The trend of economic recovery is further consolidated:The expected economic growth target for 2024 is expected

ZHIKUYAOLAN

editor's note

Recently, a number of think tanks have released research reports to predict China's economic situation in 2024. These institutions generally believe that China's economy started well in the first quarter of 2024. Although economic operation and macro-control face many challenges, the fundamentals of China's long-term economic growth have not changed. It is expected that the expected economic growth targets set out in the 2024 "Government Work Report" will be achieved. In the future, we must continue to stabilize market expectations and continuously consolidate market confidence.

The trend of economic recovery is further consolidated

reading tips: 尽管面临国内外多重挑战交织,但是2024年一季度中国经济开局良好。多家智库研究认为,中国经济有利条件强于不利因素,预计2024年经济回升向好的态势将更趋巩固。国家信息中心的研究预计,2024年中国经济运行将呈现“前稳后高、持续向好”走势。中国人民大学中国宏观经济论坛发布的报告认为,整体价格的变化、“三驾马车”的表现、工业增加值和制造业PMI等指标情况都支撑2024年经济会强于2023年的判断。中国社会科学院、国家信息中心的研究报告都认为,综合来看,2024年中国经济增长预计将为5%左右。

** National Information Center:

**

In 2024, China's economy will be "stable in the front and high in the back, and continue to improve"

On March 28, the National Information Center released the "Stabilizing the Past and Continuing to Improve the Future-Outlook for China's Macroeconomic Situation in 2024" at the 2024 National Information Center Academic Annual Conference (hereinafter referred to as the "Outlook Report") believes that in 2024, China's economic operation will show a trend of "stable before, high after, and continuing to improve", the economic recovery trend will be more consolidated, the fluctuations in growth rates between quarters will become more moderate, and the supply and demand structure will become more balanced, the employment situation and price levels will become more stable. GDP is expected to grow by about 5% in 2024.

The outlook report believes that in 2024, the world's economic growth momentum will be insufficient, regional hot issues will occur frequently, the complexity, severity and uncertainty of the external environment will increase, and the global economy will continue to have high inflation, high interest rates, high debt, low growth and low trade."three highs and two lows" trend. However, the favorable conditions facing China's economic development are stronger than the unfavorable factors, and the basic trend of economic recovery and long-term improvement has not changed. Domestic macro policies have strengthened and increased efficiency, accelerated the cultivation of new momentum, accelerated the release of reform dividends, accelerated the effectiveness of opening up dividends, and accelerated the replenishment of output gaps, supporting China's stable economic growth.

Niu Li, deputy director of the Economic Forecasting Department of the National Information Center, believes that in 2023, China will withstand multiple external pressures and overcome many internal difficulties, and the domestic economy will rebound and improve, showing a trend of "low at the front, medium to high, and stable at the back". In 2024, global scientific and technological development will enter a period of acceleration, monetary policy tightening will enter a peak period, the impact of the Ukraine crisis will weaken, and Sino-US economic and trade relations will be in a period of temporary relaxation. Domestic macro policies have intensified efforts to increase efficiency, accelerated cultivation of new driving forces, accelerated release of reform dividends, accelerated effectiveness of opening dividends, and accelerated replenishment of output gaps. The "five major effects" of policy effects, transformation effects, reform effects, opening effects, and gap effects support China's economy has grown steadily.

** Renmin University of China China Macroeconomic Forum:

**

** China's economy will be stronger in 2024 than in 2023

**

The quarterly forum of the China Macroeconomic Forum of Renmin University of China (first quarter of 2024) released a report entitled "Starting again-China's Macroeconomics in 2024" on March 30. It believes that the short-term bottom of the economy has appeared around the third quarter of 2023. The economy in 2024 will be stronger than in 2023.

There are at least three sets of arguments to support the above judgment:Changes in overall prices; the performance of the "troika"; some other indicators that characterize the macroeconomic heat and cold.

The first is prices. In February this year, the CPI increased by 0.7% year-on-year, ending the previous four months of negative value. Against the background of long-term positive growth, the core CPI rose by 1.2% year-on-year in February, an increase of 0.8 percentage points from January. Although PPI is still in the negative range, judging from the trend, its bottom has appeared in July and August last year, and has since shown a turbulent upward trend.

The second is the "troika". In terms of consumption, consumption this year has basically continued the strong momentum since 2023. In terms of exports, exports in the first two months of this year increased by 7.1% year-on-year, which was significantly higher than the cumulative growth rate in the first two months of last year. In addition to the reasons for the low base, this is also related to the resilience of external demand this year and the diversification of China's export destinations. In terms of investment, investment in infrastructure and manufacturing performed well in the first two months of this year. In the next step, expansionary fiscal policies are expected to play a leading role in investment.

