After the salary cut, CITIC Securities still has the highest annual salary, with a per capita income of 775,900

2024.0402

Number of words in this article:In 1976, the reading time was about 2 minutes

introduction: 降薪之后,中信证券依旧收入最高。

** Author| ** First Financial Android

Brokers have always been at the top of the financial industry's salary pyramid. Whether it is a female employee of a brokerage firm who complains in the "Versailles" on the Little Red Book that he has paid too much tax, or a trader whose wife has published a certificate of an average monthly income of 82,500, they all demonstrate The generous rewards of this industry.

In 2022, the Securities Industry Association issued the "Guidelines for Securities Companies to Establish a Stable Compensation System", requiring securities companies to establish a stable salary system and improve salary incentive and restraint mechanisms. That year, brokerage salaries began to decline.

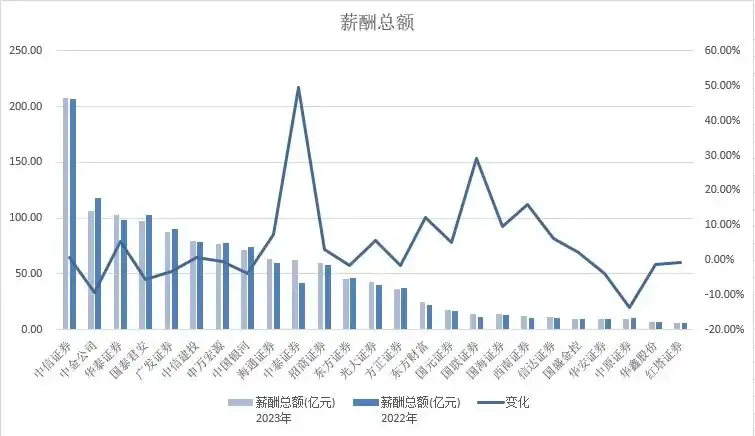

Recently, with the disclosure of the annual report, the latest salary level of securities company employees in 2023 has surfaced. According to statistics from Wind Data, among the 25 brokerages that currently disclose annual reports, 40% of the brokerages have seen their total salary shrink, and half of them have seen their per capita salary decline. The salary cut for top brokerages is even more obvious.

Among them, CITIC Securities ranked first with a per capita salary of 775,900 yuan/year, down 3.39% year-on-year; CICC's per capita salary of 696,800 yuan/year, down 10.21% year-on-year. As early as 2020, the per capita salary of CICC was as high as 1.16 million yuan/year. That is to say, in the three years from 2020 to 2023, the per capita annual salary of CICC dropped by 460,000 yuan, a drop of 40%.

Brokerage business and investment banking business are generally reduced

The securities industry is closely related to the capital market and is an industry with a particularly strong cyclical nature. The industry is booming during its upward period and "frugal" when the industry is at its trough.

Last year, the A-share market rose first and then declined, and market trading activity declined. Coupled with the tightening of IPOs and refinancing in the second half of the year, the performance of most securities firms was affected by brokerage and investment banking businesses.

For example, Guotai Junan's net fee income from brokerage business fell by 11.16% year-on-year, and the net fee income from investment banking business fell by 14.46% year-on-year; the net income from fee brokerage business of CICC fell by 13.42%, and the net fee income from investment banking business fell by 47.16%.

Even CITIC Securities, which has "far ahead" in performance, saw net fee income from brokerage business fall by 10.3%, and net fee income from investment banking business fall by 27.53%. Last year, CITIC Securities completed 34 IPO projects, with a lead underwriting scale of 50.033 billion yuan and a market share of 14.03%, ranking first in the market. In 2022, CITIC Securities's IPO lead underwriting scale will reach 149.832 billion yuan, completing 58 IPO projects.

In this environment, last year, the operating income of 25 securities firms fell by 1.97% year-on-year, and the net profit attributable to the parent company fell by 3.92% year-on-year.

During the industry's trough, not only is the increase in staff slow, but the salary level is also being lowered.

In terms of the number of employees, according to Wind data, First Financial Affairs has a total of 223,700 employees in 25 securities firms, an increase of only more than 4300 compared with 2022. Among them, about half of the increase comes from Haitong Securities and CITIC Securities, two leading securities firms.

The annual report shows that last year, Haitong Securities had a total number of employees of 13,600, an increase of 1494 year-on-year, making it the securities firm with the largest increase in employee numbers among the 25 last year; CITIC Securities had a total number of employees of 26,800, an increase of 1080 year-on-year. As the "first brother of securities firms", CITIC Securities once added more than 6000 employees in 2022.

Among the 25 securities firms, 10 have contracted in employee numbers. Among them, Everbright Securities lost 477 people last year and Guohai Securities lost 396 people.

The total salary of 40% of securities firms shrank

在人力成本方面,Wind数据显示,去年,25家券商的薪酬总额为1277.43亿元,仅比2022年同期的1257.17亿元增加了20.26亿元左右,同比增长1.6%。

其中,11家券商的薪酬总额出现下滑,中原证券薪酬总额下滑了13.48%、中金公司下滑了9.27%、国泰君安下滑了5.70%,薪酬盘子的萎缩除了受“限薪令”等政策影响外,也与业绩高度相关。

去年,中金公司业绩表现不佳,营收、利润继续双降,这已是中金公司连续两年营收净利润双降。其中,实现营业收入229.9亿元,同比下降11.87%;归母净利润61.56亿元,同比下降18.97%,作为券商顶级俱乐部“三中一华”的一员,中金公司正在“吊车尾”。

另外,国泰君安去年营业收入勉强同比增长1.89%,归母净利润同比下滑了18.55%。

而中泰证券、国联证券、西南证券、东方财富等一众中小券商去年薪酬总额增幅明显,其中,中泰证券的薪酬总额同比增长了50%,增幅最高。

目前,薪酬总额最高的依旧是中信证券,达到208.12亿元,同比微增0.66%。去年,中信证券以197亿元的净利润继续领先全行业。

The average annual salary of CICC dropped by 460,000 yuan in three years

从人均薪酬来看,Wind数据显示,去年,25家券商的人均薪酬为57.11万元/年,与2022年同期的57.32万元/年相比微降了0.36%,相当于月薪4.76万元,在金融业中,仍然保持着“天花板”级的存在。

其中,13家券商的人均薪酬有所增长,12家下降;12家券商的人均月薪超过4万元,13家券商的人均月薪在2万元~4万元之间。

薪酬排名前两位的中信证券与中金公司在持续降薪中。中信证券以77.59万元/年的人均薪酬排名第一,合计月薪6.47万元,与2022年同期80.32万元/年的水平相比减少了3.39%,相当于人均每月少拿2000多元。

中金公司排名第二,人均薪酬69.68万元/年,同比下降10.21%,合计月薪5.81万元,相当每月少了6600元左右,是去年人均薪酬下降最多的券商。

在2021年,中金公司的人均薪酬达到98万元/年,2020年度甚至高达116万元/年。也就是说,从2020年到2023年这3年时间里,中金公司的人均年薪下降了46万元,降幅达40%。

去年,申万宏源、国泰君安的人均薪酬分别为65.44万元/年、64.54万元/年,同比下降0.34%、9.41%。中泰证券去年的人均薪酬突破60万元大关,达到62.80万元/年,同比大幅增长47.64%,在目前25家券商中涨薪最猛。

**