The founder of Hema retires, Hou Yi's era ends, and new retail has no choice but to "make a big retreat"

The following article comes from Understanding the Sutra, the author Zha Rui

Understand the scriptures.

Understand the scriptures.

Finally waiting for you to come together to understand the scriptures

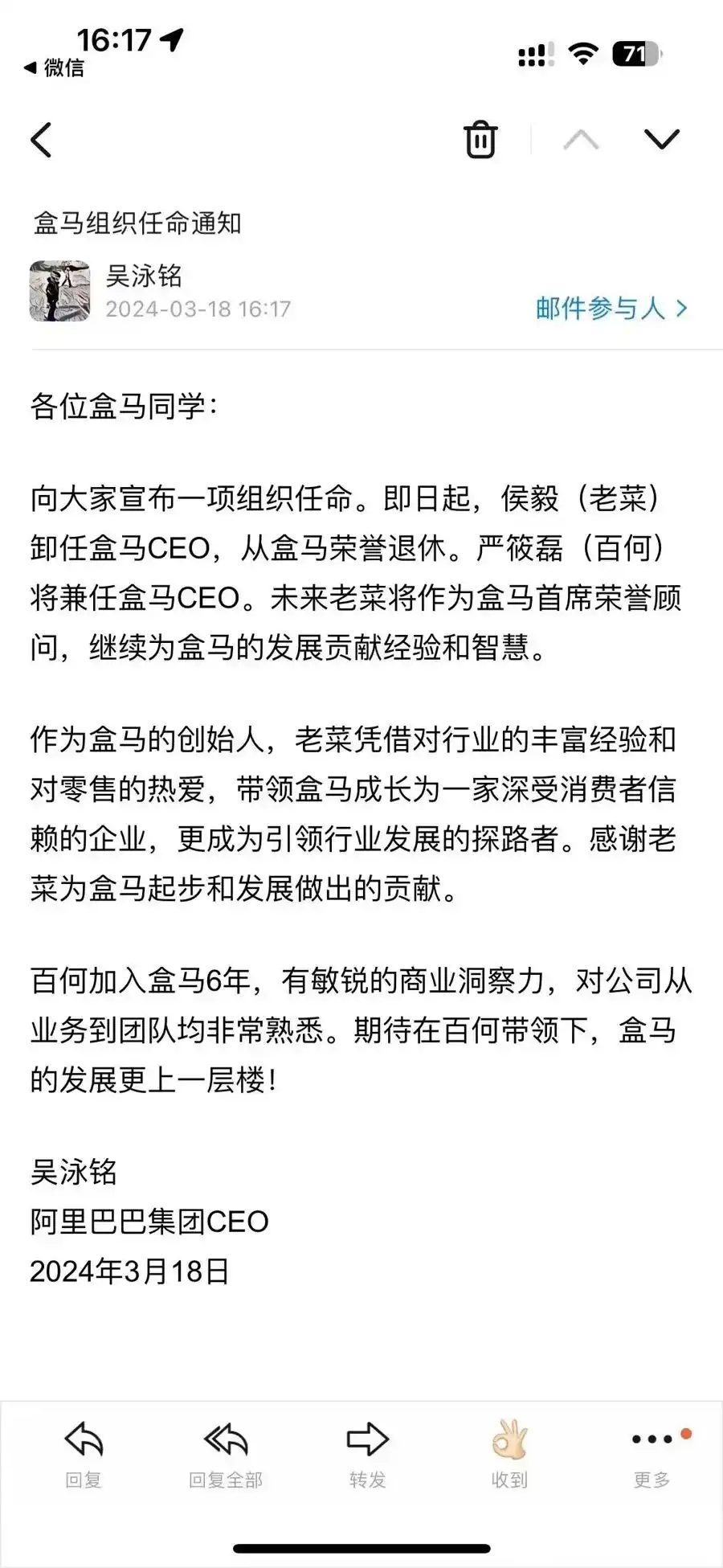

** On the afternoon of March 18, the reporter received news exclusively from Hema:Hou Yi, founder and CEO of Hema, officially retired at the age of 60 and will serve as the chief honorary consultant of Hema in the future. Yan Xiaolei, who is currently the CFO of Hema, will concurrently serve as CEO. **

Recently, Alibaba Group has accelerated the stripping of loss-making non-core businesses. New retail companies such as Hema and RT-Mart have repeatedly exposed rumors of selling. Although the rumors are still full of doubts, the profit problem of new retail is still difficult to solve, and the future is unclear.

An internal letter from Alibaba announced Hou Yi's retirement.

