Investment income of listed companies will decline in 2023, and leading insurance securities firms will grow against the trend

2024.0414

Number of words in this article:2650, reading time is about 4 minutes

introduction:随着A股年报披露进入高峰阶段,去年的投资收益亦成为一大看点。

** Author| ** First Finance and Economics Wei Zhongyuan

In order to improve the efficiency of capital utilization, listed companies generally use idle funds for investment and financial management. Some are keen on purchasing cash for financial management, while others prefer to buy and sell stocks in the secondary market, resulting in huge differences in investment returns among each family. As the disclosure of A-share annual reports enters its peak stage, last year's investment income has also become a major attraction.

Overall, the net investment income of A-share listed companies that have released annual reports in 2023 will decline year-on-year. As of the evening of April 13, 1558 companies disclosed their net investment income in 2023, with a total amount of 958.95 billion yuan, compared with 1,099.713 billion yuan in the same period last year, a year-on-year decrease of 12.8%. Among them, 298 companies suffered losses in net investment income, accounting for about 20%. Some companies suffered losses due to stock trading.

The overall income from insurance investment declined, and leading securities firms grew against the trend.

** **

Against the background of the relatively sluggish A-share market in 2023, the investment income of listed companies has attracted special market attention. Data shows that among the above-mentioned 1558 listed companies, 101 have a net investment income of more than 1 billion yuan in 2023. The industry distribution has not changed significantly compared with the past few years, including 24 non-bank finance companies, 19 banks, and 13 transportation companies., 5 cars and 5 real estate companies.

There are 21 listed companies with net investment income exceeding 10 billion yuan in 2023, distributed in financial industries such as banking, insurance and securities. China Life Insurance (601628.SH)'s net investment income in 2023 will be 198.207 billion yuan, temporarily ranking first in the two cities, with a net investment return rate of 3.77%. In 2022, China Life's net investment income will also rank first in the entire market.

Insurance funds have always been major investors, but in 2023, the five listed insurance companies showed "one rise and four declines" in investment income, with total investment income falling by 15.24% year-on-year. Only Ping An (601318.SH) total investment income compared with 2022. Achieve positive growth, reaching 123.899 billion yuan, a year-on-year increase of 32.78%. The total investment income of China Pacific Insurance, China Life Insurance, and Xinhua Insurance in 2023 was 44.115 billion yuan, 52.237 billion yuan, 141.968 billion yuan, and 22.251 billion yuan respectively, with year-on-year changes of-19.7%, -28.3%, -24.38%, and-50.03% respectively.

In addition to insurance, among large state-owned banks, Industrial and Commercial Bank of China, Agricultural Bank of China, and Bank of Communications (601328.SH) rank among the top in net investment income in 2023, and their year-on-year growth rates all reached double digits. Among them, Bank of Communications reached 26.028 billion yuan, a year-on-year increase of 70.3%, mainly due to the year-on-year increase in related income from equity investment in subsidiaries. Among joint-stock banks, CITIC Bank (601998.SH)'s net investment income growth rate in 2023 will reach 30.96%, increasing from 19.727 billion yuan in the same period last year to 25.834 billion yuan.

Among the brokerage stocks, the net investment income of China International Capital Corporation (601995.SH), Huatai Securities and Guotai Junan (601211.SH) temporarily ranked among the top three, with 15.084 billion yuan, 13.281 billion yuan, and 10.855 billion yuan respectively. All three companies achieved year-on-year double-digit growth, and Guotai Junan's growth rate reached 49.4%.

The amount of equity investment of CICC at the end of 2023 increased by 1.017 billion yuan year-on-year, with a growth rate of 18.23%, mainly due to the net income from securities held due to the Science and Technology Innovation Board investment compared with the net loss in 2022. change. In addition, CICC's net bond investment income also increased by 586 million yuan, while other investment income decreased by 1.638 billion yuan year-on-year, mainly due to the significant decline in the scale of private equity fund investment.

Outside non-bank financial and banking stocks, among the top 20 net investment income, SAIC Motor (600104.SH) is the only manufacturing company. Its net investment income in 2023 will be 14.949 billion yuan, a slight increase from 14.702 billion yuan in the same period last year. About 250 million yuan.

In addition, the net investment income of China Mobile, PetroChina (601857.SH), and GAC Group in 2023 will exceed 8 billion yuan; Ningde Times (300750.SZ), Zijin Mining, Tianqi Lithium, China Coal Energy, China Shenhua and other energy leading stocks The net investment income also exceeds 3 billion yuan.

