2024 European PPA Market Outlook:Germany leads the way, mixed PPA welcomes growth

全文1586字,阅读大约需要3分钟

Reproduction in any form without permission is strictly prohibited

Southern Energy Watch

micro-signal:energyobserver

Welcome to submit, submit email:

Compiled up eo reporter Jiang Tao

Editor He Nuoshu

Audit Feng Jie

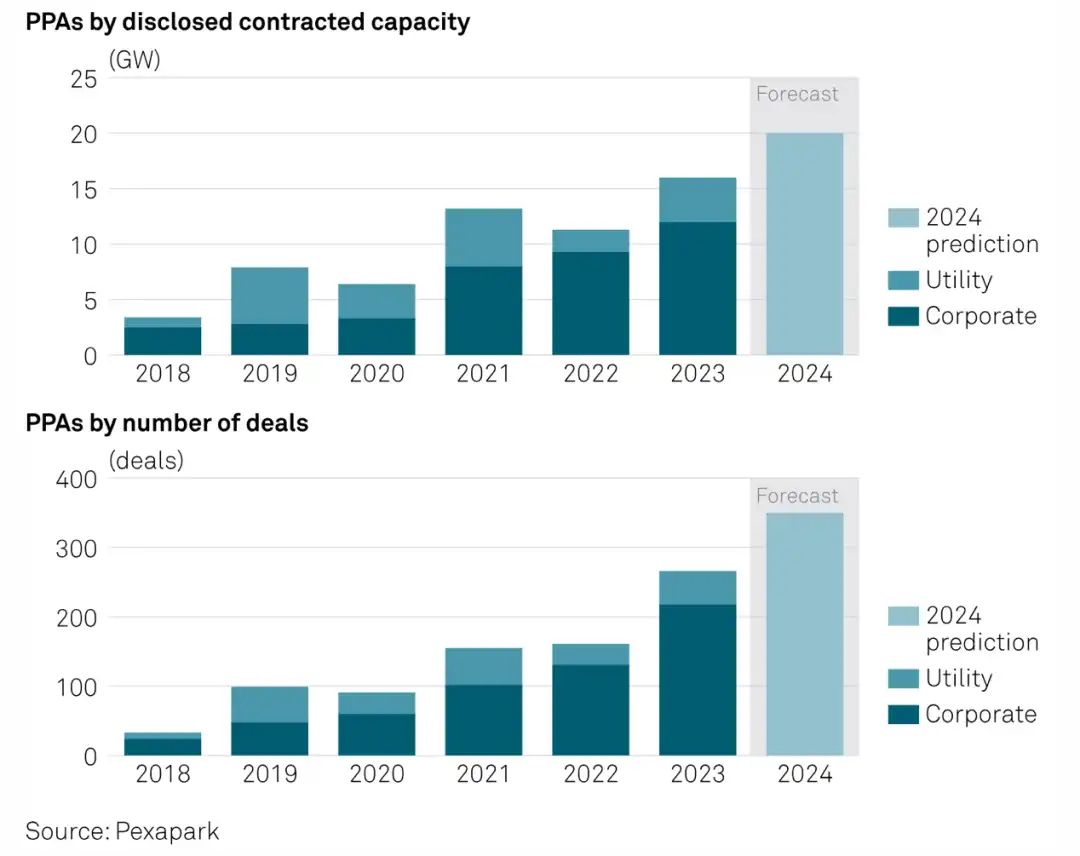

On January 30, 2024, Swiss energy consulting agency Pexapark released the "2024 European Power Purchase Agreement (PPA) Market Outlook" report. The report shows that the European PPA market will hit new highs in terms of the number of signed contracts and agreement capacity in 2023.

The report provides the following outlook for the European PPA in 2024:

● European PPA market size will exceed 20 GW

● Germany will surpass Spain in terms of PPA quantity and capacity, ranking first in Europe

● The popularity of green power PPA will be further increased

● The share of public utilities signing PPAs will increase

● Hybrid PPA will continue to grow in Europe excluding the UK

01 Solar PPA dominates the market in 2023

In 2023, a total of 272 PPAs were signed in the European renewable energy market, with an agreement capacity of 16.2 GW, a year-on-year increase of more than 40%. Among them, a total of 160 PPAs have been signed in the solar photovoltaic field, with an agreement capacity of 10.5 GW, accounting for approximately 65% of the total capacity; a total of 58 PPAs have been signed in the onshore wind power field, with an agreement capacity of 2.3 GW; and a total of 20 PPAs have been signed in offshore wind power, with an agreement capacity of 2 GW.

