European banks 'profits explode, but the prospects hide hidden worries

"More than 70 billion euros in dividend distribution, more than 45 billion euros in share buybacks, and a return on capital of more than 50%.""Moody's rating agency changed its outlook from stable to negative." These two recent highly "divisive" news items both have a common protagonist-the European banking industry.

On the one hand, overall profitability and shareholder returns have increased significantly, and on the other hand, the development prospects of the banking industry in some countries are facing major challenges. This is the prominent question facing the European banking industry today-how to deal with the upcoming high-risk environment after record profits in 2023.

There is no doubt that the past year has been a glorious year for European banking. Faced with geopolitical risks and high inflation risks, the European banking industry's annual outlook for early 2023 is not optimistic. However, even after experiencing the Silicon Valley banking crisis and the Swiss banking crisis, the overall performance of the European banking industry throughout the year was still outstanding.

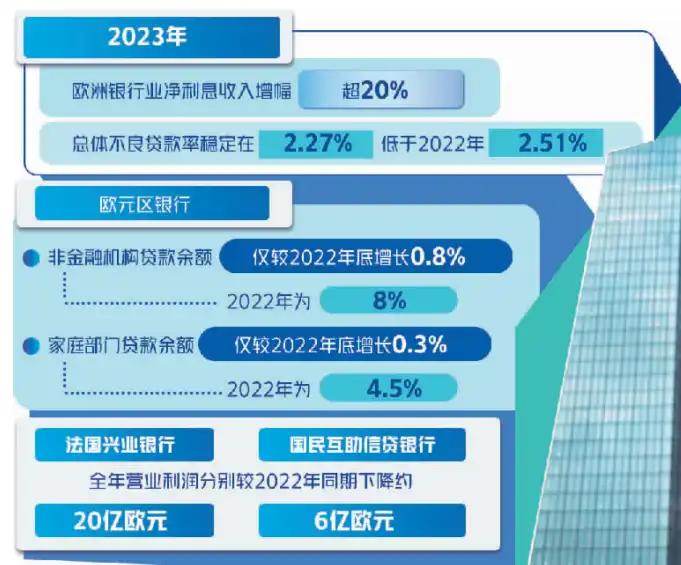

In 2023, Europe's overall economic growth will be slow, but banking industry profits will achieve rapid growth. This outstanding data is mainly due to the increase in spread income adjusted by benchmark interest rates. 伴随欧洲央行和英国央行的持续快速加息,欧洲银行业关键收入来源——利差收入大幅增长。考虑到2022年的低基数效应,部分机构统计数据显示,2023年净利息收入增长幅度超过了20%。

At the same time, the risk prevention capabilities of the European banking industry are also steadily improving. European Central Bank data shows that as of the end of the third quarter of 2023, the common equity tier-1 capital adequacy ratio of systemically important banks in the euro zone was 15.61%. During the same period, data from the European Banking Authority showed that the asset quality of European banks remained relatively resilient, and the overall non-performing loan ratio remained stable at 2.27%, slightly lower than 2.51% in the same period in 2022.

值得关注的是,The outstanding financial report data of the European banking industry cannot conceal the problems behind it.

在收入构成方面,除了息差收入和在总营收中占比较小的交易类收入相对较高外,Overall income in Europe's banking industry is largely poor 。其中,由于资本市场无法维持新冠疫情期间连续两年的发展势头,欧洲银行业的手续费和佣金收入几乎零增长;投资银行业务、并购业务和银团贷款业务也相对疲弱,股票和债券发行收入微弱增长,处于历史较低水平。

即使是息差收入,其背后的支撑逻辑也令人担忧。数据显示,净利息收入的增加更多源于基准利率的调整而非业务规模的拓展。事实上, The downturn in the real economy and the pressure of high financing costs have significantly impacted the demand for bank credit in various European sectors 。德意志银行统计数据显示,欧元区银行的公司贷款业务和家庭贷款业务在2023年呈现逐步下滑态势。2023年非金融机构贷款余额仅较2022年底增长0.8%,而2022年同期数据为8%;家庭部门贷款余额增速也仅较2022年底增长0.3%,2022年同期数据则为4.5%。无论是公司业务还是家庭业务,其增速均远低于疫情前的历史平均水平。

