Target the "big market" and choose technologies with high "silicon" content

**投行圈子针对付费会员,已组建股权投资人交流社群,仅限清科上榜投资人及会员加入。有兴趣朋友欢迎扫码文末投行君微信。 **

Wherever silicon abounds, invest

Source | Stanford Business School (YouTube) / China Entrepreneur Magazine

Image source | Visual China

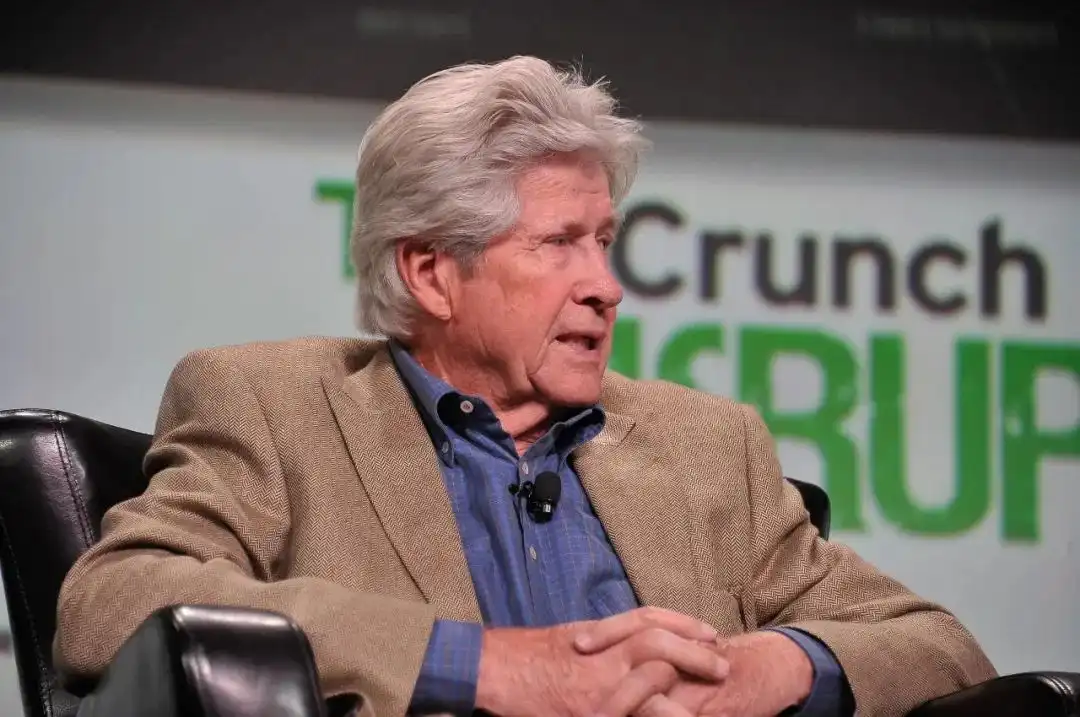

"He picked up the phone and called Don Valentine and said,'Don, I'm sending a child over and I want you to invest in him.' He is one of the best employees LSI has ever had.'" Huang Renxun said this in an interview recently.

The Don Valentine he mentioned is the founder of Sequoia Capital and is known as the "father of venture capital in Silicon Valley". He led Sequoia Capital to participate in investing in famous technology companies such as Apple, Oracle, Google, and Youtube. Recently, Huang Renxun also said that NVIDIA's first investment came from Don Valentine. Don Valentine gave a very classic speech at Stanford Business School. In his speech, he shared some of his investment experience with Sequoia Capital from a high-level perspective. He said that compared with other venture capitalists, he values the market more than individuals, because in his view, only by investing in large markets and building large companies can we achieve great success, and as long as there is a market, finding the right talents is just a search problem. In addition, Don Valentine also shared his views on the future of technology. He has worked in the semiconductor industry for 10 years. With this work experience, he insists on investing in products and markets with high silicon content, where he believes there is a future for technology.

Here are some great views::

Sequoia has always focused on large markets and aiming to build large businesses.

In our firm, it's imperative you're as technically and engineering savvy as you are capable in your secondary professional skill set which is marketing, so we can understand the lay of the marketplace. We're not interested in creating markets, they're too expensive to create, we prefer to exploit existing markets early.

In my world, it's important to be able to tell a good story, as telling a good story can leverage financing and gain the recognition of investors.

