Weak U.S. non-farm payrolls data triggered global stock market shocks, and the Japanese yen and RMB strengthened

On August 2, local time, the U.S. non-farm payrolls index was weaker than expected, the U.S. dollar index fell sharply, non-U.S. currencies rose across the board, and the offshore RMB rose above 1000 basis points against the U.S. dollar, breaking above the 7.15 mark.

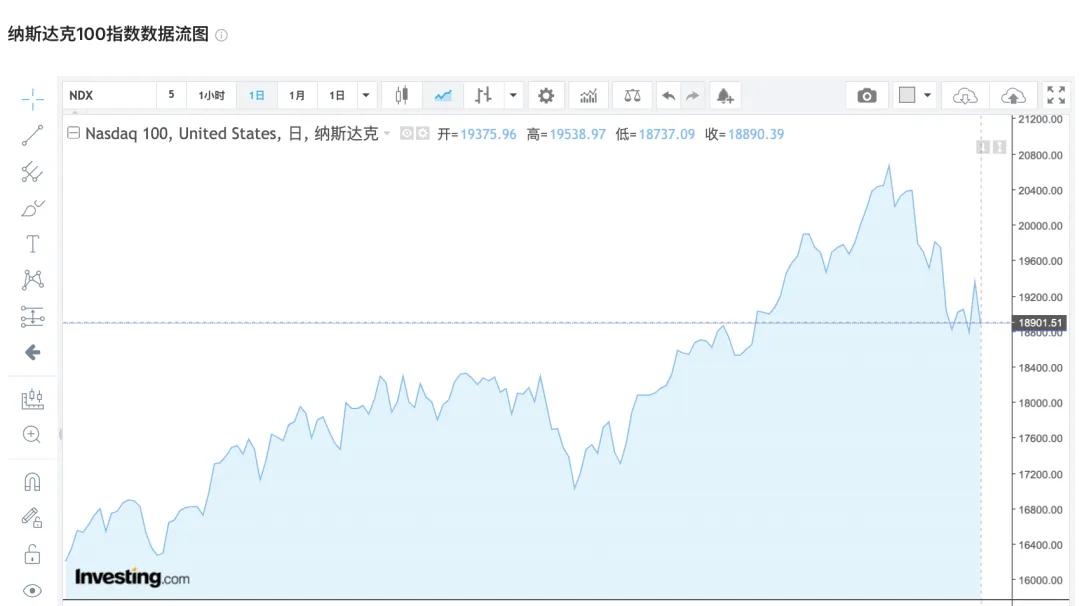

The three major U.S. stock indexes opened sharply lower, with the Dow Jones Industrial Average, Nasdaq Index, and S & P 500 Index all falling. The Nasdaq 100 index's decline widened to 3%, Intel fell nearly 30%, Amazon fell more than 12%, and Nvidia fell 7%.

Japan's stock market has attracted global funds with sharp gains in the past two years, but this week it fell into a sharp sell-off. On Friday, August 2, surrender selling swept the Japanese stock market. The Nikkei 225 index closed down 5.81% at 35,909.7 points, the lowest since February 7. Japan's Toki Index closed down 6.1%, the largest decline since 2016.

On the same day, Asia-Pacific stock markets also fell overall, with Hong Kong's Hang Seng Index falling more than 2%. On the contrary, Asian low-interest currencies such as the Japanese yen and RMB have continued to strengthen. The US dollar/RMB once fell below 7.2 in the afternoon trading session of August 2, while the US dollar/Japanese yen fell below 149, reaching a peak of 162 before.

Japanese stock market crashes after interest rate hikes

Senior global macro trader Yuan Yuwei told reporters that there are two main logics for Japan's decline. First, the reasons are similar to the recent collapse of U.S. technology stocks. People from all walks of life previously thought that the Federal Reserve's upcoming interest rate cut would be good for technology stocks, but technology growth stocks have long since surged ahead of schedule. As a result, it has become a result of the cashing of profits and the stock market has fallen; The Bank of Japan has been expecting a rate hike for a long time, so bank stocks and insurance stocks that have benefited from the rate hike have been soaring. When the rate hike is really implemented, the gains will become negative. At the same time, all walks of life are also worried that the surge in the yen will be negative for the export sector.

In fact, the yen has recently surged nearly 8% against the dollar, forcing the Nikkei to a nearly five-month low, down 15% in just 16 days. It also fell below its 200-day moving average and fell 5.8% on Friday, its worst day since the epidemic. It is not difficult to find that in recent times, Japan's automobile, department stores and other export and tourism-related sectors have plunged. Since August last year, the largest increase in the Nikkei 225 index once hit 22%, reaching a high of 42,426.77 points, but the cumulative decline in the past month has reached 10%.

"The market suddenly realized that the Bank of Japan used to be hawkish and is now the only hawkish player among the world's major central banks." A foreign exchange trader from a foreign bank told the First Financial Reporter.

Jia Wenjian, head of diversified asset investment and management at Baida Asia, Switzerland, previously told reporters:"The Japanese stock market performed well before because the Bank of Japan maintained monetary easing, which led to the depreciation of the yen, which greatly boosted the competitiveness of Japan's exports and also promoted Japan's tourism and service industries." But he also said that if the yen turns to appreciation in 2024, it may be difficult for Japan's stock market to continue to rise sharply.

