Huadian International's performance surged by 37.89%, and the driving force behind it is...

2023年,华电国际的归母净利润同比增加了3789%!

值得关注的是,自2015年以来的9年间,公司还未曾出现过如此的业绩暴涨。期内营业收入1171.76亿元,同比增长9.45%,归母净利润为45.22亿元,同比增长超37.89倍。

华电国际全年发电量完成2,237.95亿千瓦时,较上年同期增长约1.30%;供热量完成1.72亿吉焦,较上年同期增长约3.27%。

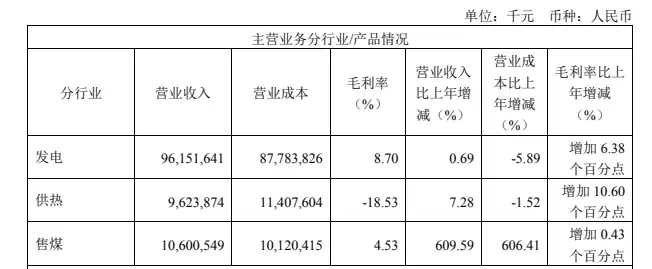

分业务来看,华电国际2023年发电业务实现收入961.52亿元,同比增加0.69%,实现毛利率8.70%,同比增加6.38个百分点。供热业务实现收入96.24亿元,同比增加7.28%,实现毛利率-18.53%,同比增加10.60个百分点;售煤业务实现收入106.01亿元,同比增加609.59%,实现毛利率4.53%,同比增加0.43个百分点。 2023年华电国际主营业务分行业、分产品、分地区、分销售模式情况

2023年华电国际主营业务分行业、分产品、分地区、分销售模式情况

** Thirty years of development history ** Huadian International was established in 1994. The company's main business is the construction and operation of power plants, including large and efficient coal-fired and gas-fired generating units and a number of renewable energy projects. Huadian International operates controlled power generation assets in twelve provinces and cities across the country, with a superior geographical location, mainly located in power load centers, heat load centers or coal-rich areas. The controlling shareholder of Huadian International is Huadian Group, which holds 45.17% of the company's shares.

As of the disclosure date of the annual report, Huadian International has a total of 45 holding power generation companies in operation, with a holding installed capacity of 58,449.78 MW, mainly including a holding installed capacity of 46,890 MW for coal-fired power generation, a holding installed capacity of 9,094.59 MW for gas-fired power generation, and a holding installed capacity of 2,459 MW for hydropower generation.

In terms of revenue proportion, revenue from sales of power products and heating products accounted for approximately 90.89% of the company's main business income. Huadian International's coal-fired power generation capacity accounts for approximately 80.22% of the company's controlled installed capacity, and the installed capacity of clean energy power generation such as gas-fired power generation and hydropower generation accounts for approximately 19.78%.

华电国际股权情况

华电国际股权情况

值得关注的是,除了2020年疫情下公司发电量下降导致营收同比下滑以外,近年来华电国际营收呈现增长态势。2018—2022年,公司营收从883.65亿元增长至1070.59亿元,CAGR为4.91%。2019年、2021年公司营收同比增长主要因为发电量同比增加等。2022年公司营收增长得益于煤机电价上涨。

根据最新业绩,国海证券调整了华电国际的盈利预测,预计其2024—2026年归母净利润分别为65.0/69.3/73.3亿元。

** Coal prices continue to decline ** What is curious is why Huadian International will see a significant jump in performance in 2023? In fact, this is closely related to the trend of coal prices.

2018-2020 In 2001, the average price of coal declined steadily, and Huadian International's parent net profit gradually increased. In 2021, due to the significant increase in coal prices, the company will experience significant losses.

In 2022, although coal prices are operating at high levels, Huadian International can still turn losses into profits, mainly due to the increase in coal machinery electricity prices and the year-on-year increase in equity income.

Entering 2023, with the gradual release of advanced coal production capacity, China's coal output has increased. The annual industrial raw coal output above designated size was 4.658 billion tons, a year-on-year increase of 2.9%. At the same time, coal imports have increased significantly year-on-year. In 2023, China imported 474 million tons of coal and lignite, a year-on-year increase of 61.8%. This has also caused coal prices to show a downward trend.

Data shows that as of February 23, 2024, the coal inventory of Northern Port was 22.67 million tons; as of February 28, 2024, the average closing price of Qinhuangdao Port Shanxi Premium Mixed (Q5500) thermal coal this year has been 916 yuan/ton, a year-on-year decrease of 20%.

According to iFinD data, as of February 28, 2024, the average daily coal consumption of the six major power generation groups was 793,000 tons, and the available days for coal storage were 15.8 days. On the whole, against the background of continuous replenishment of imported coal and long-term coal, the inventory of power plants is relatively abundant, the demand for power plants to purchase spot thermal coal is relatively limited, and the market price of thermal coal may fluctuate at a low level.

