The economy is expected to start off in the first quarter, and efforts are still needed in the complex external environment.

2024.0411

Number of words in this article:2986, reading time is about 5 minutes

introduction:当前外部环境复杂性、严峻性、不确定性上升,经济运行中存在的问题还需下功夫解决。

** Author| ** First Finance Zhu Yanran

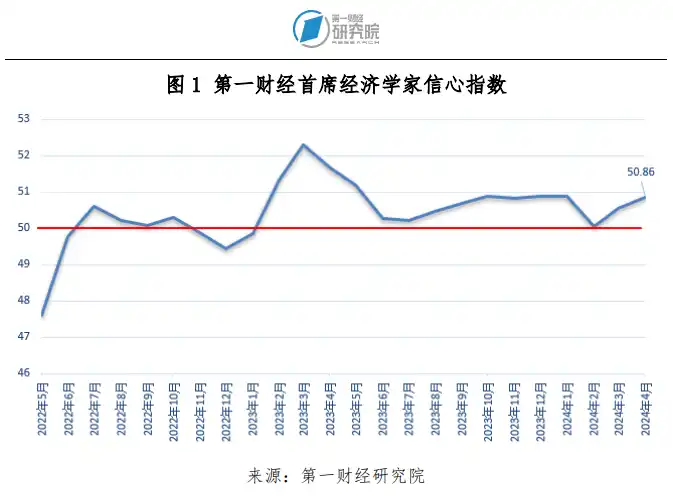

With the accelerated release of macroeconomic policy effects and the continuous accumulation of favorable factors for economic development, China's economy is expected to get off to a good start in the first quarter. The National Bureau of Statistics will release economic data such as GDP growth, industrial value added, investment in fixed assets and retail sales of consumer goods in the first quarter on April 16. A number of institutions expect China's economic growth to slow year-on-year in the first quarter due to the high base effect. With the receding of factors such as the wrong month and low base during the Spring Festival, indicators such as industry and consumption may decline in March, but the growth rate of manufacturing and infrastructure investment may maintain a relatively high growth rate, and the overall economic momentum is still in the process of repairing. Premier Li Qiang recently presided over a forum of economic situation experts and entrepreneurs to listen to opinions and suggestions on the current economic situation and the next step in economic work. Li Qiang pointed out that the current external environment is complex, severe, and uncertain, and the problems existing in economic operation still need to be solved. China's development has a solid foundation, many advantages and great potential, and the long-term trend for the better will not change, and we are confident that we will be able to maintain sustained and healthy economic development. The latest issue of the confidence Index of the Chief Economist of first Finance and Economics released by the first Institute of Finance and Economics is 50.86, rising for two months in a row. Economists believe that China's economic recovery has a good momentum, and a smooth start to the economy in the first quarter will lay the foundation for achieving the economic growth target for the whole year.

The first quarter is expected to have a good start

今年以来,随着宏观稳经济政策协同发力,经济复苏加速。国家统计局此前发布的12月经济数据好于预期,12月全国固定资产投资同比增长4.2%,增速较去年加快1.2个百分点。规模以上工业增加值同比上涨7.0%,比去年12月加快0.2个百分点。 仲量联行大中华区首席经济学家庞溟对第一财经表示,1~2月国民经济各主要指标均出现好于预期、强于季节性的加速增势,说明前两个月国民经济的企稳回升不只是恢复性的增长,更有持续向好、全面改善、供需平衡的积极变化。工业、服务业、投资等指标增速多月来首次出现齐头并进、共同回暖的势头,有效弥补了房地产投资等方面的困难与挑战。 中国银行研究院发布的报告认为,从内部看,宏观政策进一步发力,经济增长内生动力增强,服务消费和制造业投资成为主要支撑。初步预计,一季度GDP同比增长4.8%左右。 还有不少专家和机构的预测更为乐观。长江证券首席经济学家伍戈在参与第一财经首席调研时表示,今年年初,多项经济数据超出市场预期。固然有春节服务业脉冲等影响,但统计口径优化、闰年工作日等效应,也引致基数“降低”情形下投资、工业数值的向上扰动。结合开年以来工业及服务业等走势,他预计一季度实际GDP有望在5%~5.5%的区间。 北京大学国民经济研究中心认为,在稳增长政策持续助力下,国内经济持续向稳发展,预计2024年第一季度GDP同比增长5.2%,较2023年同期提升0.7个百分点。 一季度的良好开局为实现全年经济增长目标打下良好基础。中央财经领导小组办公室原副主任杨伟民日前表示,今年经济开局良好,从一二月的情况来看,一季度很有可能迎来开门红,这对于全年经济发展信心的引导至关重要。预计今年的增长将更加稳定,名义增长和实际增长之间的差距有望缩小。 广开首席产业研究院院长连平表示,2024年中国GDP增速有望达到5%左右。他认为,在扩张性宏观政策的积极推动下,“三驾马车”不同程度地协同推动经济增长,最终消费和资本形成拉动GDP分别为3.6和1.4个百分点,净出口对GDP的贡献相对中性。