The Bank of Japan announced a 15BP interest rate hike on July 31, well before the market consensus in September or October, and the 15BP rate also exceeded the 10BP expectation. At the same time, the Bank of Japan announced a specific plan to gradually reduce the purchase of Japanese government bonds, aiming to reduce the monthly bond purchase to 3 trillion yen in March 2026. Recent data shows that Japan's wage growth range has widened and household inflation expectations continue to rise. Companies 'expected pricing has increased, and concerns about imported inflation have intensified as the yen remains weak against the dollar.

US stock market plunge accelerates Japanese stock market correction

The collapse of U.S. technology stocks has undoubtedly accelerated the collapse of Japanese stocks. Overnight, the Nasdaq 100 index plunged 2.44% to 18,890.39, down nearly 9% from its July high of 20700. This is a deep correction rare in a year.

In the past half month, due to the sharp appreciation of the yen against the U.S. dollar, the carry trade has suffered huge losses. If traders carry the arbitrage target on U.S. stocks that have fallen sharply recently (U.S. technology stocks have pulled back sharply), the losses will be further amplified, so the strategy also Continue to reverse, thereby further pushing the yen to strengthen.

First Financial News recently reported that Seiji Maruyama, Japan's fixed income head and chief investment officer of PGIM, told reporters that since the Federal Reserve launched the interest rate hike cycle in March 2022, the real interest rate gap between the US and Japan markets widened, the yen has been under pressure. Spread allows investors to use the yen as a financing currency to arbitrage by long high-yielding currencies such as Mexican Bissau, Brazilian real and, more recently, Turkish lira. This financing strategy has performed well in the past two years, resulting in a significant increase in positions. However, the more volatile currency peg reversed sharply as the carry trade was lifted, with Bissau's cross against the yen falling 11% from its July peak.

In fact, the correction in U.S. technology stocks began nearly three weeks ago, when the "Trump 2.0 deal" swept Wall Street and the rotation began. In the week ending July 21, small-cap stocks, which had endured humiliation for nearly three years, began to perform. The Russell 2000 index rose 9%, the S & P 500 index fell 1%, and the gap reached 10 percentage points. Small-cap stocks are very sensitive to the U.S. economic growth environment, are more domestically oriented than large-cap stocks, and are less affected by tariffs. Recently, technology stocks have not stopped falling, which is also closely related to the unsatisfactory financial reports of technology giants.

The three major U.S. stock indexes collectively fell sharply on Thursday. The Nasdaq index fell 2.3%, the S & P fell 1.4%, and the panic index VIX rose to 18.6%. Major indices in Europe and Asia-Pacific all fell overnight. Among the large technology stocks, except Meta, which rose 5%, driven by positive earnings reports, all fell back from high levels.

What is even more worrying is the performance of technology giants released after hours. Intel's performance was bleak and its outlook was pessimistic. At the same time, it announced a dividend freeze and 15% layoffs, and its share price fell 20%. Amazon's second-quarter revenue and third-quarter outlook fell short of expectations, and its share price fell 6%. Apple's overall results were better than expected, with strong growth in the services sector offsetting a year-on-year decline in iPhone revenue, and its stock price fell 0.6% after hours.

In addition to U.S. stocks, future changes in Japan's monetary policy are also crucial to the Japanese stock market. Given that the Bank of Japan has raised its medium-term inflation forecast, there is a possibility of further interest rate hikes. The current virtuous cycle of wages and commodity prices is expected to continue, meaning that Japan's neutral interest rate will reach a higher level. If wage growth momentum continues, the Bank of Japan may need to raise policy rates further to achieve its 2% price stability target.

Looking around, major central banks around the world have already begun to cut interest rates, or are about to start a cycle of interest rate cuts. The Bank of England announced interest rate cuts this week, while the Federal Reserve hinted at its interest-rate meeting on Thursday that a window for interest rate cuts may open in September. This also means that yen bulls may make a comeback.

Barclays predicts that the FOMC will cut interest rates twice in September and December this year, and expects the FOMC to cut interest rates three times in March, June and September in 2025; Goldman Sachs expects the FOMC to cut interest rates at every other meeting starting in September this year (ie, quarterly). Overall, it is expected that the Federal Reserve will cut interest rates by more than 150BP by the end of 2025.

The RMB continues to follow the yen to rebound sharply

Despite the dismal performance of the stock market, Asian currency markets were unexpectedly boosted, and the yen and RMB, representatives of low-interest currencies, rebounded sharply.

Matt Simpson, a senior analyst at Jiasheng Group, told reporters that since the RMB and the Japanese yen are used by hedge funds as part of low-interest currencies in Asia, carry trade has continued to reverse recently, and the surge in the Japanese yen has also driven the rebound of the RMB.

Although China's own fundamentals are the most critical to the exchange rate, short-term market momentum cannot be ignored. Some traders also said,"The RMB continues to be carried away by the yen, and market sentiment has changed greatly. The view that the RMB will fall below its previous low has begun to reverse."

This also means that the subsequent direction of the US dollar/Japanese yen is also crucial to the RMB. The current yen bulls are still in strength. Simpson said that on the one hand, the Federal Reserve gave the green light to interest rates, and on the other hand, the Bank of Japan's hawkish combination of "interest rate hikes + shrinking balance sheet + intervention". The distinctive interest rate policy differences have narrowed the spread between the 10-year government bonds between the United States and Japan to around 3%, the lowest level since May 2023. It is undeniable that the spread is still large, and the carry trade may come back. Therefore, it is not ruled out that the exchange rate will stop falling near the trend line of 148.30 and correct the oversold technical indicators. However, the direction with the least resistance of the exchange rate is still downward, with a moderate rebound or a potential opportunity to become a short position. After falling below the key trend line, it may drop to the December low of 140.