在资产质量方面,虽然整体不良贷款率保持低位,但The risk of deterioration in asset quality has begun to emerge 。欧洲央行数据显示,在欧元区银行资产中,预计整个贷款周期可能发生违约事件导致预期信用损失的贷款在2023年年中已经开始呈现上升态势,从二季度的9.19%上升至三季度的9.29%。

In fact, the European banking industry will not show a "general rise" in 2023. The tragic players are France and the United Kingdom.

Although BNP Paribas's net profit attributable to shareholders for the whole of last year increased by 1.2 billion euros compared with 2022 to about 11 billion euros, its net profit attributable to shareholders in the fourth quarter has dropped to about half of that in the same period in 2022; similar full-year profit growth but the sharp decline in profits in the fourth quarter also occurred at Credit Agricole. On the other hand, Societe Generale and Credit National Bank experienced a downward trend in operating profits for the whole year, down approximately 2 billion euros and 600 million euros respectively compared with the same period in 2022.

Compared with the decline in French banking profits, some large British commercial banks suffered losses in the fourth quarter of last year. Among them, although HSBC Holdings achieved a significant increase in pre-tax profit for the whole year, it experienced a net loss of about US$150 million in the fourth quarter; Barclays Bank's situation was similar, with a net loss of about 110 million pounds in the fourth quarter.

The European Central Bank building was photographed in Frankfurt, Germany on December 14, 2023. Photo by Zhang Fan (Xinhua Agency)

在历经了欧洲银行业财报季的喜悦之后,Concerns about the development challenges of the European banking industry in 2024 are beginning to rise ,未来运行环境的恶化是否会加剧欧洲银行业的既有风险,成为各方关注的焦点。

作为典型的顺周期行业,The prominent risk facing the European banking industry is the deterioration of Europe's economic growth prospects. 日前,欧盟委员会将2024年欧元区和欧盟GDP增速分别从去年秋季预测的1.2%和1.3%下调至0.8%和0.9%。德国央行近期表示,在当前经济下行的背景下,几乎三分之二的储蓄银行和合作型银行都存在未变现亏损问题。2024年的周期性经济风险,尤其是房地产市场的周期下行压力将加剧这一风险。此外,经济前景的恶化也进一步压低企业和家庭部门新增贷款的意愿,冲击银行业新增业务规模。

Under the macroeconomic downward cycle, ** The dilemma faced by the European banking industry in the interest rate environment is more prominent. ** On the one hand, as the European Central Bank and the Bank of England continue to issue signals to cut interest rates, the level of net interest margins may shrink. Considering the decline in the banking industry's new expansion business in the context of the sluggish macroeconomic environment, the net interest income of the European banking industry may not reach the high level in 2023. On the other hand, the current overall higher interest rate environment is posing an increasing threat to the health of banks 'balance sheets. In a high interest rate environment, the European household sector has begun to seek high-yield investments other than retail financing, increasing the financing costs of the European banking industry; at the same time, the high interest rate environment is also increasing the debt service costs of European companies, threatening the asset quality of the banking industry.

Currently, supported by high capital adequacy ratios and restructuring liquidity, systemic risks in the European banking industry are not high, but the impact of the 2023 Silicon Valley banking and Swiss banking crises is still deeply imprinted in the memory of European banking regulators. It is based on concerns about these risks that the Bank of England said that although the current capital adequacy ratio and liquidity of the banking industry have improved, it must be prepared for potential shocks and challenges. The German Federal Financial Supervisory Authority also said that "we must remain vigilant about more difficult environments" and that banking institutions must set up higher capital buffers to deal with potential loan default risks.