The threat of hollowing out German industry:The energy crisis accelerates industrial relocation

全文5175字,阅读大约需要10分钟

Reproduction in any form without permission is strictly prohibited

Southern Energy Watch

micro-signal:energyobserver

Welcome to submit, submit email:

Eo reporter Cai Yixuan

Editor Chen Yifang

Review Jiang Li

能源价格居高不下,作为经济增长引擎的大型工业企业外移,德国“工业空心化”风险正日益显现。

On April 14, 2024, German Chancellor Scholz embarked on a trip to China. This is Scholz's second visit to China since taking office as German Chancellor in December 2021. It is also the first leader of a major Western country to visit China this year.

This time Scholz visited China with three ministers of environment, agriculture, and transportation as members of the delegation. An economic delegation composed of relevant leaders from large companies such as Siemens, BMW, and Mercedes-Benz also accompanied him.

In the past two years, Germany, an economy with industry as its main pillar, has been deeply affected by the energy crisis. The economy has weakened and the industrial chain has flowed out. The German government also hopes to enhance its competitiveness while attracting more investment from Chinese companies.

Due to soaring energy prices, Germany's inflation rate will reach 5.9% in 2023, the second highest since 1990 (second only to the highest record of 7.9% in 2022); industrial output continues to decline, and many companies are facing pressure to stop production and reduce production, with the energy-consuming and energy industries experiencing the largest decline.

The decline in manufacturing has dragged down economic recovery. In 2023, Germany's gross domestic product (GDP) will fall by 0.3% from the previous year, making it the only G7 country to experience economic contraction. At the same time, many mainstream institutions predict that Germany's economic growth will once again lag behind the international average in 2024. The Organization for Economic Co-operation and Development (OECD) has cut Germany's 2024 GDP growth forecast by half to 0.3%. The Bundesbank also issued a warning that the German economy will continue to shrink in the first quarter of 2024 and fall into a technical recession (two consecutive quarters of economic contraction).

Whether German industrial enterprises can withstand pressure to maintain operations in 2024, whether the industrial chain and supply chain will be restructured, and how energy transformation policies will affect industrial development have become must-answer questions before the German government.

0 1

Industrial energy consumption declines, and the era of low-cost energy ends

In Germany, electricity prices were once the focus of debate. The Confederation of German Industries (BDI) has warned that rising electricity prices pose a threat to the international competitiveness of German manufacturing.

Dong Xiucheng, a professor at the School of International Economics and Trade at the University of International Business and Economics and executive director of the China International Institute of Carbon Neutrality Economics, said in an interview with eo that rising energy prices have not only increased the pressure on energy costs on German manufacturing, but also led to the rise in overall social and economic operations, and a series of cost increases have dragged down economic recovery.

The reason why Germany's current electricity price level is high is that before the Russia-Ukraine conflict, most of its natural gas relied on imports, of which 55% came from Russia. After the Russia-Ukraine conflict, the United States and Europe imposed multiple rounds of sanctions on Russia, and Russia also took corresponding countermeasures. As a result, the export of natural gas from Russia to Europe through Ukraine and Poland pipelines will be significantly reduced from 2022. Germany, on the other hand, has almost no oil and natural gas reserves of its own, and the shortage of natural gas supply has caused prices to soar. On the other hand, the economies of various countries recovered after the COVID-19 epidemic, coupled with extreme weather leading to increased heating demand, and energy market demand increased.

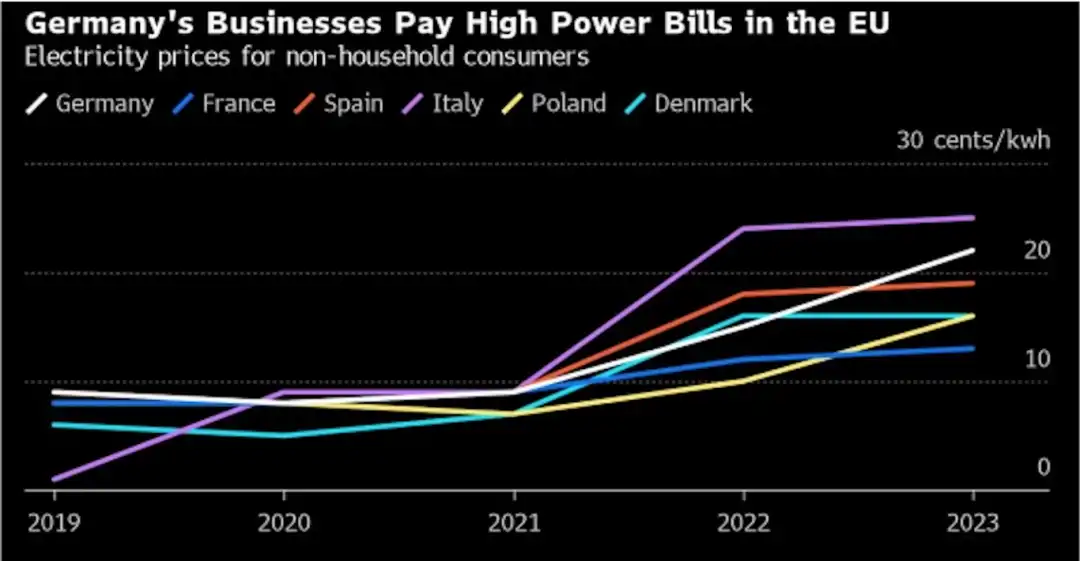

Although natural gas power generation accounts for only 13% of Germany's total power generation, due to the marginal pricing mechanism adopted in the European electricity market, electricity prices are deeply affected by marginal unit fuel prices. The sharp increase in the cost of natural gas power generation has caused wholesale electricity prices in Germany to rise. During the electricity crisis in August 2022, wholesale electricity prices in Germany increased by 459.5% compared with the same period last year, while electricity prices in France, Italy and the United Kingdom increased by 70.6%, 64.0% and 53.8% respectively. In 2023, Germany's electricity price level will still be 61% higher than the 2019 average price. According to calculations by Germany's Handelsblatt, the electricity bills paid by German energy-intensive companies on the spot market in 2023 will be more than twice what they were before the Russia-Ukraine conflict.

On the other hand, with the rapid development of renewable energy in Germany and the advancement of reducing coal and reducing coal, the operating costs of the power system have risen, which has also driven an increase in terminal electricity prices.

Fig.:2019-2023 Comparison of German industrial and commercial electricity prices with electricity prices in other EU countries in 2009 (white line shows the trend of German electricity prices)