Non-ferrous metals return strongly,"Dr. Copper" returns, aluminum prices hit new highs

_

_

In the recent market, non-ferrous metals are undoubtedly the "most beautiful"!

美联储降息周期即将开启叠加美元的弱势预期激发有色金属“金融属性”,Some resource products with limited supply have ushered in a bull market. Among them, the prices of aluminum, copper and other metals have been "far ahead" all the way. 引得市场高度关注。

On April 8, the single-day transaction volume of the underlying index of Nonferrous Metals 50ETF (159652) reached 100 million yuan, setting a new record for the highest single-day transaction volume since the second day of listing in February 2023! Data shows that it is the non-ferrous index with the highest copper content in the whole market, with its "copper content" reaching 26.06%.

** **

**

:

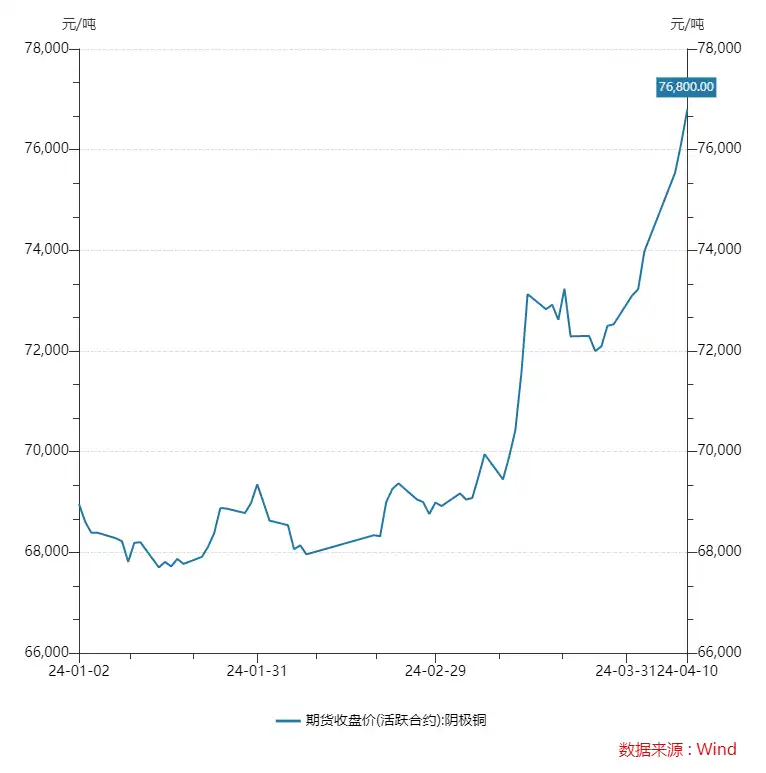

今年以来铜价持续震荡上行。具体来看,国内方面,wind数据显示,截至4月10日下午收盘,沪铜主连报76800元/吨,较上个交易日上涨0.66%,1月至今,铜价持续攀升,较年初上涨7840元/吨,涨幅达11.4%。国际方面,截至2024年4月8日收盘,LME铜报9443美元/吨, Domestic and foreign prices have hit new highs in the past two years and a year respectively.

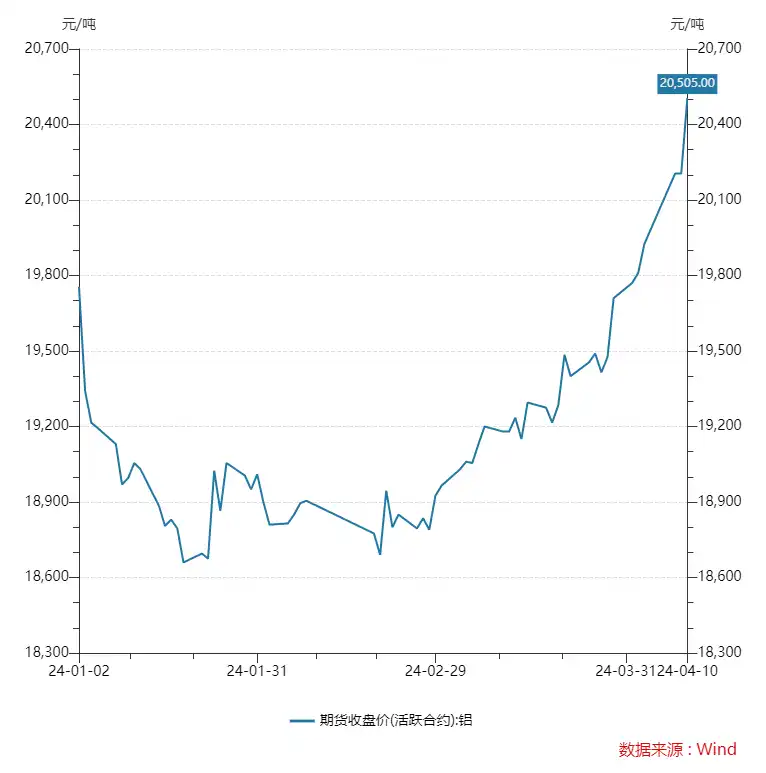

Aluminum prices are also making great progress. As of the close on the afternoon of April 10, Shanghai Aluminum reported 20505 yuan/ton, up 1.38% from the previous trading day and 750 yuan/ton from the beginning of the year, ** Set a new high price since July 2022. ** LME aluminum closed at US$2459/ton on April 8, up 0.33% from the previous trading day.

