Public funds lost another 1.9 trillion yuan:A long road to word-of-mouth restoration

2024.0401

Number of words in this article:2212, reading time is about 4 minutes

introduction: 又被“按在地上摩擦”,公募口碑回升还需要多少时间。

** Author| ** First Finance and Economics Cao Lu

The 2023 annual report of public funds has been gradually disclosed, and the full picture of fund product net profit, management fees and other data has also surfaced. According to Wind data, First Finance and Economics found that public funds collected a total of 135.657 billion yuan in management fees last year, a decrease of more than 10 billion yuan from the previous year. This is the first time that the industry has "shrunk" in the past ten years. At the same time, after a loss of 1.46 trillion yuan in the previous year, the overall public fund products still failed to make money for the holders. The total net profit loss of the fund was 435.118 billion yuan, and the loss amount in the two years has increased to 1.9 trillion yuan. This also means that it will take time for the reputation of the public offering industry to pick up.

Management fee income exceeds 130 billion yuan 行至4月初,公募基金2023年年报基本披露完毕。第一财经基于Wind数据统计,公募行业去年198家基金管理人共收取管理费用1356.57亿元,较2022年同期的1458.87亿元减少了超过100亿元。 从增速角度来看,赚钱效应不佳叠加降费浪潮,公募基金的2023年管理费减少超7%,这是该行业近十年以来首次出现下滑。不过近几年来早有减缓趋势,如2022年的管理费增速已从上一年的52%降至2.32%。

At present, there are four fund companies with management fees exceeding 5 billion yuan, half the number compared with the same period last year. Among them, although the management fee income of Yi Fangda Fund has decreased for two consecutive years, it still remains at the top of the list of fund companies, reaching 9.274 billion yuan, down 8.64 percent from 10.151 billion yuan in 2022. A similar situation has happened to other large and medium-sized companies. For example, Guangfa Fund, Huaxia Fund and Wells Fargo Fund ranked 2nd to 4th, with management fee income of 6.655 billion yuan, 5.974 billion yuan and 5.455 billion yuan respectively. The management fees of five companies, including Huitianfu Fund, Southern Fund, Castrol Fund, China Merchants Fund and China Europe Fund, all exceeded 4 billion yuan. The management fee income of these companies has decreased. On the one hand, fund companies' management fee income "ceiling" is reduced, and there are no fund companies with 10 billion-level management fees. On the other hand, the "top ten" has generally fallen, and the threshold has been reduced to 3.695 billion yuan from 4.332 billion yuan the previous year. This all means that the management fee of the head company "shrinks" obviously, especially the fund companies with relatively high active rights and interests. According to the statistics of China Finance and Economics, of the 194 public fund managers with data for nearly two years, nearly half (48.97%) of the companies' management fee income has declined to varying degrees; among the 35 fund companies with management fees exceeding 1 billion yuan, the proportion of companies with reduced management fees is more than 70%. Of the 35, 10 achieved year-on-year growth in management fee income, and 3 of them achieved double-digit growth. For example, the management fee income of Chinese business funds in 2023 was 1.064 billion yuan, an increase of 52.15% compared with 699 million yuan in 2022; the management fees of Huatai Berry fund and Wanjia fund increased by 24.54% and 13.59% respectively. As one of the main sources of income for fund companies, the general decline in management fees may also be due to public offering reform. Since the promotion of the reform of public offering fund rates on July 8 last year, the first place has been gradually extended from the head company. By the end of last year, the management fees of most active equity products (including ordinary stock, flexible configuration, partial stock hybrid and balanced hybrid funds) have been adjusted. According to Wind, the management fee for active equity products was 61.175 billion yuan last year, a decrease of 12.857 billion yuan compared with the previous year. However, on the whole, the management fee income of public offering funds still shows the trend of "the strong is always strong", but the proportion has decreased. Data show that last year, the top 20 fund companies with management fee income totaled 84.077 billion yuan, accounting for 61.97% of all fund companies' management fee income, a decrease of 2.32 percentage points from 64.29% in the previous year.