It is understood that in 2021-2022, Huaneng International's electricity-related fuel costs will account for approximately 70% of the company's total costs. Thermal coal is the main raw material in the thermal power industry, and its price changes have a significant impact on the production costs and operating results of thermal power companies.

Data shows that as of the first three quarters of 2023, driven by factors such as the year-on-year decline in thermal coal prices, the Shenwan thermal power sector (including thermal power generation, thermal services, and other energy power generation) achieved a net profit of 57.420 billion yuan, a year-on-year increase of 458.42%. Therefore, some analysts believe that if the market price of thermal coal fluctuates at a low level in the future, it will help continuously improve the operating performance of thermal power companies.

Huadian International burns coal and other fuels to generate electricity and heat. Therefore, coal and other fuels are very important raw materials. In recent years, Huadian International's fuel costs have accounted for more than 50% of its main business costs. 2021-2022 In 2021, this proportion will continue to rise, mainly due to the sharp increase in coal prices in 2021 and 2022. Changes in coal prices will affect the company's operating costs, which in turn will affect the company's performance.

**近水楼台先得月 ** 除了煤价的走低以外,华电国际的业绩暴增也与其所在平台具有紧密的关联性。众所周知,火电行业属于资本密集型,在火电项目开发建设阶段,企业往往需要投入大量资金。通常而言,大型能源央企的资金实力更强,并且拥有股权融资、债务融资等多元化融资渠道,融资优势相对明显。

据不完全统计,截至2022年末,国家能源集团、华能集团、华电集团、大唐集团、国家电投、华润电力六大能源央企的火电装机容量约为688.42GW,约占全国火电装机容量的52%,大型能源央企占据主要市场份额。

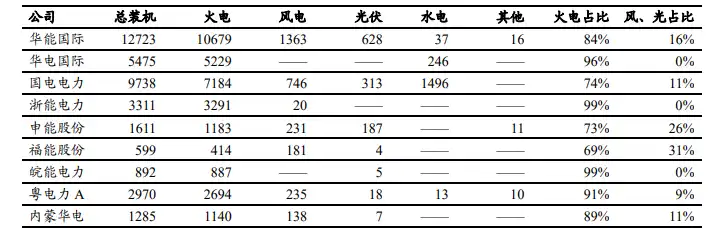

据东吴证券统计,根据2022年控股装机情况,按火电装机规模从高到低排序分别为: Huaneng International, Guodian Power, Huadian International, Zhejiang Energy, GD Power, Shanghai Energy Group, Inner Mongolia Huadian, Anhui Energy, Fujian Energy。

若按火电占比由高到低排序:Zhejiang Energy, Anhui Energy, Huaneng Power International, Guangdong Electric Power A, Inner Mongolia Huadian, Huadian Power International, China Guodian Corporation, Shanghai Shenergy Group, Fujian Energy Group。 A 股主流火电公司 2022 年火水风光装机容量(万千瓦)及占比情况

A 股主流火电公司 2022 年火水风光装机容量(万千瓦)及占比情况

再来看华电国际火电表现,收入端,2023 年火电发电量同比增长 1.55%至 2145 亿千瓦时,火电综合电价微降;成本端,公司燃料成本约为 754.62 亿元,同比减少约8.93%,主要系煤炭价格下降。综合来看,公司火电业务盈利能力大幅提升,2023 年实现毛利 75.89 亿元,同比大幅增长;毛利率为 8.05%,同比提高 6.69个百分点。

值得关注的是,火电行业又迎政策春风。近期,国家能源局印发《2024年能源工作指导意见》,指出要强化化石能源安全兜底保障,建立煤炭产能储备制度,提升煤炭供给体系弹性;推动煤炭、煤电一体化联营,合理布局支撑性调节性煤电,加快电力供应压力较大省份已纳规煤电项目建设,力争尽早投产。深化能源重点领域改革,24年将制定《电力辅助服务市场基本规则》等三项规则,落实煤电两部制电价政策。在电力保供与消纳双重压力背景下,火电作为中国关键能源保供电源,在新型电力系统的建设推进中仍将发挥关键作用,辅助服务市场细则的落地也将完善火电盈利模式。意见同时提出退役机组按需转为应急备用电源,意味着火电机组将在设计寿命结束后可继续发挥余热,从而提升火电机组生命周期内的盈利能力。

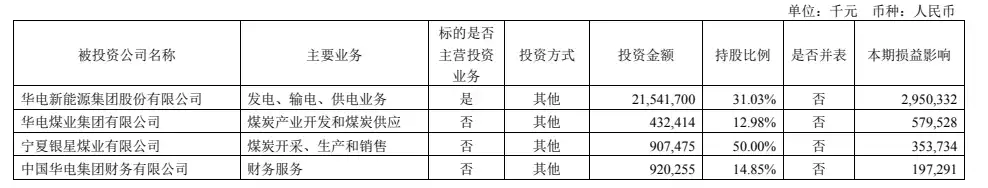

**聚焦新能源 ** 在发展火电业务的同时,华电国际也在积极布局上游煤炭行业,参股宁夏银星煤业有限公司(简称“银星煤业”)、华电煤业集团有限公司(简称“华电煤业”)等煤炭生产企业,持有银星煤业50%股份、华电煤业12.98%股份。

2021—2022年,公司火电业务毛利率受高煤价拖累,同期两家参股煤电企业净利润之和分别为139.22、83.11亿元。分析认为,华电国际参股煤炭企业获得投资收益,有助于减缓煤价变动对其业绩的影响。