4. There is a very important financial indicator in the venture capital industry - the cash flow, which we need to maintain to control the risk.

5.在半导体行业积累的工作经验也让我更容易将投资目标集中在硅含量高的产品和市场中,那里有技术的未来。

##Targeting the "Big Market"

风险投资行业的大多数人都会资助他们认为最优秀、最聪明、最伟大的经理或者创业者,但我想说,Sequoia has always focused on large markets,

The goal always is to build large businesses. So we are obsessive about a set of metrics that relate to the market: the size of the market, the dynamics of the market, the nature of competition, and so on. We know very clearly that if you don’t go after a big market, you can’t have a truly great outcome. 我们在考量要投资的公司时,不会把时间浪费在了解被投资者的教育生活经历上,他们来自哪里,在哪里上学一点也不重要,我更感兴趣的是他们对市场的看法。

就像我们之前投资雅虎和苹果一样,我们会去了解这两家公司的创始人有什么想法。苹果公司的创始人史蒂夫·乔布斯一心想做的是让所有人都能拥有个人电脑。因为一台普通的迷你电脑至少需要25万美元,作为学生是远远负担不起的。苹果公司选择的这个市场就非常有想象空间,一旦研究出人人都用得起的电脑,市场回报一定很可观。 Thus we always give priority to and choose the market over individuals. 我们很少投资只有一种产品的领域,比如数据存储方面,我们认为以前那种录像带存储和播放的方式就十分危险,一是数据存储有限,二是安全性得不到保障,并且它们还需要很长时间才能下载信息。所以我们后来选择为多个研发内存处理方式的公司提供资金,这当中有苹果公司、IBM等十几家,它们有研发系统的,也有做软盘和磁盘驱动器的,其中有一家公司在没有内存系统的情况下实现了10亿美元的收入,这让我感到十分吃惊。如果你继续往下挖掘,就会发现个人电脑很有市场。 还有一家值得一提的公司——施乐(Xerox,美国施乐公司是全球最大的数字与信息技术产品生产商)。施乐有一个叫做帕洛阿尔托研究中心(Xerox PARC)的地方,当苹果公司的员工去了这个研究中心后,他们发现这里有他们需要的东西——鼠标。苹果当时拥有最好的GUI(图形用户界面),很感谢施乐的慷慨,给予了苹果公司需要的技术和产品。这也让红杉决定选择在系统应用程序方面进行投资,我们研究了苹果电脑的系统,最终决定在该类别中进行15项投资,其中一项是应用程序投资,我们当时选择投资艺电公司(互动娱乐软件公司),第一次接触到电子艺术。我们同样也选择投资苹果公司,因为当时苹果的视觉业务一直很出色,乔布斯在当时也表现得像一位营销专家,和平时完全不一样。其实, Marketing is always an underrated affair. 施乐这家公司曾经拥有让人羡慕的专利、市场,以及良好的现金流。但它们后来从罗彻斯特搬到了康涅狄格州南部,改变了公司的性质,成为了一家服务公司。这个决定让Rico、三星和其他所有计划夺走施乐市场份额的人都在窃喜,为施乐放弃自己的优势而欢呼,这是施乐董事会的一个错误决定。 In our eyes, the market is everything. 我们与一些不具备商业资格的人开展业务,以某种方式组织公司,以便那些经验不足的年轻人也可以经营公司。我们教他们如何将业务外包,如何培养和组建真正的核心团队。 ** 在我们公司,你必须非常擅长技术和工程,还需要掌握第二项职场技能——营销,这样我们就可以了解市场的动态,我们对创造市场不感兴趣,因为那太过昂贵,我们更喜欢尽早去开发市场。 Once a market is chosen, talents will become easier to find; moreover, the market has always been the cradle for cultivating and training professionals. Whenever a company achieves success in this market, it will cultivate a steady stream of talents for the market. 有几家公司一直是技术人才的储存库,像之前提到的施乐、IBM还有思科(Cisco美国跨国数字通信技术集团公司)等,它们对硅谷大多数伟大公司的形成都起到了关键作用。 ** 不仅是因为它们输出了大量技术人才,还在于它们为这些公司提供了重要的系统。当个人电脑全面应用于各大公司的远程办公时,问题也慢慢显现出来,来自东方的信息数据包无法在西方的主机中分析,因此这些数据包经常与西方的主机发生冲突。思科的IT部门研发出了一款很有意思的产品,它们设计了一种路由器,只能识别来自光速的内容。后来,它们把这款产品出售给各大高校的IT部门。这个例子我们想表达的是该产品实质上是我们已有产品经验的衍生品,所以对我们来说,要寻找了解问题的人是一个搜索问题, When we enter the market, we actively look for the talent we need.