Industry is recovering steadily

Economists involved in the chief survey of China Finance and Economics forecast an average of 5.67% year-on-year growth in industrial production in March, down from 7.0% last month. In terms of leading indicators, the purchasing managers' index (PMI) of China's manufacturing sector released by the National Bureau of Statistics for March was 50.8 per cent, up 1.7 per cent from the previous month and returning to a range of more than 50 per cent after a lapse of five months. Zhang Liqun, a special analyst at the China Federation of Logistics and Purchasing, believes that the PMI index rebounded sharply in March and returned to above the line of rise and fall; it is not only affected by seasonal factors, but also shows that the economic recovery is further clear. The expected index of production and business activities increased by 1.4 percentage points, indicating that business confidence has recovered, and the effects of a number of policies to stabilize growth and boost confidence have begun to show since the beginning of the year. CICC Macro pointed out that manufacturing PMI rose super-seasonally to 50.8% in March, indicating an acceleration in month-on-month improvement in the manufacturing sector. However, the receding of temporary factors such as leap years and the increase in the base brought about by the rush to work after the epidemic in the same period last year may affect the year-on-year growth of industrial production. Judging from the high-frequency operating rate data, the year-on-year growth rate has also slowed down. Industrial production is expected to grow by 5% year-on-year in March. It is worth mentioning that the SME development index released by the China Association of small and medium-sized Enterprises in the first quarter on April 9 was 89.3, up 0.2 points from the previous quarter and higher than the same period in 2022. Ma Bin, executive vice president of the China Association of small and medium-sized Enterprises, said that production has accelerated after the Spring Festival holiday, and the policy "combination punch" after the two sessions has continued to show effectiveness, the momentum of economic recovery has been increasing, and the production and operation of enterprises have continued to improve. the development index of small and medium-sized enterprises has rebounded again. Among the 8 industries surveyed, the domestic order index of 5 industries and the sales price index of 4 industries increased.

Consumption potential continues to be released

After the concentrated release of consumer demand brought about by the Spring Festival holiday, the post-holiday consumption activities showed a natural downward trend. Economists involved in the chief survey of China Finance and Economics forecast an average year-on-year growth rate of 4.3% for retail sales of consumer goods in March, down from 5.5% last month. CICC Macro pointed out that travel and consumption activities have stabilized since mid-March. At the same time, in mid-late March, some localities introduced policies to promote the trade-in of consumer goods, providing shopping subsidies for consumer goods such as cars and home appliances. Taking into account the impact of the release of consumer demand after the epidemic in the same period last year and a high base, the total social zero growth rate is expected to fall back to about 3.5% in March this year, and the corresponding compound growth rate since 2019 is roughly the same as that from January to February. Chen Xing, chief macro analyst at Caitong Securities, said that from the perspective of automobile consumption, which accounts for the largest proportion of optional consumption, under the background of actively introducing policies to promote consumption, auto market consumption still maintains a good performance, but the price reduction strategy of car companies in the peak sales season has led some consumers to wait and see. Given the impact of a higher base in the same period last year, he expects the growth rate of retail sales of consumer goods to slow slightly to 4 per cent in March from a year earlier.

The latest data released by the China Association of Automobile Manufacturers on April 10 showed that from January to March, domestic sales of automobiles were 5.396 million units, a year-on-year increase of 6.2%; automobile exports were 1.324 million units, a year-on-year increase of 33.2%. Among them, automobile exports in March were 502,000 units, a month-on-month increase of 33% and a year-on-year increase of 37.9%.

Investment growth may accelerate

参与第一财经首席调研的经济学家对13月固定资产投资增速的预测均值为4.26%,稍高于上月4.2%的公布数据。 民生银行首席经济学家温彬预计一季度固定资产投资同比增长4.4%左右,高于12月的4.2%。基建投资方面,3月份,随着气候转暖和节后集中开工,各地建筑工程施工进度加快,建筑业商务活动指数录得56.2%,但仍不及历史同期水平。 受出口、利润等基本面因素的带动,制造业投资增速或仍将保持较高增速。温彬分析,考虑到出口略有回暖,制造业企业利润降幅已明显转正,以及政策要求“加快发展新质生产力”,预计制造业投资增速将由12月的9.4%回升至10%左右。 房地产开发投资方面,高频数据显示,3月30个大中城市商品房成交面积为875万平方米,较上年同期下降47%;100大中城市土地成交面积为7281万平方米,同比增长26.8%,近9个月首次同比转正。温彬表示,居民购房意愿仍然偏弱,但房企信心有所恢复,土地出让收入预计会对房地产开发投资形成支撑,叠加去年同期基数下降,预计房地产开发投资由12月的-9.0%收窄至-8.7%左右。 连平认为,“三大工程”建设可能带动万亿元投资资金,约合全年房地产投资额的9%左右。“保交楼”专项贷款、地方房地产融资协调机制将部分缓解房企现金流压力。一些大城市土拍规则的修改可能会推动部分央企、国企房企适度加大土地储备的投资规模,进而对房地产投资增速带来帮助。 **