Cumulative loss in two years is 1.9 trillion yuan 除了营收情况,随着年报披露的还有公募基金去年一年的实际经营成果。第一财经基于Wind数据统计,在去年震荡反复的极致行情下,公募基金管理人旗下产品再度“被按在地上摩擦”,合计亏损4351.18亿元。 至此,公募基金已经连续两年亏损,累亏近1.9万亿元。这一数字与公募行业2020年处于“高光时刻”时的全年盈利(1.97万亿)相近。这也意味着,投资者借基入市的信心还需要时间恢复。 回望去年的A股市场,承接2022年的震荡市,2023年的行情仍在犹疑中前行,上证指数持续调整走低,四季度大都徘徊在3000点之下。数据显示,截至12月底,上证指数定格在2974.93点,期间下探2882.02点的年内低位,全年跌幅达3.7%。

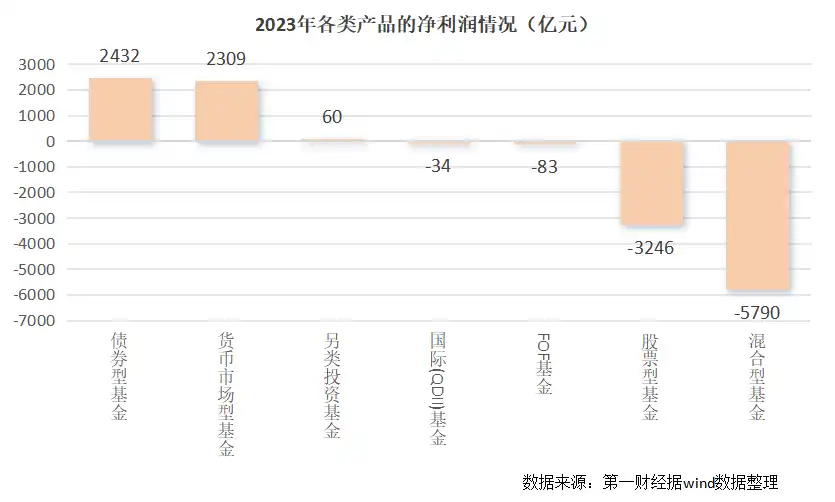

Under the tragic market, the effect of making money is relatively limited, and the equity products related to the stock market are naturally difficult to have eye-catching performance. According to China Financial and Economic Statistics, according to the first-level classification of funds, hybrid funds lost the most last year, with a total net profit of-578.979 billion yuan, while equity funds also lost 324.561 billion yuan for the whole year. The reporter noticed that in the first quarter of last year, rights and interests products were still the pillar of profits, with a combined profit of more than 20 million yuan. However, since the second quarter, there have been many fund products have given back the previous profits, from profits to losses. In a single quarter, the losses of these two types of products exceeded 10 million yuan in the last three quarters. As the "worst-hit area" of the previous year, active equity funds still suffered "heavy losses" last year, and only 10% of the fund products were profitable. According to Wind data, 4250 active equity funds with available data (only initial funds) lost a total of 673.5 billion yuan in 2023. At the same time, fixed-income products maintain a "stable output", once again contributing to the vast majority of profits. Specifically, the annual profit of bond funds in 2023 is 243.199 billion yuan, followed by money market funds of 230.859 billion yuan. In last year's market, these two types of products made a profit of 36 billion yuan to 80 billion yuan each quarter. From the perspective of public offering fund managers, the profit situation has improved compared with the same period last year. According to the statistics of China Finance and Economics, of the 197 fund managers with data, 100 fund companies achieved positive returns for their holders in 2023, accounting for more than half of them, compared with 64 in the same period of the previous year; the profit limit was also raised from 2.377 billion yuan to 8.747 billion yuan. On the whole, the fund companies with relatively high fixed income products are at the top of the list. According to statistics, a total of 22 companies made more than 1 billion yuan for their holders last year, and 6 made more than 5 billion yuan. Specifically, Boshi Fund and Jianxin Fund were the most profitable companies last year, with both products making profits of more than 8.7 billion yuan. The profits of Societe Generale Fund and Bank of China Fund were followed by 6.956 billion yuan and 6.925 billion yuan respectively, while the product profits of Yongwin Fund and Pu Yin Axa Fund exceeded 5 billion yuan. In addition, the products of Guoshou Security Fund, Ping an Fund, Shanghai Bank Fund and China Canada Fund have made a profit of more than 4 billion yuan. **