Among the 101 companies with net investment income of more than 1 billion yuan in 2023, PetroChina has the biggest change. The company's net investment income in 2022 will be a loss of 11.14 billion yuan, compared with 9.554 billion yuan in 2023. This is mainly due to the significant decline in investment losses arising from the disposal of derivative financial instruments. This indicator lost 28.931 billion yuan in the previous year and 11.019 billion yuan in 2023.

In the list of net investment income losses in 2023, China Railway Construction (601186.SH) temporarily ranks first with 4.23 billion yuan, with investment losses of China Southern Airlines, OCT A, China Metallurgical, China Communications Construction, and Industrial Fulian ranking at the forefront.

China Railway Construction's net investment income has been losing money for three consecutive years, with a loss of 4.665 billion yuan in 2022 and a loss of 193 million yuan in 2021. As of the end of 2023, China Railway Construction held 23 stocks, 2 funds, and 2 trust products. The gain and loss from changes in fair value of the company's securities investments was a loss of 33.707 million yuan. The net loss on large investments is mainly caused by the loss on derecognition of the company's financial assets measured at amortized cost. The investment loss in this accounting subject is 5.563 billion yuan.

Eight listed companies hold more than 10 shares, and Andrei is the most keen on investing in stocks

** **

Securities investment income of listed companies is the most concerned focus during the annual report season. Wind data shows that in the released 2023 annual report, 309 listed companies have disclosed securities investment information, and 8 companies hold more than 10 A-share stocks, including China Railway Construction, China Communications Construction (601800.SH), Andeli (605198.SH), China Railway (601390.SH), Volkswagen Public, Changyuan Donggu, etc. But overall, purchasing bonds and currency funds was the main direction of securities investment by listed companies last year, and some companies spent hundreds of millions of funds on stocks.

Among the above-mentioned 309 listed companies, 156 have securities investment amounts exceeding 100 million yuan, and a total of 41 companies have an amount exceeding 1 billion yuan. The securities investment amounts of Shenwan Hongyuan (000166.SZ) and PetroChina Capital (000617.SZ) reached 385.77 billion yuan and 238.404 billion yuan respectively. They are the only two companies with securities investment amounts exceeding 100 billion yuan in the disclosed annual report. However, the two companies did not invest in stocks, and their main investment direction was bonds.

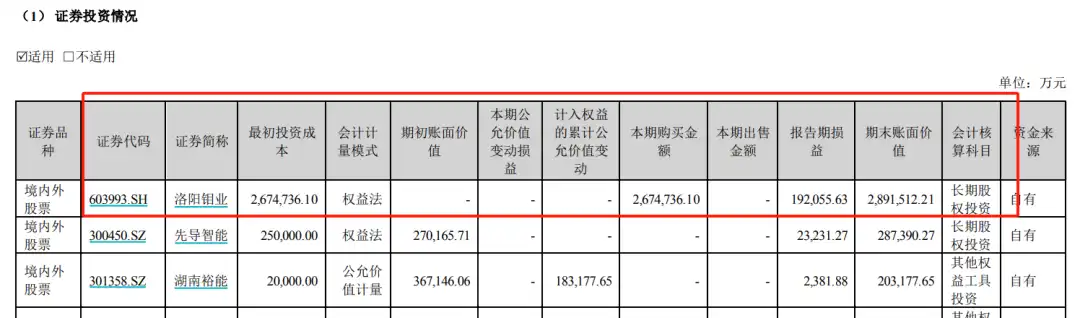

Ningde Times 'securities investment amount temporarily ranks third, with 32.447 billion yuan. The company holds stocks including Luoyang Molybdenum Industry (603993.SH), Pioneer Intelligence, Liqin Resources, Tianhua Xinneng, Yongfu Co., Ltd., Hunan Yuneng, etc. 10, most of which are upstream and downstream companies in the new energy battery industry chain. Among them, Ningde Times bought 26.747 billion yuan of Luoyang Molybdenum Industry shares in 2023, achieving an investment income of 1.92 billion yuan. Last year, Luoyang Molybdenum Industry's share price rose 15.97%.

China Railway Group holds the largest number of securities. As of the end of 2023, the company holds 73 securities products, the vast majority of which are funds, with a total of 13 stocks, including Huaxi Securities, China Stock, HNA Holdings, Liaoning Chengda, China Resources Shuanghe, etc. During the reporting period, China Railway Group's net investment income loss was 71.229 million yuan, of which the income from disposal of long-term equity investments decreased by nearly 200 million yuan compared with the previous year.