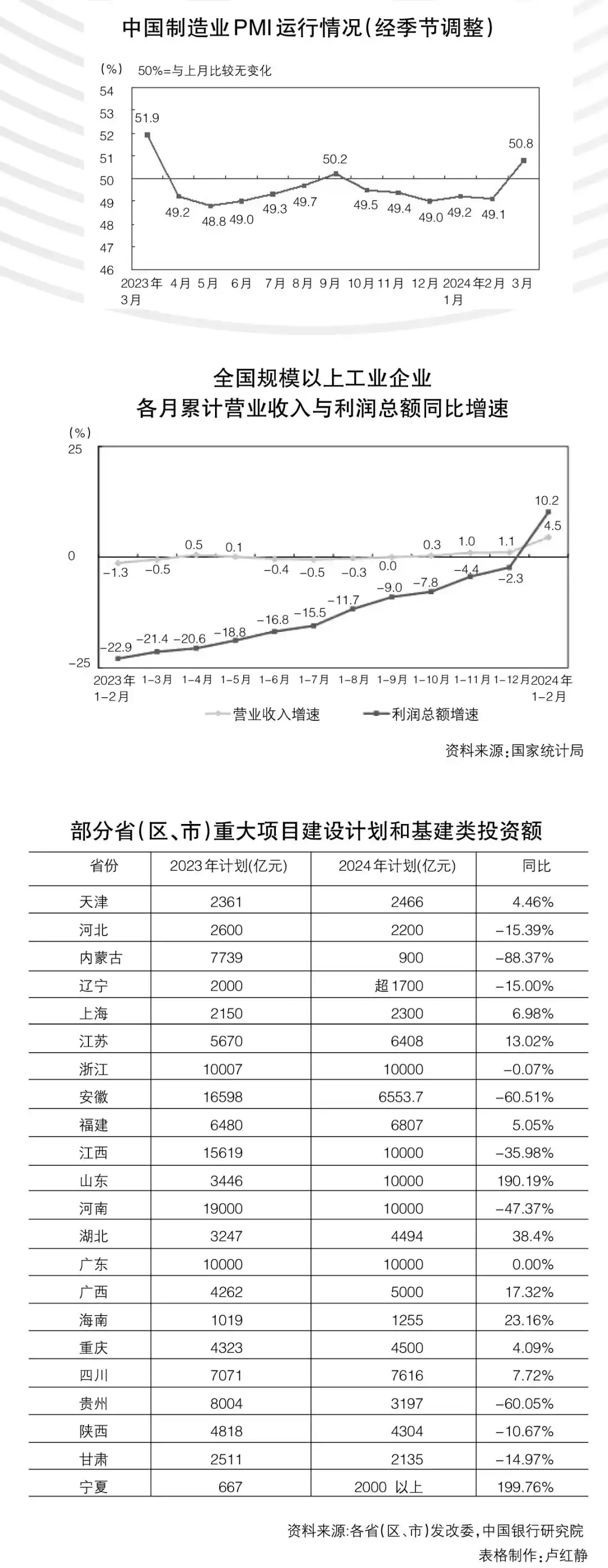

The third is indicators such as industrial added value and manufacturing PMI. In the first two months of this year, the cumulative year-on-year growth rate of industrial added value above designated size was 7.0%. Although the manufacturing PMI in the first two months of this year is still below the 50% boom-bust line, the indicators reflecting expectations of production and operating activities were 54.0% and 54.2% in January and February respectively.

In addition, other positive factors support this year's economic improvement. For example, the formation of consensus on economic issues from all walks of life will help the formation of policy synergy in the next step.

However, China's economy also faces some hidden concerns, including consumption that is "clearly strong but weak", such as the enthusiasm for "playing" is high but still dominated by "poor tourism"; real estate is still in the process of finding a bottom; and the rising tendency of "regularization" in deposits in the residents and corporate sectors.

Chinese Academy of Social Sciences:

China's economy is expected to grow by around 5% in 2024

The "Economic Blue Book-Analysis and Forecast of China's Economic Situation in 2024"(hereinafter referred to as the "Blue Book") released by the Chinese Academy of Social Sciences on April 1 pointed out that in 2023, China's economic performance will generally pick up for the better. Looking forward to 2024, on the whole, China's economy is expected to grow by around 5%.

The "Blue Book" believes that China is in a superimposed stage of the "new three phases" of a critical period of economic recovery after the epidemic, a period of transition between old and new momentum, and a period of profound changes and adjustment in the external environment. Although economic operation and macro-policy regulation are facing many difficulties, it should also be noted that the fundamentals of China's long-term economic growth have not changed.

