, stabilize oil production and increase natural gas production. BP lowered its 2030 oil and gas production reduction target to 25% from the previous 40%. BP CEO Murray Okincloss said BP would pragmatically adapt to changes in global energy demand.

International oil companies in the United States and global national oil companies have increased oil and gas investment, focusing on high-quality oil and gas assets, and increasing oil and gas production.

ExxonMobil, focusing on the acquisition and development of deepwater oil and gas in Guyana and shale oil and gas assets in the Permian Basin of the United States, spent US$60 billion to acquire Pioneer Natural Resources. ExxonMobil's oil and gas production in 2023 will be 3.738 million barrels of oil equivalent/day, an increase of 1000 barrels of oil equivalent/day year-on-year.

Chevron spent US$53 billion to acquire Hess, acquiring Guyana's deepwater oil and gas assets and domestic shale oil and gas assets in the United States. In 2023, Chevron's oil and gas production will increase by 7% to a record 3.12 million barrels of oil equivalent per day.

Saudi Aramco's oil and gas production in 2023 will reach 12.8 million barrels of oil equivalent per day, including 10.7 million barrels of oil (including condensate) production. Petrobras 'sub-salt oil and gas production in 2023 will reach 2.17 million barrels of oil equivalent/day, a year-on-year increase of 10%.

At the same time, major oil companies still attach great importance to the net-zero emission goal and have adopted various measures to reduce greenhouse gas emissions. ExxonMobil reduces carbon emissions during oil and gas production through measures such as electrification of drilling units, replacing natural gas drives, and deploying electric fracturing units. Total Energy will spend 35% of its 2023 capital expenditure on low-carbon energy, mainly electricity. Saudi Aramco has signed shareholder agreements with the Public Investment Fund (PIF) and ACWA Power to develop Al Shuaibah1 and Al Shuaibah2 solar energy photovoltaic projects in Saudi Arabia, with an estimated total installed capacity of 2.66 GW.

This article was originally published on page 7 of China Petroleum News on March 19, 2024. The original title was "International Energy Market Volatility Intensifying, Energy Security Still a Core Issue for All Countries, Major International Oil Companies-Adjusting the Rhythm of Transformation and Strengthening Upstream Oil and Gas"

**·