Vanke's owner has made a move! Shenzhen Railway Group supports Vanke

Vanke's "owner" finally made a move!

On the evening of March 15, 2024, it was reported that Shenzhen Railway Group supported Vanke-it would subscribe to and support approximately 1 billion yuan in the CICC India Consumer REIT strategic placement of India Group (a subsidiary of Vanke), with a contract period of 25 years.

Is Vanke saved? Asset Insights will discuss it today.

————

walk a tightrope

Recently, Vanke has become the focus of public discussion.

Roughly related, there are a few things--

1. Vanke bonds fell in price; 2. Vanke is selling its high-quality assets; 3. Vanke is conducting debt negotiations with a number of insurance companies; 4. The syndicate negotiated with Vanke to raise 80 billion yuan in loans; 5. Moody's downgraded Vanke bonds to "junk level".

people judge:Vanke has no money... Is today's Vanke the same as yesterday's Evergrande?

Looking again, it seems possible--

Vanke's quarterly report data for the third quarter of 2023 shows that its debt is 1.24 trillion yuan, assets are approximately 1.65 trillion yuan, and asset-liability ratio is approximately 75%. Because the real estate market is in the downward range, Vanke's related assets can only be discounted if they really want to realize them. As long as it is less than 30% off, Vanke will theoretically become insolvent.

30% off?

On February 20, 2024, Vanke sold the remaining 50% interest in Shanghai Qibao Vanke Plaza to Link Real Estate Trust (50% had been previously traded), with a discount of 30%.

With a little calculation, it is as if we see that Vanke is walking on a tight wire at a critical moment.