First, production factors are supported. At present, China's working-age population is still close to 900 million, and the total number of high-quality talents with higher education and vocational education exceeds 240 million. The savings rate exceeds 40%, and investment growth still has strong support.

Second, market demand has potential. China has a population of more than 1.4 billion and the largest middle-income group in the world. The per capita GDP has exceeded 12,000 US dollars, and huge market potential will continue to be released.

Third, the industrial system is resilient. China is the only country in the world that has all industrial categories in the United China Manufacturing Classification. The added value of the manufacturing industry has ranked first in the world for 12 consecutive years, and emerging industries have continued to grow and develop.

Fourth, innovation and creation are dynamic. In 2022, the national R & D investment intensity will be 2.58%, reaching the average level of developed countries. Innovation and entrepreneurship are booming, and a number of unicorn companies with high valuations have emerged.

Fifth, there is room for macro policies. China's inflation rate and fiscal deficit rate are both at low levels, the government debt ratio is within a reasonable range, foreign exchange reserves are sufficient, there is much room for proactive fiscal policies and prudent monetary policies, and there are sufficient tools in the macro-control policy toolbox.

The "Blue Book" recommends focusing on the following tasks. First, focus on implementing the strategy of expanding domestic demand and enhancing the traction of the domestic economic cycle. The second is to accelerate development and growth of new driving forces and build a modern industrial system. The third is to continue to promote reform and opening up and stimulate high-quality development momentum. The fourth is to effectively prevent and resolve risks in key areas and build a solid safety bottom line. The fifth is to comprehensively promote high-quality and full employment to better protect and improve people's livelihood.

Continue to consolidate the foundation for economic improvement

reading tips: 多家智库预计,2024年中国经济增长预期目标能够实现。不过,面对经济运行中的挑战,政策需要聚焦发力。中国人民大学重阳金融研究院与美国、俄罗斯、加拿大、印度等国智库学者合作撰写的研究报告认为,当前,中国经济“社会预期偏弱”的本质是“经济复利预期偏弱”,建议持续夯实高质量发展的根基,不断累积大国复利的坚实基础。厦门大学宏观经济研究中心的研究建议,维持宏观政策的稳定性和持续性,以稳定市场预期,巩固市场信心。中国银行研究院的研究报告建议,持续巩固经济恢复的基础,谨防经济增长中枢下移由短期现象变成长期趋势。

Report on the cooperation think tank of China, the United States, Russia, India and Canada:

Six major suggestions release the compound interest of China's economy

"Compounding Interest in Great Countries" was written by the Chongyang Institute of Finance of Renmin University of China and think tank scholars from the United States, Russia, Canada, India and other countries:China's High-Quality Development and 2035 Trend Imagination "(hereinafter referred to as the" Report ") was officially released on March 31. The report demonstrates the results of China's high-quality development in the past few years, especially in the past year, and proposes the concept of "compound interest in a great country" for the first time. The report believes that the essence of the current "weak social expectations" is "weak economic compound interest expectations" and puts forward relevant suggestions.

The report believes that the foundation of China's high-quality development is constantly being consolidated, and the compound interest of major countries in internal institutional reforms and high-level opening up to the outside world is gradually being released. Only by closely focusing on the overall goal of Chinese-style modernization and continuing to lay a solid foundation for high-quality development in various fields such as science and technology, finance, and industry can we continue to accumulate a solid foundation for compound interest in major countries.

The report puts forward six recommendations to pay close attention to policy implementation and bridge the information gap of policies; stimulate innovation vitality and break through the "stuck neck" problem of high-end technology; from integrating into globalization to leading globalization, focusing on promoting the opening of the service industry; reform income distribution system, implement a national income doubling plan; increase risk appetite, establish first and then break through to enhance development confidence; promote high-quality capital market reform around the goal of a financial power.

The report imagines China's top ten development prospects in 2035:China's GDP is likely to surpass the United States around 2035 and become the world's largest economy; the disposable income of Chinese residents is expected to double in 2035 compared with 2023; the proportion of middle-income groups is expected to expand from one-third to nearly half; In 2035, on average, every three households will own a new energy vehicle; China will become the primary force in maintaining international peace and leading the international stable order; The number of countries that grant China mutual visa-free, unilateral visa-free, and visa-on-arrival is expected to expand from more than 80 to more than 120; China will achieve its carbon peak early before 2030 and become the country with the highest absolute value of annual emission reductions in 2035; The number of Chinese companies shortlisted among the world's top 500 companies is expected to exceed 200; China has become one of the most mature capital markets in the world; and the "Belt and Road" has become the world's largest cooperation initiative.

macroeconomic research Center of Xiamen University:

Policy focus and efforts to consolidate market confidence

The "China Macroeconomic Forecast and Analysis-Spring Report 2024"(hereinafter referred to as the "Report") recently released by the Macroeconomic Research Center of Xiamen University believes that the expected economic growth targets set out in the 2024 "Government Work Report" can be achieved. However, this requires policy focus. At the macro policy level, it is necessary to maintain the stability and sustainability of macro policies to stabilize market expectations and consolidate market confidence.

