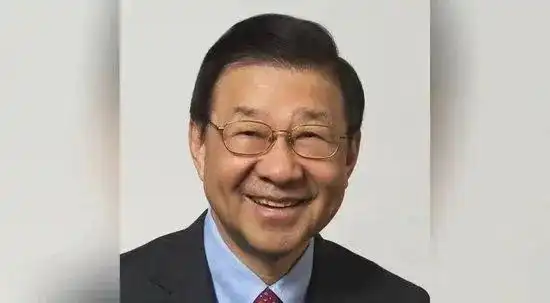

Investment Godfather Xu Dalin:Know SMIC with a discerning eye

2024.0409

Number of words in this article:2175, reading time is about 4 minutes

introduction:徐大麟在中国内地市场的最知名投资案例便是中芯国际。在中芯国际创业初期,徐大麟作为投资人,对其前景给予了肯定,并认为值得投入。

** Source| ** China Overseas Chinese Network, Broker China, Hexun Network, The Paper News, Daily Economic News, etc.

On April 9, according to China Overseas Chinese Network, Ta-Lin Hsu, a famous Chinese American venture capitalist and philanthropist, recently passed away due to illness in Taipei, China. He was 81. Dr. Xu Dalin has a legendary life, spanning scientific and technological research, venture capital and charity, and has achieved extraordinary achievements.

In the industry, Xu Dalin is known as the "godfather of Asian investment" and "half-life philanthropist." The H&Q Asia Pacific Venture Capital Company he founded is one of the oldest direct investment companies in the Asia-Pacific region.

Xu Dalin's most well-known investment case in the Chinese mainland market is SMIC. In the early days of SMIC's venture, Xu Dalin, as an investor, affirmed its prospects and believed that it was worth investing. In the end, Xu Dalin's judgment was proved to be correct, and SMIC achieved great success.

He brought Starbucks to China

According to reports, Xu Dalin was born in Shandong. He was born in Chongqing in 1943. He moved to Taiwan with his family in 1947. He graduated from the Department of Physics of National Taiwan University in 1964. Later, he was recommended by the famous physicist Wu Dayou, and received a scholarship to study in the United States. In 1970, he obtained a doctorate in electrical engineering from the University of California, Berkeley.

After graduating from his doctorate, Xu Dalin worked hard in Silicon Valley and worked for 12 years at IBM (International Business Machines Corporation). He started as a senior researcher and eventually became a senior director of the R & D department.

In 1985, Xu Dalin turned to venture capital. In 1986, he founded H&Q Asia Pacific, brought the first American-style capital to Taiwan, and invested in computer companies such as Wanghong, Acer, and Winbond to fully support Taiwan's technological development.

As a venture capitalist, Xu Dalin has facilitated the establishment of many companies in the Asia-Pacific region outside Taiwan, including assisting the successful landing of Starbucks in the United States in the mainland of China. In 1999, Handing Asia Pacific brought the first Starbucks coffee into the Beijing International Trade Building business district; in 2005, Starbucks opened its branch at the foot of the Badaling Great Wall to welcome customers.

Xu Dalin was interviewed by the media during his lifetime and recalled making this investment decision, saying,"What I was looking at was the lifestyle advocated by Starbucks. For a China with thousands of years of tea drinking history, when I brought Starbucks 'first store in, I felt a little uneasy, especially when coffee was very expensive."

After several years of operation, Xu Dalin was very happy to see the rapid development of Starbucks coffee in the mainland of China, which quickly became the world's second largest market for Starbucks coffee, second only to the United States. Although Starbucks has changed hands, it still has historical significance.

In addition to making outstanding achievements in the field of venture capital, Xu Dalin also spared no effort in charity work. In January 2011, after nomination by the Give2Asia Council and voting by all directors, Xu Dalin was officially elected as the chairman of the Give2Asia Council.

According to information provided by Donation Asia, during the Wenchuan earthquake in Sichuan, China in 2008, donations through Donation Asia reached US$16.6 million, making it the second largest organization in the United States after the Red Cross in donating money to the disaster-stricken areas.

According to reports, Xu Dalin's memorial service will be held in San Francisco, the United States in May.

** 号称“亚洲投资教父”,投资**中芯国际 In the industry, Xu Dalin is known as the "godfather of Asian investment" and "half-life philanthropist." 因多项重要投资案例与其在亚洲创投与私募基金产业发展中的卓越贡献,他被美国《商业周刊》评为50位“亚洲之星”之一。

2006年,美国《财富》杂志将其评为全美排名第18位的科技创业投资家。他还是《福布斯》杂志选出的2009年全球百大科技创投领袖。2010年,徐大麟成为美国华人精英组织“百人会”的会员。

徐大麟进入中国内地市场的时间点,最早可以追溯至1993年,当时,中国银行和美国安泰保险共同组建“中安基金”,委托徐大麟及其团队来管理。

当时,徐大麟对于中国内地市场的判断充满信心,先后在中国内地市场投资了海南航空、北京燕莎百货等优质项目。

His most well-known investment case in the Chinese mainland market is SMIC. 据澎湃新闻此前报道,2000年4月,张汝京带着300多位来自中国台湾和100多位来自美欧日韩等地的人才团队,加上陈立武先生、徐大麟博士等投资人的支持,与王阳元院士等人创办中芯国际集成电路制造(上海)有限公司。 在中芯国际一无所有之时,徐大麟敏锐地意识到,中芯国际未来的前景非常值得期待。他曾表示,“张汝京是具有丰富经验的一流操盘手,而且他的团队也是非常优秀的一流半导体方面的人才,加上上海市和国家对于半导体产业的扶持,因此我认为中芯国际是值得投入的一个企业。”事实果然如徐大麟当初的判断一样,中芯国际获得了巨大成功。 2008年10月6日,中芯国际公告称,独立非执行董事徐大麟辞职。公告称,徐大麟博士自2001年起出任本公司董事,于2008年9月30日辞任本公司第二类独立非执行董事。 据公告显示,徐大麟向公司确认,他的请辞是因为要专注于其他业务及投资项目,他也确认其与公司董事会并无任何不同意见,且就其请辞一事而言,并无任何其他事项需要通知股东。 值得一提的是,他曾在亚洲金融危机期间同时参与了韩国经济的复苏——为了挽救亚洲经济,世界银行曾组建了振兴亚洲经济小组,而金融方面的重组计划,世行则选择了对于亚洲经济熟悉的徐大麟和他的团队来完成。 后来,凭借十几年在亚洲地区的耕耘,徐大麟借着世行让他们管理拯救韩国财务经济创投基金的机会,完成了对于韩国三阳证券的重组,不但没有花韩国政府一分钱,而且还把一个濒临倒闭的证券公司改造为现在韩国数一数二的证券公司,此举极大地减缓了韩国的金融危机。 **