From a national perspective, the total number of PPA agreements signed in Spain in 2023 will reach 4.67 GW, leading the European PPA market for the fifth consecutive year. Germany ranks second, with a total agreement volume of 3.73 GW. The combined number of PPAs in the two countries accounted for more than 50% of Europe's total annual transactions in 2023. In addition, Italy (1.06 GW), the United Kingdom (0.96 GW) and Greece (0.95 GW) rank third to fifth.

From a corporate perspective, Spain's Iberdrola company signed 9 agreements in 2023, with a total capacity of 908 MW, ranking first. Norway Statkraft is the most active company, signing a total of 19 agreements with a total capacity of 739.5 MW.

In addition, in 2023, the number and capacity of PPAs signed by public utilities will increase significantly. A total of 48 agreements will be signed with an agreement capacity of 4.02 GW, more than double the 1.96 GW in 2022. The number of agreements signed will increase by 60% compared with 2022. Pexapark believes that utilities are constantly making adjustments to respond to challenges posed by volatile energy prices, intermittent renewable energy and stricter green power standards.

02 Hybrid PPA is expected to see growth

According to the report, mixed PPA, namely renewable energy + supporting facilities, has become an important driving force for the growing PPA in the renewable energy sector in Europe. A typical case is that in June 2023, equity fund DIF Capital Partners announced a hybrid power purchase agreement with French energy company Engie, which covers a 55-MW solar power station in the UK and a supporting construction of the power station. A 40 MW/80 MWh battery energy storage facility.

The report proposes that in the European market, if there is sufficient investment and financing scale, the number of mixed PPAs signed will increase. In the future, the number of mixed PPAs will continue to increase in Europe other than the UK, especially in Spain's solar-energy storage sector PPA is expected to surge in a few years.

However, the report also pointed out that in Europe, corporate interest in base load PPA is weakening. The agreement period for such transactions usually lasts for several years, but the price is not affected by short-term price fluctuations. The seller must commit to sell a fixed amount of electricity at a fixed price during the agreement period. This is an attractive option for buyers, but sellers may be worried that if short-term energy market prices change significantly, it will affect their earnings.

According to Pexapark's data, the European baseline PPA signed in 2023 has a capacity lower than the 2022 level of 2 GW, with only three PPAs reached, of which only one deal is related to solar projects with a total capacity of 76.5 MW. The report believes that considering the characteristics of base load PPA, solar photovoltaic power generation is not attractive in the PPA market due to its high volatility.

03 Germany will become Europe's most active PPA market

The report believes that as the volatility of the energy market weakens, PPA prices will stabilize, and buyers and sellers will gradually have more experience in dealing with energy market risks. The report shows that by 2024, the European PPA market signing capacity will exceed 20 gigawatts, and the number of PPA signed will reach 350. Both of these figures will hit record highs.

The report also predicts that by 2024, Germany will surpass Spain in the number of PPA signed and agreement capacity, becoming the most active PPA market in Europe; mixed PPA will gradually grow in Europe outside the UK.

Luca Pedretti, chief operating officer of Pexapark, said that following the formation of a enterprise-led PPA market in 2023, the PPA of public utilities is also expected to rebound in 2024. In the past two years, European energy prices have experienced a sharp rise, and the risk of signing long-term PPA has greatly increased. Now that the risk of price fluctuations has been temporarily reduced, public utilities are less worried about large price fluctuations.

Pexapar believes that the European renewable energy PPA market will usher in further development as the demand for green electricity grows and the maturity of market transactions continues to increase. The agency predicts that the popularity of mixed PPA, green electricity, green hydrogen production PPA and multi-buyer power purchase agreements will further increase in 2024.

Fig. 1:European PPAs and agreement capacity forecast in 2024

data