The number of stocks held by China Communications Construction has reached 42, including 4 Hong Kong stocks and 38 A shares. China Merchants Bank, China Merchants Securities and Yutong Bus are the stocks with the highest book value at the end of the period. The fair value of China Communications Construction Securities 'investment during the reporting period The loss was 3.602 billion yuan, and the net investment income loss in 2023 was 894 million yuan.

SAIC Motor, which ranks first in net investment income, had 10 securities investments as of the end of the reporting period. During the reporting period, A floating loss of 1.1666 million yuan, with a book value of 9.014 billion yuan, accounting for approximately 152.3 billion yuan in the company's overall financial assets. The proportion is 6%. SAIC Motor's shareholding is leading stocks in various industries, such as China Merchants Bank (600036.SH), Changyuan Lithium Technology, Huahong Company, Tianyue Cash, Juyi Technology, etc. China Merchants Bank is SAIC Motor's most invested stock, with a book value of 86.277 million yuan as of the end of the period, which still has a good book profit compared with the initial investment cost of 36.8119 million yuan. SAIC Motor's initial investment in the remaining nine stocks was relatively low, with seven stocks less than 1 million yuan.

▲ 上汽集团的证券投资信息

▲ 上汽集团的证券投资信息

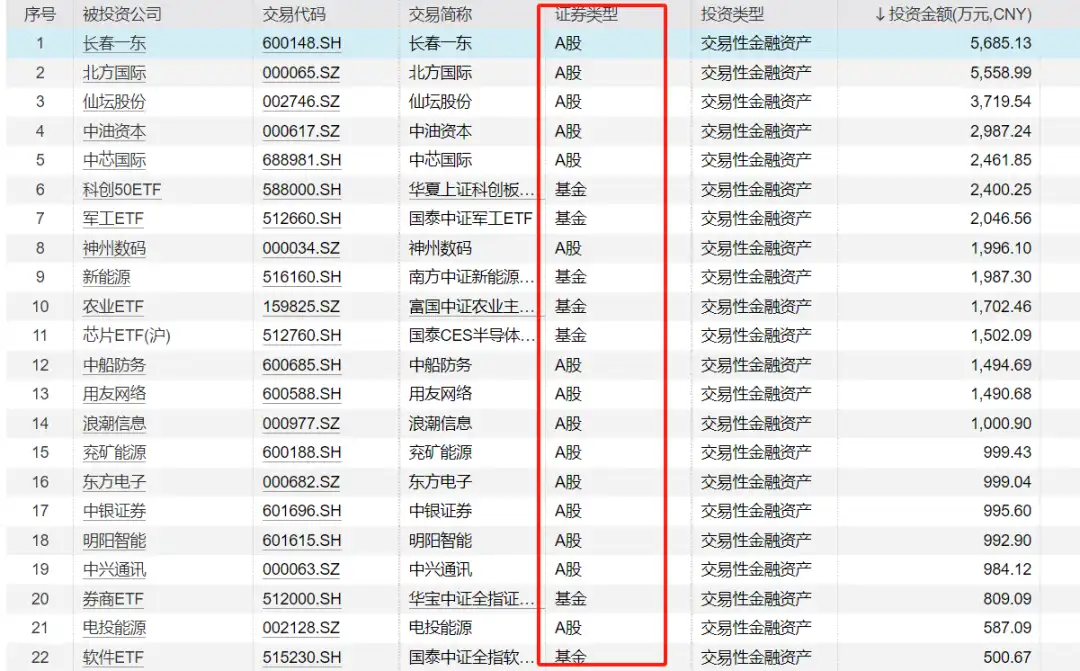

Andrei is a well-established "big stock trader". As of the end of 2023, the company holds 26 A-share stocks and 8 public funds. The stocks held are mainly concentrated in the electronics and energy industries, including SMIC, Shaanxi Energy, UFIDA Network, BOC Securities, Inspur Information, Yankuang Energy, Shangji CNC, etc.; the funds cover agricultural ETFs, brokerage ETFs, military ETFs, Science and Technology Innovation 50 ETFs, etc., and have bought almost all popular ETFs. As of the end of 2023, Andri's securities investment totaled 482 million yuan, with a current loss of 34.7514 million yuan, and the company's current net profit attributable to the parent company was 255 million yuan.

▲ 安德利的证券投资信息

▲ 安德利的证券投资信息

**