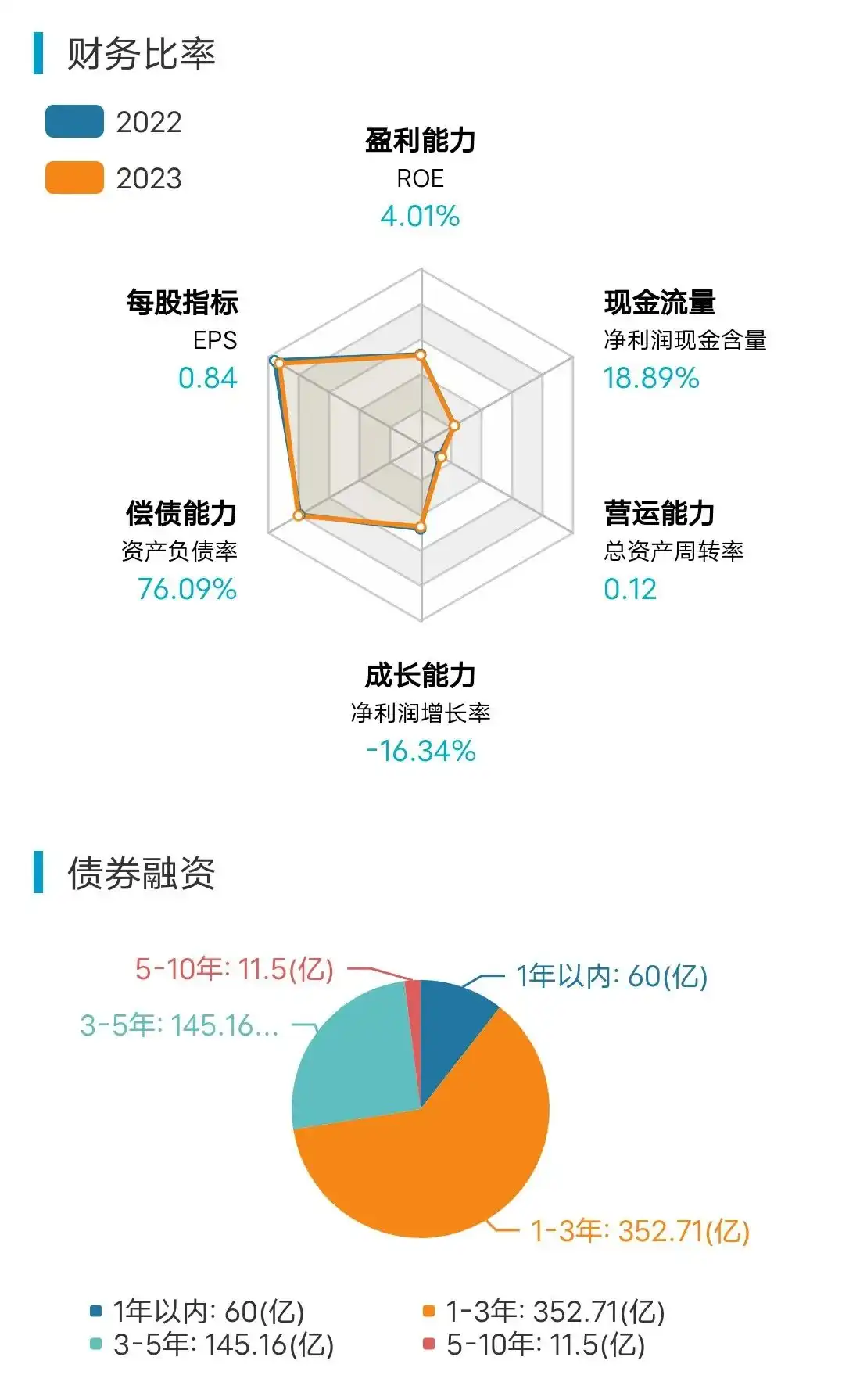

万得数据以2023年万科中报绘制的万科财务比率及债券融资示意图,显示万科资产负债情况尚可,但短期运营有压力,未来1至5年债券偿债压力较大

万得数据以2023年万科中报绘制的万科财务比率及债券融资示意图,显示万科资产负债情况尚可,但短期运营有压力,未来1至5年债券偿债压力较大

This is like worrying about banks. Stable business reputation is the key.

Vanke's efforts, including its game with various voices, are also here.

People speculate that if Vanke has problems with its cash flow, some creditors do not believe in Vanke and recklessly want to get their own money first, theoretical insolvency may turn into real bankruptcy-is the insurance company talking to Vanke about this?

This is again related to Moody's, the international rating agency.

On March 11, 2024, Moody's downgraded Vanke's debt rating:Adjust from Baa3 to Ba1.

Baa3 is the lowest rating of the investment grade, and Ba1 is the highest among the speculative grades (entering the non-investment grade and having speculative attributes, the so-called "junk grade").

Investment grade to speculative grade is also a line between the front line.

Moody's general meaning for Vanke's downgrade is--

Before the downgrade, Moody's believed that Vanke could ensure the safety of bond principal and interest payment in the short term, and there was uncertainty in its long-term debt repayment ability; after the downgrade, Moody's believed that Vanke's ability to repay principal and interest in the short term was limited. Once its operating conditions deteriorated, its debt repayment ability will be further weakened and the probability of default may increase.

Relevant sources from Moody's said that in the next one to one and a half years, due to the decline in contract sales and the long-term downturn in the real estate market, Vanke's liquidity will weaken and financing uncertainty will increase.

The power of Moody's rating is that it can trigger practical actions from all parties in the debt market. Therefore, Moody's is equivalent to directly "shooting". If there continues to be negative situations in the future, Moody's will continue to "fire the next shot."

If Vanke wants to withstand the "shooting gun", it must do its best to maintain its business reputation. This is what Vanke's leader Yu Liang means by "running non-stop".

3月17日,郁亮微信朋友圈发布“奔跑不止”

3月17日,郁亮微信朋友圈发布“奔跑不止”

At present, Vanke's operating conditions and real estate environment are not ideal. "Running endlessly" is tiring-Mr. Yu Liang must be familiar with this feeling.

Running long distances, such as running a marathon, can experience several periods of fatigue. After the fatigue period, it will be much easier to run, but the fatigue period is very difficult. Only by "running non-stop" can we survive the fatigue period.

On the other hand, Moody's "shooting" timing is very accurate, aiming at the "fatigue period". Therefore, people can even ignore the "gunshots" and only see that Moody's analysis does not seem to be much different from domestic views.

The analysis of relevant domestic institutions may be like this:"The industry recovered less than expected, the policy relaxed less than expected, and the company's sales recovered less than expected..."

————

Vanke's "Live"

Vanke is in trouble.

Moody's is calculating the difficulty.

So is Vanke.

Moreover, Vanke can be said to be a carefully calculated company, and the industry is often called "financial-oriented".

Vanke has been planning its own operations and financial arrangements.

Therefore, Vanke has the appearance of a "model student". It is also hard to believe that such a cautious company would be in extreme danger.

Let's also take a look at Vanke's plans.

As early as 2018, Vanke proposed to "live".

How to "survive"?

Vanke's idea is to transform-from an incremental market to an existing market, and from a real estate developer to an urban construction service provider.

One of Vanke's formulations is:"Accept and learn to make small money, grow money, and work hard money."

Vanke has 5 operating segments--

1. Real estate development 2. Property services (Wanshiyun, Diecheng) 3. Logistics and warehousing (Wanwei Logistics) 4. Rental housing (Boyu) 5. Commercial development and operation (India)

Among the five sectors,"big money" means real estate development. For example, when the year-on-year decline of more than 30% in 2022, the annual sales will be more than 400 billion yuan;"small money" means the other four sectors-in 2022, the four sectors added together, with a year-on-year growth of more than 20%, the sales will be more than 50 billion yuan.

Vanke places its hope of "surviving" on "diversified" development, or to say, realizing walking on two legs:On the one hand, maintaining the real estate development business is in line with the guidance and pace of national policies-Vanke still has more than 100 million square meters of land reserves, and its annual housing sales rank second in the country; on the other hand, it seeks transformation and opens up new market opportunities in the urban service sector.