The report believes that in 2023, the main contribution to China's economic growth will come from final consumption. Looking forward to 2024, the foundation for sustained consumption growth is not yet solid. Uncertainty about residents 'income growth expectations, the tendency of "small amounts" and "fragmentation" of residents' consumption, and the continued adjustment of the real estate market may restrict the continued growth of final consumption.

Investment growth is expected in 2024. A combination of front-line fiscal expenditures and policy instruments such as special bonds, ultra-long-term special treasury bonds, and tax incentives will have an increased effect on investment in infrastructure construction. New productivity and "artificial intelligence +" actions will also further encourage the rapid increase of investment in emerging industries characterized by high technology, high efficiency and high quality.

In 2024, economic growth in developed economies is more likely to weaken. How to stimulate external demand and stabilize foreign trade, especially export growth, will likely be a greater challenge that China's economy needs to face in 2024.

The report recommends: First, maintain the stability and sustainability of macro policies, stabilize market expectations, and consolidate market confidence. In the process of policy implementation, we must not only change according to the times, follow the trend, pay timely attention to new changes and new trends that have emerged in the process of economic operation, and propose countermeasures earlier. We must also grasp the same theme of macro policy orientation and maintain the determination of policy implementation. The second is to correctly understand the changes in the situation faced by external demand and more accurately position export growth targets and export contribution. The third is to do everything possible to increase residents 'disposable income, improve the consumption environment, enrich consumption stimulation methods, and tap into consumption potential so that residents dare to consume and consume easily. The fourth is to enhance the consistency of macro policy orientations. Shift the focus of macro-control policies to guiding and promoting the expansion of investment and consumer demand by micro-entities.

Bank of China Research Institute:

Efforts still need to be redoubled to achieve annual economic growth of around 5%

The "Economic and Financial Outlook Report for the Second Quarter of 2024"(hereinafter referred to as the "Report") released by the Bank of China Research Institute on April 1 believes that China's economy started well in the first quarter of 2024. It is initially estimated that GDP in the first quarter will increase by about 4.8% year-on-year. In the second quarter, China's economic prosperity is expected to rebound slightly, with GDP expected to grow by around 5.1%. In the future, China's economic operation will further shift to normalization. China's development environment will still be one of both strategic opportunities and risks and challenges, and favorable conditions outweigh unfavorable factors. Macroeconomic policies must continue to consolidate the foundation for economic recovery and guard against the downward shift of the economic growth center from a short-term phenomenon to a long-term trend.

The report said that in the first quarter, from an external perspective, global market demand rebounded, international trade prosperity rebounded, and China's foreign trade export growth rebounded. Internally, macro policies have been further exerted, the endogenous driving force of economic growth has been enhanced, and service consumption and manufacturing investment have become the main support.

Looking forward to the second quarter, consumption will continue to play the role of the "ballast stone" of China's economic growth, and the potential of service consumption is expected to be further released. The trend of industrial transformation and upgrading is obvious, and new productivity continues to be cultivated. The global inventory cycle has entered the replenishment stage, which will help increase the momentum of external demand. Coupled with the low base of the previous year, the trend of export recovery is expected to continue.

The report believes that the 2024 "Government Work Report" sets the economic growth target at around 5%, which is not only an important consideration for expanding employment, increasing residents 'income, and preventing and defusing risks in the short term, but also a need to achieve medium-and long-term development goals. Achieving this growth goal requires redoubled efforts from all parties.

The report puts forward six suggestions, including accelerating the implementation of fiscal policies and improving the quality and efficiency of capital use; financial policies should take multiple measures simultaneously to balance the relationship between "stabilizing growth","promoting reform" and "preventing risks"; further digging deep into consumption and investment growth space and increasing efforts to expand domestic demand; properly respond to the impact of the evolution of the international economic and trade pattern and help foreign trade enterprises operate steadily; Increase real estate policy support from both sides of supply and demand to accelerate the resolution of industry risks; Consolidate the foundation for cultivating new quality productivity and accelerate the improvement of infrastructure, talents, factors, and industrial systems that adapt to the development of new quality productivity.