The investment banking circle has set up an equity investment community for paid members. Only investors and members listed on Qingke are allowed to join. Friends who are interested are welcome to scan the QR code to join the private communication group of the investment banking circle.

**

**

Being able to tell stories is important. I won't answer any question that exceeds 20 words. I hope that every entrepreneur seeking investment can express his questions in concise language. 有一天,三个创业者来到我们的办公室,充满激情地向我们介绍他们的产品,介绍着他们如何用这款产品去改变世界,并邀请我们去他们的公司看一看,但我们拒绝了,其中两位创业者还显得有些失落。我向他们要了一张名片,给他们5分钟的时间,在这张名片的背面写下他们的商业计划,并告诉他们5分钟后会重新给他们机会。后来,他们在名片背面用微代码写下了商业计划书,估计表达的内容有500字。 In my world, it's very important to be able to tell a story. Telling a good story can open the door to funding and help you win over investors, and it also means that you need to learn how to ask questions so that people can easily understand what you're trying to say. 通常我们在倾听时并不了解产品或市场,所以需要创业者学会简洁明了地表达他们的想法,介绍他们的产品。为此,我们也总结出了一套如何向创业者提问的方法,我们会问他们竞争对手是谁?需要多少钱?如何让我的投资感到有安全感?可能我们自己都不一定有准确答案,但我们需要问出这些问题。当我们投资的公司失败时,红杉会在事后进行剖析,会反思我们错过了什么问题,还没问到哪些重要问题,还有哪些不明白的答案。 我们经常被问到红杉资本的员工都来自哪里。其实从地理层面讲,红杉的员工来自五湖四海,我们根本不在乎他来自哪里,我们只关心他在上一家公司做了什么。 红杉上周刚招了一个人,我带来了他的简历,他的名字叫Alfred Lin,机缘巧合下,我们投资过Alfred的第一家公司,最终这家公司被微软收购了,Alfred是那家公司的首席财务官。红杉内部的员工很多都有创办过自己的公司,所以加入红杉后,他们会用自己感兴趣的方式分配任务,Alfred就是这种类型的人,他现在加入了红杉,我很期待下一步他将带我们去哪家公司,他是一个聪明且多才多艺的人,而且很清楚自己不知道什么。 我一直在努力让公司的管理尽可能简单。很多管理内容是可以被外包出去的,这种我们就不费心思去钻研,我们只注重那些无法被外包出去的管理内容,所以最后我们雇用最多的管理人才是财务官。 ** 在风险投资行业,有一个非常重要的金融指标——现金流,我们需要保持健康的现金流,以此来掌控风险,所以我们会雇用擅长管理现金流的人才。我们没有资产负债表,不惧怕处于经济下行期。 **  Wherever silicon abounds, invest 我进入风险投资行业有一个绝佳优势,这是我的亲人及朋友们完全没有的,那就是我曾经在半导体行业工作了大约10年的时间。在半导体行业的工作经历让我对所有需要运行微处理器的应用程序都有一些了解,在20世纪70年代初期我们就投资了Atari(雅达利,电子娱乐行业的公司),那时微处理器已经投入生产,英特尔在1969年就开始涉足游戏业务,不管是投币游戏和家庭游戏都是由微处理器驱动的。 My experience in the semiconductor industry also makes it easier to focus investment targets around silicon-centric products and markets where the future of technology exists. 有人曾问我从最糟糕的投资中学到了什么,但其实我们没有做过糟糕的投资。投资成功与失败是一个结果,而糟糕的投资是一个决定。 我们投资了很多公司,没有详细统计过失败了多少家,但我可以肯定,我们没有做出过糟糕的投资。 为了让技术能发挥作用,我们花了很多钱来做这件事,但技术做得再好,没有产品也就意味着没有买家,没有市场,那此时我们会倾向于停止这个项目。虽然这听起来会很残酷,对于创业者来说的确也很残酷,我们不再为他们提供资金,因为我们看不到这项技术的未来,看不到任何市场前景,此时退出对我们风险投资来说是明智的。 这个问题归根到底还是要思考我们的钱从哪里来。红杉资本的资金大多来自有限合伙人,我们与大量美国基金会合作,有相当一部分国际有限合伙人。我们拿到有限合伙人的资金后,大约需要三年或三年半的时间来投资这笔钱,我们会为未来几轮融资预留金额,从来没有在第一天就为创业者提供完全的融资,创业者能否拿到后面的融资,就看他们的表现。 If there is no significant progress, no breakthroughs have been made in terms of the products and market, we will consider suspending the investment, and we will consider shutting down the company once we find out that the investment return is not as expected. 我们愿意投资哪怕只有10个人组成的公司,很多公司的融资都是在红杉的办公室完成的,但面对投资回报,我们没办法让步。我们资助了500家公司,如果数年后我们关停了其中的100多家,我不会感到惊讶,那肯定是因为投资期望落空了。 还有人问我喜欢投资哪个市场,不看好哪个市场。在我看来,我可能不会投资纳米技术,并不是说这个行业不好,而是不在我的考虑范围内。纳米技术火热时,每个人都想掺和一脚,但我们对其不感兴趣,因为 We have a semiconductor background, and semiconductor is a process business, while nano is a chemical business. There is no application that can easily allow nano to realize production applications in all fields. 从商业角度来看,我们投资纳米市场很可能会失败,而且目前为止也没有看到其他投资者有成功的迹象。** 投行圈子针对付费会员,已组建股权投资人交流社群,仅限清科上榜投资人及会员加入。有兴趣朋友欢迎扫码文末投行君微信。**