For example, Wanshiyun, which will be listed in Hong Kong in September 2022, is a property service company founded by Vanke with digitalization as its core. It currently operates the "Butterfly City" model in various places-multi-community, regional collaborative digital management.

For another example, India Group shoulders Vanke's commercial development and operation tasks, develops shopping centers, etc. The entry point for Shenzhen Railway Group to support Vanke this time is also to support India Group, which shows its support for Vanke's transformation.

However, there have always been different evaluations of Vanke's methods of "making small money" and seeking retreat.

The result of the actual transformation is that among the four sectors, except for property services, which are closely related to the main business, Vanke is not good at. Coupled with the impact of the epidemic, to this day,"small money" is still "small money", and the volume and main business are not enough to form an "escape route"-90% of Vanke's profits still come from real estate development.

However, the overall real estate market is weak. Vanke's annual real estate sales performance fell by about 30% year-on-year, and sales fell by more than 40% year-on-year in the first two months of 2024.

In this context, Vanke has faced a concentrated impact of debt "flood peaks"-some estimates believe that Vanke will need to pay more than 60 billion yuan in 2024 - 2025 to repay its debts. Some analysts believe that this scale of debt repayment is likely to be equivalent to the 80 billion yuan Vanke is fighting for with the syndicate.

Does Vanke have enough cash flow?

If the cash flow is not enough, can Vanke persuade its creditors to tide over the difficulties with it?

What else does Vanke have?

In fact, Vanke has three advantages:One is the background of state-owned assets with mixed ownership; the second is that Vanke's current annual profit is more than 20 billion yuan, and even if it declines, it is still a clear income; the third is that Vanke still has more than 100 billion yuan in its accounts. Cash, although the actual use of this cash is limited. Together, although the three are stretched and it is difficult to "survive", Vanke still has things to plan and discuss with all parties.

————

Bottom line battle

Whether Vanke can "survive" depends largely on our attitude towards the real estate market.

Vanke's life and death is actually a bottom-line battle.

The so-called "model student" is Vanke as an industry representative of a real estate company that has no financial violations, has not evaded debts, and is actively exploring ways out, and is still the second largest seller... Should such a company "survive"?

Giving up Vanke is equivalent to breaking before it is established. The resulting market turmoil will not only impact the real estate market, but will also affect the Chinese economy. The cost is far greater than the cost of saving Vanke. In this sense, no matter what method is used, Vanke will be saved.

However, Vanke's question brings us more thoughts than that.

Is Vanke enough to renew his life?

Can the real estate market solve the problem simply by maintaining blood transfusions?

Facing difficulties, Vanke, a "model student", is embarking on a textbook-like trajectory-almost an annotation of Japanese scholars 'theory of "balance sheet recession". By continuing to trade time for space through debt rollover, borrowing long and short, and capital injection, Vanke is likely to follow the path of "balance sheet recession":After successfully paying debts again and again, the company shrank again and again...

Is Japanese-style recession the future of Vanke and China's real estate market?

Shouldn't there be another way?

On March 9, 2024, at the press conference on people's livelihood theme at the Second Session of the 14th National People's Congress, Ni Hong, Minister of Housing and Urban-Rural Development, made an important speech. Here are three key points--

The first point is to maintain the bottom line of preventing systemic risks. The second point is (on the basis of ensuring the first point) that real estate enterprises that are seriously insolvent and have lost their operating capabilities must be reorganized in accordance with the principles of legalization and marketization. Third, to build a new real estate development model, there are two key points in implementation:The first is to plan and build affordable housing, promote the construction of "both emergency and emergency" public infrastructure and the renovation of villages in cities; the second is to make efforts to build good houses.

The first two points are both bottom-line defense, but one protects and the other consolidates. The third point is the breakthrough direction of China's real estate market.

Minister Ni Hong said:

"Under the new model, current real estate companies should see that in the future, they will strive for high quality, new technology, and good services. Whoever can seize opportunities, transform and develop, who can build good houses and provide good services for the people, will have a market, who will have development, and who will have a future."

Minister Ni Hong has repeatedly emphasized that while completing the task of social protection housing, we must also "good houses" and "new models"... This is a new core issue in China's real estate industry.

In other words, China's real estate market needs the power to break the situation.

In fact, when everyone discusses Vanke, there is a hidden perspective-what everyone wants to see is not just Vanke that transforms into "making small money, growing money, and working hard", but Vanke that faces the "new model" and stands up to break through.

Taking a leading attitude and leading the development of the real estate market like a leader... In this market, we need to see who can stand up.

贾玲用一部瘦身电影诠释了自我救赎

贾玲用一部瘦身电影诠释了自我救赎

Editorial board on duty:su Zhiyong

edit:Han Jianming

studying the:Dai Shichao