International copper prices once again hit a new high since January last year, and aluminum prices also reached a new high since April last year.

Previously, Goldman Sachs analysts Nicholas Snowdon and Lavinia Forcellese pointed out in a report that ** By the end of 2024, copper will rise to US$10000 per ton and aluminum will rise to US$2600 per ton. **

"Dr. Copper" returns,"aluminum" reaches a new high! What is the logic behind it? How long can the upward trend last?

Contradictions between supply and demand push prices upward

Copper has both financial and commodity attributes. It is called "Dr. Copper" because it can promptly and sensitively reflect macroeconomic changes. ** The strong performance of copper prices this time is not only driven by inflation expectations, but also mainly affected by the tight balance of supply and demand. **

宏源期货分析师王文虎在研报中表示,From the demand side, 国外的美联储和欧洲央行降息预期引导欧美经济增长“软着陆”预期,国内推出更多经济稳增长与消费刺激政策,支撑光伏与风电及新能源汽车等新能源领域甚至包括房地产等传统需求领域,拉动铜需求。

** From the supply side, ** Global copper concentrate supply is expected to be tight and difficult to change. Coupled with the fact that a large number of domestic copper smelters have started maintenance in the second quarter, and news of production reduction has been released, which will shift domestic electrolytic copper supply and demand expectations from loose to tight.

The reporter also noticed that since the beginning of this year, the spot processing fee for imported copper concentrates has been operating at a low level, and the processing fee for imported copper mines has dropped from US$90/ton to US$10/ton. Smelters have suffered significant losses. Affected by this, some domestic smelters have jointly reduced production expectations. Increase.

Goldman Sachs previously said that the copper market is at an important seasonal turning point, and the inventory level of the refined copper market will gradually decline in the second quarter. ** With strong domestic demand and continued supply constraints, the copper market will gradually shift to a supply shortage pattern. **

Against the background of weak supply and strong demand, the enthusiasm of the copper market has soared.

此外,高盛还指出,Similar to copper, the global aluminum market will also turn into a period of sustained supply shortages starting in the second quarter.

As a light, high-strength metallic material, aluminum is widely used in aviation, automotive, construction and other industries. ** As the world pays more attention to new energy, countries have increased their investment in the field of new energy, and the demand for aluminum, a lightweight, corrosion-resistant and high-quality material, is also increasing, which has brought aluminum prices back to a certain extent. warm. **

Secondly, with the macroeconomic recovery and rising copper prices driving non-ferrous metals, and with April being the traditional peak consumption season, the aluminum market has also ushered in its own "spring".

Research results from Shanghai Nonferrous Metals Network show that production and orders of most aluminum processing companies will continue to improve in April, and the operating rate of domestic aluminum processing companies may continue to rise.

上海有色网分析师李加会认为,From the perspective of supply and demand, domestic electrolytic aluminum supply and demand will remain tightly balanced in 2024. 一方面,国内产量供应放缓,及云南等地电力供应不稳定的情况,将限制电解铝厂家开工率,预计中国仍将从海外净进口铝锭。另一方面,光伏及新能源板块对铝的需求增量将弥补房地产用铝需求减量。

While the market fundamentals of copper and aluminum are tight and balanced, their prices have "skyrocketed".

It is expected to be the first year of copper and aluminum price increases

在全球经济回温、政策利好刺激的背景下,加之美联储降息预期、市场供需紧张等多重因素,Domestic and foreign investment institutions are generally optimistic about this strong rise in non-ferrous metals.

Changjiang Securities 'latest view believes that the moderate U.S. inflation data and the dovish stance of the Federal Reserve have pushed the U.S. debt downward. This will help catalyze the upward trend of copper and aluminum at a time when the global industrial economy has reached its bottom. ** 2024 is expected to be the first year of copper and aluminum price increases. **

Wang Jun, president of the Founder Mid-term Research Institute, once said that this year's "Government Work Report" proposed to vigorously promote the construction of a modern industrial system and accelerate the development of new productive forces. New energy, new infrastructure, new materials and other directions have become important starting points for economic transformation, and the application and demand for copper will become increasingly strong.

Morgan Stanley also said that with the rapid development of AI technology, copper demand will increase significantly, and AI data centers will become a new growth point for copper demand. ** By the fourth quarter of 2024, copper prices may rise to US$10500/ton, up 18% from the current level. **

Analysts such as Guojin Securities Li Chao pointed out that under the soft landing scenario of the U.S. economy, the Chinese and US economies resonate upwards, coupled with tight supply during the traditional peak season, copper and aluminum prices are expected to continue to rise in the later period.

The bull market for copper and aluminum is really here!