The dream of listing "old vegetables" is difficult to realize

"Lao Cai" is Hou Yi's WeChat name and his "flower name" within Alibaba. In his continuous entrepreneurship, the founder of Hema is the most well-known identity.

Hou Yi, who loves food, was born in Changning, Shanghai. In 1974, he came to Jinshan to live with the first batch of Shanghai's parents who supported Shanghai Petrochemical. After graduating from college, Hou Yi returned to Shanghai Petrochemical Polyester Factory as a software engineer. At that time, computers had just been introduced to China, and Hou Yi was doing software development while conducting employee training.

In 1992, Hou Yi resigned and started a business following the "sea trend" and became a self-employed person. At that time, in Maozhong Square, Shanghai Petrochemical's first open rental counters, Hou Yi rented two small counters and began to "resell" clothing. From a clothing store to selling air conditioners in the home appliance industry, Hou Yi's career has grown bigger and bigger-general manager of Kedi convenience store supply chain, chief logistics planner of Jingdong, and president of Jingdong's O2O business unit.

** In 2015, 51-year-old Hou Yi decided to start a business again. He once mentioned his young dream-to become a listed company. In the same year, Hema was established in Shanghai and received an investment of US$150 million from Alibaba in March 2016; on July 14, 2017, Jack Ma came to Hema Jinqiao Store, and Hema Xian, which had been prepared internally for more than two years, generated Alibaba's new retail "benchmark". **

Regrettably, Hema still failed to help Hou Yi realize his dream. In May last year, Hema launched its listing plan, which has finally stalled due to unsatisfactory market valuation and other reasons.

"Old dish" Hou Yi

Yan Xiaolei, the "successor" of Hema, is 45 years old and has worked for Siemens China and KPMG. After joining Ali in 2016, she successively served as the financial head of UC Business Department and Intime Group, and began to serve as the CFO of Hemar in 2018.

At a time when the focus is on "price power", a CFO leader is obviously more in line with Hema's future financing needs.

"Selling box horses at a low price" is full of doubts

Hou Yi's retirement adds a trace of gloom to Box Ma, who is in the midst of "suspicion of selling".

抛售盒马的消息早已有之。去年12月,有消息称阿里巴巴集团CEO吴泳铭正在重新规划资产,Considering selling Box Horse, the rumor was dismissed by Box Horse that "the sales rumors are false"。

On the evening of the 16th, news of the sell-off came out again, saying that Ali had basically decided to sell RT-Mart and Hema to COFCO. RT-Mart was valued at about 10 billion yuan, and Hema was valued at about 20 billion yuan. It even claimed that this transaction was Jack Ma personally made the decision and a framework agreement had been drawn up.

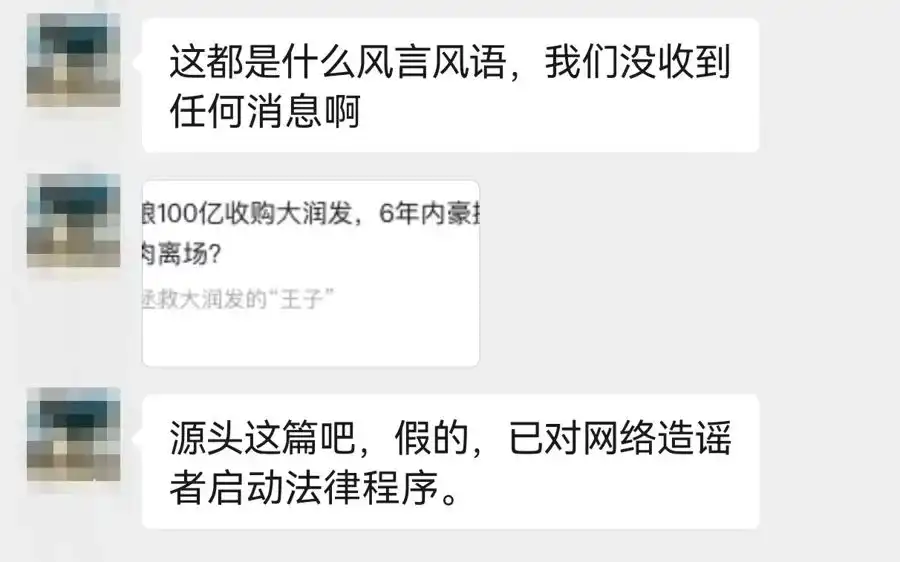

However, the well-established news was still denied by RT-Mart and Hema. RT-Mart told reporters that legal proceedings have been initiated against the rumor-mongering, and many insiders in Hema have also publicly refuted the rumor-mongering.

