Minglida's sky-high divorce case:1.8 billion shares go to ex-wife

2024.0405

Number of words in this article:1169, the reading time is about 2 minutes

introduction: 铭利达董事长陶诚与卢萍芳近日公告离婚,前妻卢萍芳分走价值近18亿元公司股票。

** Author| ** First Finance and Economics Lu Ruyi

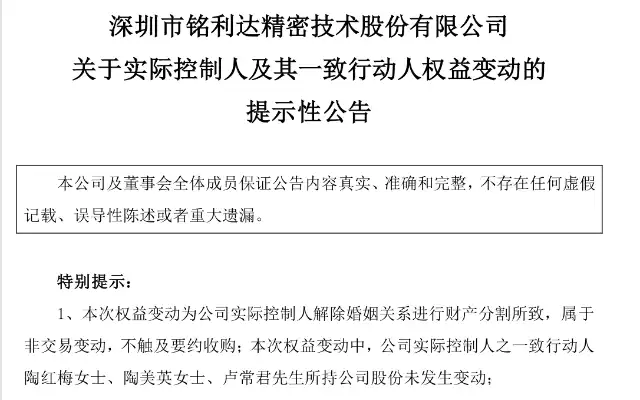

A-shares have recently reappeared in a sky-high divorce case. Minglida (301268.SZ), a precision structural parts manufacturing company, announced on the evening of April 2 that the company had received notice from the actual controllers Tao Cheng and Lu Pingfang. After friendly negotiation, the two had dissolved their marriage and made arrangements for the division of divorce property.

According to the disclosure of the company announcement, the chairman of the company, Mr. Tao Cheng, intends to split and transfer the 10.8749 million shares of the company directly held by him to Ms. Lu Pingfang. It also intends to transfer 41.44% of the 41.44% stake in Shenzhen Dalei Investment and Development Co., Ltd (hereinafter referred to as "Dalei Investment") (indirectly corresponding to 63.3648 million shares of the company) to Ms. Lu Pingfang. Based on the closing price of 24.18 yuan per share on April 2, the above shares are worth about 1.795 billion yuan. On April 3, the day after the announcement, Minglida's shares opened low and closed down 6.33% at 22.65 yuan per share, lower than the offering price of 28.50 yuan per share at IPO in 2022. Compared with the all-time high of 67.87 yuan, Minglida's share price has fallen by 75%. After this equity change, Mr. Tao Cheng no longer directly holds shares of the company, but indirectly holds 105 million shares of the company through holding Dalai Investment, Saiming Investment and Seton Investment, accounting for 26.36% of the total share capital of the company. Ms. Lu Pingfang holds a total of 81.8843 million shares of the company through direct and indirect means, accounting for 20.47% of the total share capital of the company. Before this division, Mr. Tao Cheng, the real controller of the company, held a total of 180 million shares of the company through direct and indirect shareholding, accounting for 44.92% of the total share capital of the company. The announcement shows that according to the "concerted Action Agreement", this change of rights and interests is caused by the dissolution of the marriage relationship and the division of property between Mr. Tao Cheng and Ms. Lu Pingfang, and there is no subjective increase in the voting rights of the company controlled by Ms. Lu Pingfang to acquire listed companies. "the control of the company has not changed." Ming Lida said that after this change of rights and interests, the control of the company is still dominated by Mr. Tao Cheng, who is still the chairman of the company and is still able to achieve control of the company. Ming Lida also mentioned in the announcement that after the change in the company's shareholders' rights and interests as a result of the dissolution of the marriage, Tao Cheng, Lu Pingfang and other actors will merge to calculate the status of major shareholders. The reduction of holdings will be in strict accordance with the relevant regulations, including that the shareholding of major shareholders will be reduced by no more than 1% within 90 consecutive natural days through centralized bidding transactions, and that the annual transfer of shares during Tao Cheng's tenure shall not exceed 25% of the total number of shares held by them. Ming Lida landed in A shares in April 2022, mainly engaged in precision structural parts manufacturing industry. The company's main products include a variety of process precision structures and moulds, including photovoltaic, energy storage, security, new energy vehicles and consumer electronics. The prospectus at the time of the listing of Minglida shows that Tao Cheng has complete actual control of Minglida, and Lu Pingfang himself no longer has any position. Lu Pingfang 100% controls Shenzhen Hetai Biotechnology Co., Ltd., which is mainly engaged in the production and sales of vinegar egg liquid and enzyme products. Minglida said many times in the interactive platform that the new energy vehicle industry has grown into the second largest industry besides photovoltaic, and the company also maintains close cooperation with Huawei, Tesla and other enterprises. In the first three quarters of 2023, benefiting from the magnificent demeanor of the downstream industry, Minglida achieved revenue of 3.141 billion yuan, up 51% from the same period last year, and net profit of 292 million yuan, up 32% from the same period last year. **