Create a new digital finance ecosystem, and Jiufang Intelligent Investment Digital Intelligence leads the way

old saying goes:If you are easy to be poor, you will change; if you change, you will understand. The general rule will last for a long time. The wheel of history is rolling forward, and change is the eternal theme of social development. From ancient times to the present, human society has undergone countless changes. Changes have not only promoted the progress of civilization, but also shaped our world today. The Central Financial Work Conference held in 2023 proposed the need to seize the opportunity of the digital technology revolution. Digital finance is a new direction and new trend for future financial development under the transformation of digital technology and industrial digital transformation. It is an important engine and key support for the transformation and upgrading of the financial industry.

The development history of digital finance in China

** **

With the rapid development of the informatization wave since the 1970s and the outbreak of the Internet industry since 2000, the financial capital market has gradually shifted from serving the real industrial economy to serving the Internet economy. The development process of digital finance in China can be summarized into the following stages: 1. Financial informatization stage (1980s to before 2003): At this stage, financial institutions began to adopt electronic information technology, such as the popularization of bank cards and ATMs, as well as paperless securities transactions, with the aim of improving business efficiency and reducing operating costs. In 1993, the State Council of China proposed "accelerating the construction of financial electronic", marking the official launch of China's financial informatization. 2. Internet Finance Phase (2003 - 2013): In 2003, the launch of Alipay marked that China's digital finance entered a new stage of development. Alipay solves the trust problem in online shopping through online payment and promotes the rapid development of e-commerce. In 2013, the emergence of Weixin Pay further changed the market structure of mobile payment, making mobile payment an indispensable part of daily life. 3. Deep integration stage of financial technology (2013 to present): With the development of emerging technologies such as artificial intelligence, big data, cloud computing, and blockchain, financial technology has begun to be deeply integrated into all aspects of financial services, including investment decisions, risk pricing, asset allocation, etc., greatly changing the way and logic of financial services. At present, digital finance has become an important force in promoting China's economic development, especially playing an increasingly important role in serving the real economy, inclusive finance and preventing financial risks. At the same time, with the rapid development of China's digital finance, domestic regulatory policies have gradually improved.

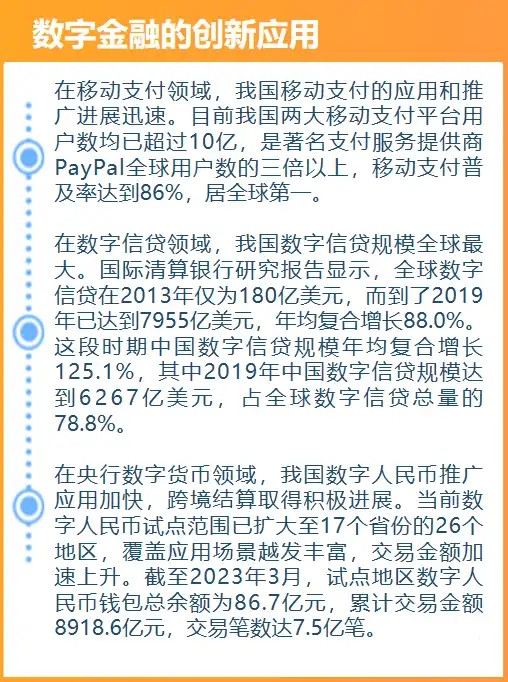

Innovative applications of digital finance

The development of China's digital finance is characterized by rapid iteration and innovation. Therefore, the business model and business format of digital finance are constantly evolving. Financial fields such as digital currency, digital payment, digital credit, digital securities, digital insurance, and digital financial management are undergoing tremendous changes. "In recent years, China has made outstanding achievements in the development of digital finance. Mobile payments, digital credit, central bank digital currency, financial technology innovation capabilities, and financial technology corporate value have been at the forefront of the world." Zhang Xiaojing, director of the Institute of Finance of the Chinese Academy of Social Sciences, once said. In addition, digital finance has become an important part of the digital economy. It has the dual attributes of digital and finance. It can accelerate the free circulation and effective allocation of funds, information, digital and other elements, and correct market failures and financial problems caused by information asymmetry in traditional finance. Fragmentation issues.

On November 27, 2023, intellectual property Publishing House officially released the "White Paper on Patent Analysis of Financial Technology Industry 2023" (referred to as "White Paper"). The white paper points out that in terms of technological development, China's digital financial technology development has been in the forefront of the world, with a high increase in the number of digital financial technology R & D patents and a leading position in the world. China's financial science and technology patent applications take the lead. Since 2018, the number of global financial technology patent applications has exceeded 340000. China and the United States are important leaders in technological innovation in the financial technology industry, accounting for 64.5 percent of the world's patents. From a national point of view, China's financial technology patents accounted for 44.3 percent, ranking first, the United States ranked second with 20.2 percent, and South Korea and Japan ranked third and fourth. Judging from the distribution of financial technology patent holders, there are eight Chinese companies and two from the United States among the top 10 patentees. Generally speaking, big data and cloud computing technology are the most prominent patent technologies in China's financial technology and digital financial technology, and the technical levels of mobile payment, large-scale science and technology credit, Internet banking and other fields are among the forefront of the world, showing the development characteristics of precision, intelligence, security and standardization as a whole.

Jiufang Intelligent Investment took the lead in building a digital financial ecosystem

中国领先的在线投资决策解决方案提供商——九方财富(09636.HK)旗下核心业务子公司上海九方云智能科技有限公司(以下简称“九方智投”),从2019年便开始围绕数智化转型,秉持“让投资理财更简单、更专业、提升投资理财的幸福感”的企业使命,为投资者打造全周期金融教育养成体系,旨在让投资理财更简单、更专业、更高效。 Always adhere to digital and intelligent transformation to solve the problems of unbalanced market supply and demand and poor sense of experience. 随着投顾业务需求大增,证券行业正不断经历着转型、迭代、升级。买方投顾时代到来,中国72%的个人投资者可投资资产在10万元以下,投资体量小且投资顾问缺口大,个人投资者难以享受到优质的投顾服务。 九方智投凭借多年 证券行业 数据积淀与 金融科技 研发积累,携手华为云和 科大讯飞 ,推出业内首款证券投资数字人产品——九方智能投顾数字人“九哥”,可为用户客观提供全方位的股票诊断和市场分析结果,是用户专属的智能投顾专家。 “九哥”的出现不仅刷新了人们对金融智能的认知,还在一定程度上弥补了真人投资顾问精力有限、服务成本较高等问题。智能投顾数字人作为一种创新的数字金融服务模式,能利用人机交互技术为投资者提供更加便捷、高效、低成本的投资服务。无需预约和等待的数字人能全年无休地跟投资者互动,最大程度提升了投资者的体验感和投资理财的“幸福指数”。

picture