RT-Mart said it had initiated legal proceedings against rumor-mongers.

After Zhang Yong faded out, Alibaba Group's three new retail "trump cards", Hema, RT-Mart and Intime Department Store, all had a difficult life. At present, if the price is right, it will be a foregone conclusion for Ali to sell Intime Department Store.

"RT-Mart and Hema have such a large commercial volume that there are very few buyers on the market that can catch them." A retail person close to Alibaba told reporters that RT-Mart's parent company, Gaoxin Retail, is a listed company with a latest market value of HK$13.1 billion (as of March 18), which is not much different from the online sales price of 10 billion yuan, but compared with the huge amount of money Alibaba spent about HK$50 billion to invest in shares that year, it still has a huge loss. Previously, the valuation price set by Hema during financing was about US$6 billion to US$10 billion, which was a huge gap compared with the sales price of 20 billion yuan. "If we really sell Hema and RT-Mart for 30 billion yuan, Alibaba will lose too much." The person said.

There are also many doubts about the sales price of "RT-Mart 10 billion yuan and Box Horse 20 billion yuan" rumored online. Although the topic degree and discussion degree of Hema are significantly higher than that of RT-Mart, there is still a big gap in the actual volume. According to data from the China Chain Store and Franchise Association, the total sales of Hema in 2022 will be 61 billion yuan, while Gaoxin Retail's revenue in the fiscal year 2023 will reach 83.662 billion yuan. The number of Hema stores nationwide is also more than 100 fewer than that of Gaoxin Retail, and almost all of them are property rentals. However, only about 30% of Gaoxin Retail's hypermarkets are self-owned properties. There is also a big gap between the cost pressures of the two.

The above-mentioned people close to the situation also believe that Yintai Department Store and Gaoxin Retail are both acquired companies by Alibaba, as supplementary assets to the new retail format, and the format is more traditional, so the possibility of selling is higher than that of Box Horse."After all, Box Horse was personally incubated by Ali. A benchmark company, coupled with more than 8 years of real money investment, unless the asking price is right, the possibility of 'selling at a low price' is relatively low."

New retail "big retreat"

After the "1+6+N" organizational reform last year, Alibaba is accelerating the divestment of loss-making non-core businesses and shifting to the "core profit portion" of e-commerce.

Under the premise of "returning to Taobao", the "new retail" advocated by Ali is also in jeopardy.

On February 26, Suning Tesco announced that Taobao would transfer 1.861 billion shares it held to Hangzhou Haoyue at a price of 2.847 billion yuan. Although this was a transfer between different entities within Alibaba Group, Taobao China no longer holds any shares in Suning Tesco.

Intime Department Store has also been placed on the "shelves". It was previously reported that Alibaba has begun to reach out to potential buyers interested in acquiring Intime. RT-Mart may be the next "Intime Department Store". Alibaba's latest quarterly report pointed out that Alibaba achieved revenue of 260.348 billion yuan, but operating profit for the same period was 22.511 billion yuan, a year-on-year decrease of 36%, mainly due to the impairment of Gaoxin's retail intangible assets and the impairment of Youku's goodwill.

2月7日财报会上,阿里巴巴集团主席蔡崇信表示: "We still have some traditional physical retail businesses on our balance sheet, and these are not our core focus. It would be very reasonable if you could complete the withdrawal." 不过,阿里巴巴同时强调,考虑到当前的市场情况,退出需要时间慢慢实现。

"Alibaba's withdrawal from traditional physical retail is a precursor for Alibaba to adjust its business structure and optimize resource allocation." An Guangyong, an expert on the Credit Management Committee of the All-China Mergers and Acquisitions Association, said that in the context of intensified market competition, Alibaba is assessing its return on investment in the traditional physical retail sector and choosing to focus more resources on its core business and future growth potential. Big area. The "slimming" of Alibaba's business aims to enable the company to focus more on core competitiveness, improve efficiency and profitability, and is also a proactive adaptation to changes in the external environment.

"Alibaba's new retail model is not 'no good' in practice, but faces profitability problems and strategic transformation." Financial and financial commentator Yu Fenghui also believes that factors such as the long return on investment cycle of the new retail model, high operating costs for offline stores, and rapid changes in the consumption environment are affecting the profitability of the business format. He said that even if there is business contraction or reorganization, it cannot be regarded as a denial of the original concept, but should be understood as a rethink and repositioning of the new retail practice path.

**