"Australian Natural Gas Market Trends:Analysis of acquisition rumors and price fluctuations "

preface

On July 4, a report in the Middle East triggered market calls for Santos (ASX code:STO) may face widespread speculation about a takeover. However, a Santos spokesman immediately clarified that the company would not comment on market speculation.

Saudi Aramco and Abu Dhabi National Oil Company denied this speculation

。Bloomberg's report also pointed out that investors and analysts generally believe that the two foreign groups are unlikely to make a takeover offer and are mainly subject to FIRB's strict review.

In this scenario, U.S. private equity group EIG is seen as the most likely buyer. Last year, EIG teamed up with Brookfield to try to acquire Origin Energy for $20 billion, but failed to do so.

At present, the group still maintains a high degree of attention to Santos and tried to acquire it for US$14.4 billion in 2018, but failed.

Earlier this year, EIG made significant progress in Australia's natural gas sector, acquiring minority stakes in three liquefied natural gas projects from Tokyo Gas, but it clearly has a higher pursuit of a larger market share.

Santos 'management is focusing on its LNG portfolio, which includes projects such as Papua New Guinea LNG, East Coast GLNG, Cooper Basin LNG, Barossa/Darwin LNG and Papua LNG.

natural gas exports

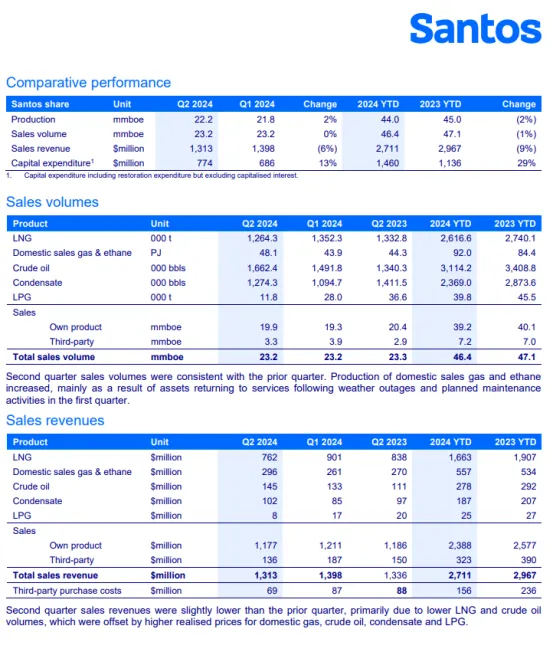

In the Q2 2024 financial report released by Santos recently, its sales fell by 6% month-on-month. Among them, revenue from the liquefied natural gas component fell by 15.43% month-on-month, while sales only fell by 6.5% month-on-month. In the second quarter, the unit price of liquefied natural gas fell 9.54% month-on-month to US$12.10 per million British Thermal Units.

Santos 'liquefied natural gas sales fell to US$1.66 billion (A$2.5 billion) in the first half of the year, compared with US$762 million in the June quarter, and revenue fell 15.4% from the previous three months.

It is not difficult to see from Santos 'financial report that Australia's natural gas export revenue is affected by prices and will inevitably decline.

According to the first data on natural gas exports in 2023-24, although export volumes remained strong, Australia's liquefied natural gas revenue fell by 25% in the last fiscal year.

In terms of shipments, shipments in the 2023-24 fiscal year were 81.7 million tons, only 800,000 tons less than the previous fiscal year. That is to say, almost all of the decline in revenue comes from falling prices.

Adelaide consulting firm EnergyQuest said that in the 2023-24 fiscal year, liquefied natural gas export revenue fell to US$69.5 billion, down from a record of US$92.2 billion the previous year (due to higher international prices due to the Russia-Ukraine war).

Another energy giant in Australia is undoubtedly Woodside Energy

。The company has formally signed its first long-term agreement to sell liquefied natural gas to China Taiwan. This move heralds strong demand for natural gas in Australia in the next decade and may even continue beyond 2040, providing a solid guarantee for ensuring energy security.

According to the agreement, starting this month, Woodside Energy will supply approximately 6 million tons of liquefied natural gas to China Petroleum Corporation, the only natural gas importer in China Taiwan, over the next ten years. and

An additional 8.4 million tons of liquefied natural gas will continue to be supplied over the following decade and is expected to continue until 2043.

natural gas prices

UBS energy analysts last week adjusted their North Asia LNG price forecast for this year by about 9%, while also raising their price forecast for 2025-26 by 2%. This adjustment is mainly based on the current tightening trend of basic market factors.

They pointed out that although EU LNG imports fell by more than 18% year-on-year due to significant increases in renewable energy production and enhanced storage capacity

, but this decline was offset by a significant increase in LNG imports in Asia. Specifically, China's LNG demand has increased by 23% year-to-date, while India's has increased by 26%.

The author usually starts from cyclical research. Natural gas has a cycle every four years, falling in two years and rising in two years (we will not talk about why it shows such a pattern for now), in other words,

2025 will be the starting point for natural gas price increases.

On July 16, Bloomberg Businessweek interviewed Donald Trump. The following is my summary of Trump's speech on energy:

We urgently need low-cost energy. Compared with almost all countries, regardless of size, our unique advantage lies in the energy reserves unmatched by no one.

What's more worth mentioning is that we have a much more substantial amount of real energy at our disposal-energy that can be actually utilized

。Wind energy clearly does not meet this criterion. It is costly and far from ideal. Compare the price of energy per kilowatt-hour. No matter how you measure it, the gap between the cost of wind energy and the cost of natural gas is obvious.

Natural gas is not only clean, but we have abundant reserves. Wind energy costs are prohibitive. Looking at solar energy, although I trust it, it covers a huge area and is extremely unstable. It can only work in sunny, long-lasting and bright areas.

When it comes to environmental impact, these energy facilities often cover several square miles and are huge. I have completely different views on windmills. I am surprised that people often claim to pursue green in the energy sector. Maybe they love the wind, but when I see windmills operating in places like California for years, I can't help but wonder.

Windmills have a relatively short life and need to be rebuilt in about 8 to 9 years

。Windmills in the ocean suffer from seawater erosion and need to be replaced frequently. What is even more difficult is that the disassembled windmill blades are made of carbon materials, and from an environmental perspective, they cannot be buried.

Handling these leaves will cause serious pollution to the environment

。In some areas of California, old and new windmills coexist in different colors and shapes, like a garbage dump. This is not only a visual disaster, but also a huge damage to the environment.

We must go back to the root of the problem and rethink our energy strategy. Germany has tried this path and is now busy building hundreds of coal-fired power plants and continuing to expand its nuclear power business.

We should learn from their experiences and return to a rational and pragmatic path.

conclusion

As a key energy resource, natural gas has always occupied an indispensable position in our energy supply system. Over the past decade, due to insufficient investment, we have seen

Possible supply shortages in the future are particularly evident in the electricity supply sector on the east coast of Australia.

Energy, as the core driving force of the country's economic development, has always played a pivotal role and is as indispensable as a country's economic artery.