值得一提的是,在专注传统能源业务的同时,华电国际也在聚焦新能源产业。根据华电新能官网,为推动转型发展,2020年华电集团以华电新能为新能源整合平台,大力推动集团系统内新能源资产重组,打造新能源发展新引擎。2021年,华电新能完成增资引战,成功引入13家战略投资者,构建起涵盖国家级产业基金、产业投资者龙头、国有资本运营公司、地方重要产业投资平台以及财务投资者的股东结构。2022年3月,华电新能进行股份制改造。2023年6月,华电新能于沪主板IPO上会,并顺利过会。

财报显示,2023年,华电实现投资收益37.8亿元,同比下滑21.4%,主要原因系本年参股煤炭企业收益的减少。其中,华电新能带来的投资收益为29.50亿元,占总投资收益的78.13%。2020年至2022年,华电新能净利润分别为40.79亿元、72.51亿元、84.58亿元,CAGR为44.00%。分析认为,华电国际持有华电新能31.03%股份,有助于带来稳定的投资收益。

华电国际于 2023 年 12 月 31 日的长期股权投资为 437.91 亿元,比年初增加27.59 亿元,增幅 6.72%,主要原因是本公司参股单位收益增加的影响。 2023年华电国际股权投资情况

2023年华电国际股权投资情况

** Cash dividends continue to improve ** Some analysts believe that the thermal power industry cannot be counted as an industry with a high dividend rate in the traditional sense due to its strong volatility in performance. However, it is worth noting that due to the downward trend of capital expenditure in the coal power industry, combined with the downward channel of thermal coal prices in 2024-2025, some institutions expect that the price center will drop by 100-200 yuan/ton to 800-900 yuan/ton in 2024. As a result, the thermal power sector is expected to increase the dividend rate of industry companies.

In terms of policy, the National Development and Reform Commission has determined a three-step plan for coal and electricity.:During the 14th Five-Year Plan period,"capacity increase and control","capacity control and reduction", and "capacity reduction" after the 15th Five-Year Plan ". Industry insiders judge that with the arrival of the era of capacity control and reduction in the coal and electricity industry, the coal and electricity industry's capital expenditure The downward trend is basically certain, and the industry dividend ratio is expected to increase significantly.

Data shows that Huadian International plans to distribute a cash dividend of 0.15 yuan (including tax) per share. In 2023, the company's cash dividend ratio will be 43.65%. Some industry insiders pointed out that Huadian International's dividend yield and dividend yield are at a relatively high level in the power industry. In addition, the company is backed by leading power enterprises, and the group still has expectations for large power asset injection. Under the new round of actions to deepen and improve the reform of central and state-owned enterprises, power operators have both stable performance and growth, have solid fundamentals and the ability to continue to pay dividends, and are expected to become one of the directions for the market to return.

It is noteworthy that due to improved performance, the net cash inflow from Huadian International's operating activities in 2023 will be approximately 13.252 billion yuan, a year-on-year increase of approximately 37.26%. In 2023, the company's management expense ratio and financial expense ratio will be 1.42% and 3.08%, respectively, a year-on-year decrease of 0.11 percentage points and a decrease of 0.7 percentage points. The decline in financial expenses is mainly due to the company's increased capital operations and reduced financing costs.

On December 19, 2023, Huadian International's first market-type REIT project on the Exchange-Yuhua Thermal Power Energy Infrastructure Investment Asset Support Special Plan (REIT-like) was successfully issued, with an issuance scale of 2.141 billion yuan. It received extensive attention from investors on the day of bookkeeping. and actively subscribed, with a final coupon rate of 3.35%.

The agency believes that this REIT-like product provides a feasible equity financing plan for the company's coal and electricity assets, further broadens Huadian's international financing channels, reduces reliance on traditional debt financing, and reduces asset-liability ratios. At the same time, this product also set a record low for the issuance interest rate of thermal power infrastructure REITs, setting a record for the shortest review and application time for similar projects.

High fidelity rendering for automotive interiors ** ** 值得关注的是,在火电行业内,华电国际的业绩大幅增长并非独有现象。公开数据显示,截至4月1日,A股36家火电企业中,有9家披露了2023年年报,18家企业披露了2023年业绩预告。除了1家企业预告业绩下降外,其余26家企业净利润均保持增长。

机构认为,2024年,火电业绩有望进一步修复,今年火电板块资产减值风险或有望降低。考虑到火电盈利持续修复以及证监会对分红的鼓励,火电公司分红水平或有望提高。

**