Wherever silicon abounds, invest 我进入风险投资行业有一个绝佳优势,这是我的亲人及朋友们完全没有的,那就是我曾经在半导体行业工作了大约10年的时间。在半导体行业的工作经历让我对所有需要运行微处理器的应用程序都有一些了解,在20世纪70年代初期我们就投资了Atari(雅达利,电子娱乐行业的公司),那时微处理器已经投入生产,英特尔在1969年就开始涉足游戏业务,不管是投币游戏和家庭游戏都是由微处理器驱动的。 My experience in the semiconductor industry also makes it easier to focus investment targets around silicon-centric products and markets where the future of technology exists. 有人曾问我从最糟糕的投资中学到了什么,但其实我们没有做过糟糕的投资。投资成功与失败是一个结果,而糟糕的投资是一个决定。 我们投资了很多公司,没有详细统计过失败了多少家,但我可以肯定,我们没有做出过糟糕的投资。 为了让技术能发挥作用,我们花了很多钱来做这件事,但技术做得再好,没有产品也就意味着没有买家,没有市场,那此时我们会倾向于停止这个项目。虽然这听起来会很残酷,对于创业者来说的确也很残酷,我们不再为他们提供资金,因为我们看不到这项技术的未来,看不到任何市场前景,此时退出对我们风险投资来说是明智的。 这个问题归根到底还是要思考我们的钱从哪里来。红杉资本的资金大多来自有限合伙人,我们与大量美国基金会合作,有相当一部分国际有限合伙人。我们拿到有限合伙人的资金后,大约需要三年或三年半的时间来投资这笔钱,我们会为未来几轮融资预留金额,从来没有在第一天就为创业者提供完全的融资,创业者能否拿到后面的融资,就看他们的表现。 If there is no significant progress, no breakthroughs have been made in terms of the products and market, we will consider suspending the investment, and we will consider shutting down the company once we find out that the investment return is not as expected. 我们愿意投资哪怕只有10个人组成的公司,很多公司的融资都是在红杉的办公室完成的,但面对投资回报,我们没办法让步。我们资助了500家公司,如果数年后我们关停了其中的100多家,我不会感到惊讶,那肯定是因为投资期望落空了。 还有人问我喜欢投资哪个市场,不看好哪个市场。在我看来,我可能不会投资纳米技术,并不是说这个行业不好,而是不在我的考虑范围内。纳米技术火热时,每个人都想掺和一脚,但我们对其不感兴趣,因为 We have a semiconductor background, and semiconductor is a process business, while nano is a chemical business. There is no application that can easily allow nano to realize production applications in all fields. 从商业角度来看,我们投资纳米市场很可能会失败,而且目前为止也没有看到其他投资者有成功的迹象。** 投行圈子针对付费会员,已组建股权投资人交流社群,仅限清科上榜投资人及会员加入。有兴趣朋友欢迎扫码文末投行君微信。**